Investment Bulletin

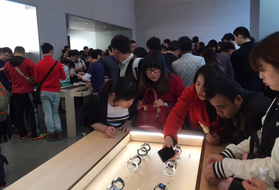

Q1 2017 Apple Earnings: All-Time-High Revenues and EPS, Growth is Back Again

|

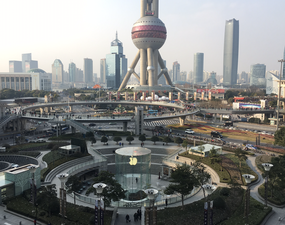

Popular Articles on InvestmentLearn Today's China

Starbucks in Changsha, China: Growing Upper Middle-Income Consumers Chinese ADRs: Is It Good to Buy Alibaba Shares? The Evidence of the Middle-Income Trap Popular ArticlesEconomics Universe

|

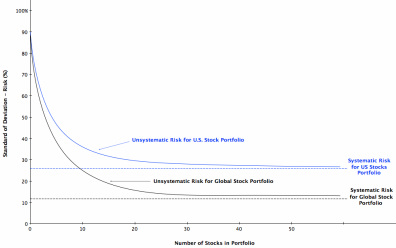

Diversification: Systematic Risk and Unsystematic Risk

|