PE Multiple Analysis - How to Determine the Future Price of a Stock?

Akira Kondo

Feb. 12, 2014

|

There are many ways to analyze what stocks to buy and sell. One of the easiest ways to analyze is probably a PE multiple analysis. The PE multiple analysis allows you to predict a future price of a stock as well as its current valuation.

A stock price is simply composed of its earnings and the multiples. By equation: P = E x M P: Stock price E: Earnings or EPS M: Multiple or PE When you look up Yahoo! Finance or Bloomberg, you will always see these numbers while you hit your favorite ticker code. You may not see “E” unless you go to owner’s equity in a company’s financial statement. However, you can find this “E” or “EPS” as long as you can find “P” and “M” from your iPhone screen or whatever. Therefore, “E” is calculated in the following equation: For instance, let’s take a look at popular Apple stock (NASDAQ: AAPL) on Yahoo! Finance.

|

More Articles on Investment |

|

Shares of Apple Computer (NASDAQ: AAPL) are currently trading at $535.96 (as of Feb. 12, 2014) while its “M” or “PE” is 13.32. This PE of 13.32 is often said, “shares of Apple are now trading at 13.32 times its earnings.”

Back to the equation and insert these numbers in: This 40.24 is Apple’s “E” or “EPS (Earnings per Share), meaning Apple earns $40.24 earnings (or income) from an each share of $535.96. Is it a lot of earnings from the stock? To answer this question, you will get back to the “M” or “PE multiple.” This PE multiple will tell you how many times of earnings investors are willing to pay for the stock.

Now, bring “M” to the left-hand side of the equation: Although we have had this number from the Yahoo! Finance, it is extremely important to know this PE to understand the current and future valuation of a stock. Again, this number tells, “Apple is currently trading at 13.32 times its earnings.”

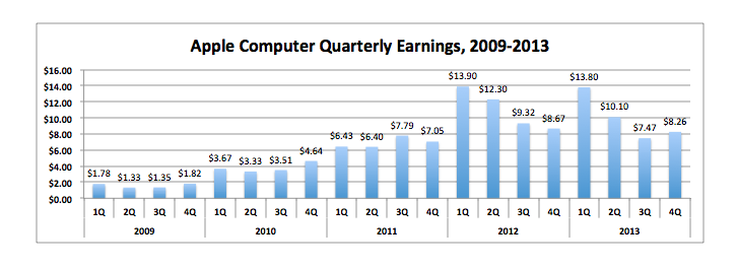

That number 13.32 alone does not tell anything. In order to utilize this number, you will need one of two other things: competitor/industry PE or historical PE. The former allows you to analyze industry-level relative comparison through multiples. Assume there are only two technology stocks in the universe: Microsoft (NASDAQ: MSFT) and Apple. Microsoft is now trading at 13.77 (as of Feb. 12, 2014) times earnings and its share price is $37.17. Since shares of Apple are trading at 13.32 times earnings, Apple is 0.45 multiple points cheaper than Microsoft because the PE multiples tell how many times earnings investors are willing to pay. The difference of 0.45 may tell you something, such as earnings growth, new product releases, and so on, between these companies. However, Apple stock is more attractive if there are only Apple and Microsoft shares available in the market. If you know the historical PE multiple of your favorite stock, it would be quite helpful to study the stock. Shares of Apple once before were trading at premium compared to today. When Apple stock hit $700, its PE was above 15. A year after Apple introduced iPhones in 2008, the stock was trading near 30 times earnings. In fact, the multiple tells the company’s earnings growth. Shares of younger technology companies tend to trade themselves at higher PE multiples. Amazon.com (NASDAQ: AMZN) is now trading at 613 (as of Feb. 13, 2014) times its earnings. Thus, Amazon is simply 47 times more expensive than Apple. However, Amazon may have more growth opportunity than Apple may have. Amazon could buy Target (NYSE: TGT) and even WalMart (NYSE: WMT) to dominate the retail market as today’s consumers shift toward online shopping. Many analysts analyze forward PE instead of current PE because prices of stocks are always indicating companies’ future profits. When a company’s business starts to mature, the PE multiple starts to settle down as well. Apple’s earnings growth is slower than it was used to be (See the Graph). When Apple introduced iPhone, its shares were trading well-below $2 a share. With a few years, the company introduced next generation iPhones, such as 4S. Its earnings topped $13.90 a share in the first quarter of 2012 from $6.43 per share a year earlier. That is 116% increase year over year. There was no reason investors were willing to pay higher premium at that time. Then, Apple’s earnings growth disappeared into 2013. All the quarters in 2013 were less than those of 2012. The stock nosedived from $700 in September 2012 to below $400 in April 2013. This is a good example of how stock price depends on the growth rate of earnings. |

Popular ArticleRelated ArticlesApple: 2014 1Q Earnings <New> Apple Q2 2015 Roundup: Another Solid Quarter Thanks to Growing Chinese Demand |

|

On the other hand, finding the future stock price is easy if you know the company’s future earnings, while you may need to become a crystal ball analyst. For example, Apple’s earnings could be higher if the company introduced new products, which could become next must-have technology item, like iPhone. The new product would significantly increase its earnings stream and investors in the markets would like to pay more premium.

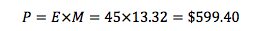

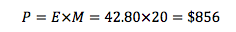

Suppose Apple’s earnings are going to increase to $42.80 a share in 2014 (according to the consensus estimates) and the multiple remains the same at 13.32. Then, the stock should be traded around $570 by the end of the year or so. What events are included in these earnings? Probably new iPhone and iPad sales as well as new Macs and so on, but not new products, like iWatch. Somewhat Apple consensus estimates tend to be very conservative because many fund managers like to own this name in their portfolios. Analysts in these funds set lower hurdles for Apple’s earnings so they do not miss their earnings estimates, which look good for their reputation and their clients. Now, suppose Apple is going to introduce new products this year, such as wearable devices and TV sets. Not including initial investment cost, Apple’s earnings may increase to $45 a share thanks to higher margins. If the multiple remains the same at 13.32, the stock price should be traded around $600. However, new products tend to increase the company growth. Investors, in fact, think of growth, growth, and growth. If the company’s earnings are expected grow over next couple of years, then investors are willing to pay more premium on the stock, like Amazon’s case. Suppose the company will grow 20% year over year thanks to the new product and decent remodeled iPhone launches, the investors may be willing to pay 20 times earnings instead of the current 13 times. Therefore, the price of the stock would hit above $850 a share if the earnings remained at $42.80 a share.

Although it is not easy to predict the future stock price, it is really useful if you understand this equation. There are many ways to analyze a stock price but it is probably the simplest way to do so and is commonly used among investors.

|

|