Diversification: Systematic Risk and Unsystematic Risk

June 23, 2014

Akira Kondo

Source: Yahoo! Finance Source: Yahoo! Finance

Since you are investing, you may think of investment banks. You can choose, for instance, JP Morgan Chase (NYSE: JPM) as your second choice. This company is probably well known in the east coast area or some people think of “Chase credit cards.” One of the leading CEOs in the United States, Jamie Dimon, has been running the company since 2005. It is not required to know the name of CEO, but at least you should know something about the company, including financial statements. When you start owning this stock, then you will realize that you are getting dividends every quarter. It yields 2.80 percent (as of June 22, 2014).

Now, you want to think of dividends. There are many companies that are paying out dividends to investors. The best source of finding dividend stocks is NASDAQ.com, where you can find their yields as well as historical payouts. High dividend-yielding stocks tend to have limited downsides, though depending on types of stocks. Importantly power of compounding really starts to encourage your investment when owning the stocks that increases payout annually. These are two good reasons to own have dividend stocks. <Read Apple’s Dividend Growth and Power of Compounding for more details about the importance of dividends>  Source: Yahoo! Finance Source: Yahoo! Finance

Now you have technology/retail and a bank in your portfolio. Let’s look for the other industry with a high yielding stock. Ensco International (NYSE: ESV) is one of my favorite picks for many years. It is an offshore drilling company that hunts for precious deep-water assets. The stock currently yields a handsome 5.40 percent (as of June 22, 2014). That is nearly twice higher than that of JP Morgan. Is it really paying every quarter? Yes, so far. This company pays out dividends every quarter and increases the dividend amount every year, which power of compounding is also imbedded.

Again, there are many stocks that are paying out dividends. For instance, McDonald’s (NYSE: MCD) can be the forth pick in your portfolio. The company has both positive and negative images; however, the company’s business is performing well out of the United States. It sells burgers globally but now sells more and more healthier meals that attract customers across the globe. The stock yields 3.20 percent (as of June 22, 2014) and the company also increases payout annually for over many years. That is more consistent than JP Morgan and Ensco International. |

|

|

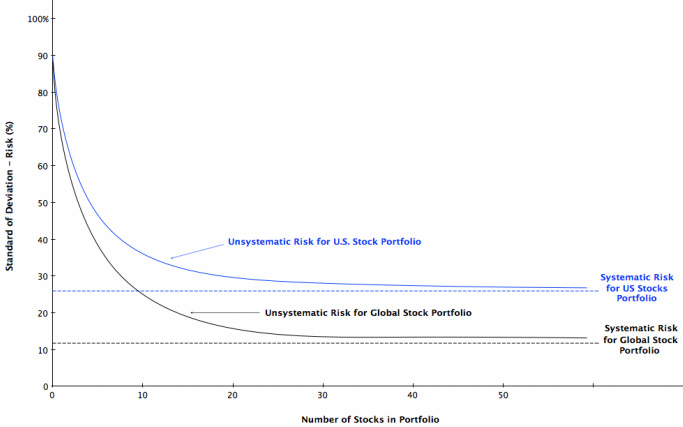

However, it does not make sense owning 30 different stocks in your portfolio as an individual investor. If you buy 30 stocks, you have pay 30 commission fees when you buy and when you sell. Plus, you will also be busy checking up your stocks daily basis while your productivity at work may become lower, which may reduce your annual bonus. If you have $50,000 or more to invest, you can start to add up more stocks, say up to 10 or 15 stocks, which would be still controllable than owning 30 stocks. You should think of your dairy work in priority and you do not want to reduce your productivity by adding up too many stocks.

As investment products and services are developing fast over past years, you can diversify your risk by much easier way. If you dislike buying five different stocks or do not know what to choose, you can just buy ETFs, which stand for Exchange-Traded Funds. SPDR, known as Spider, offers S&P 500 stocks in one basket under SPY ticker. It nicely follows the S&P 500 index and you now own 500 stocks in one ETF symbol. Vanguard offers the similar ETF under VOO symbol. Though this article does not discuss asset diversification, you can add Vanguard Total Bond ETF in your portfolio to increase bond exposure. This ETF is powerful because buying bonds are not easy unless you have a premier investment account and good knowledge in trading bonds. This Total Bond ETF is right for you that bonds are already diversified and that will help your asset allocation strategy easily. Although you cannot eliminate the risk when investing stocks, you can still manage your risk by adding up stocks and these stocks should be selected from different sector. Plus, you can manage your dividends by choosing dividend stocks, which you can easily find from NASDAQ.com. Be sure to understand that power of compounding really kicks off if you select the stocks that consistently increase dividend payouts. Do not have too many stocks in your portfolio otherwise you cannot manage them all and your productivity at work become lower. Diversification is free lunch and this free lunch should be imbedded in your portfolio. Akira Kondo is long AAPL and ESV. |