2016 Portfolio Summary: Winning Streak Finally Ended, Still Another Solid 7.20% Return

Janauary 3, 2017

Akira Kondo

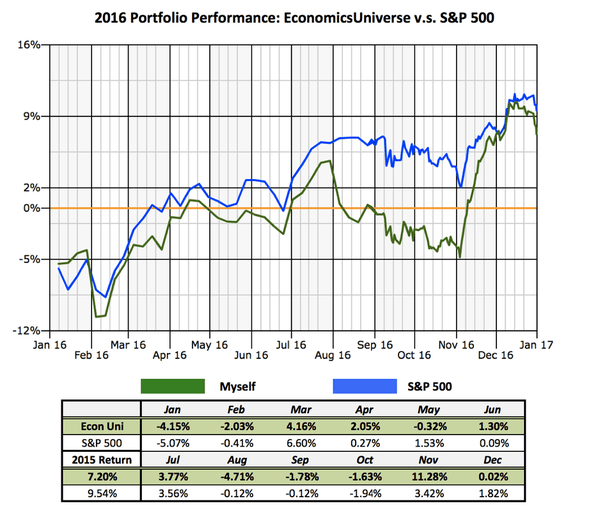

For the 2016 stock market year ended, the blue-chip Dow advanced 13.41 percent or 2,337.57 points to 19,762.60, market benchmark S&P 500 gained 9.54 percent or 194.89 points to 2,238.83, and tech-heavy NASDAQ composite rose 7.50 percent or 375.71 points to 5,383.12. In the meantime, EconomicsUniverse model portfolio made another solid return of 7.20 percent, followed by an excellent 19.8 percent return in the 2015 market year. However, the 2016 EconomicsUniverse portfolio was underperformed the benchmark by 2.33 percent, making the portfolio’s winning streak of seven years since 2009 finally ended. Despite the first underperformance over past seven years, portfolio’s long term strategy remains solid as it outperformed, for instance, 13 percent in 2014 and 31 percent in 2013 (Please read: 2014 Portfolio Summary, 2013 Portfolio Summary). As always mentioned in past annual summaries, making money is getting harder after easy money has been made since the 2008-09 global financial crisis. With that in mind, 2017 market year is going to be once again challenging for individual investors. <Continue to read - click here>

Portfolio Performance in 2016

EconomicsUnverse Portfolio struggled to catch up with the benchmark most of the 2016 market year. As soon as the market kicked off in January, core holdings, such as Starbucks (NASDAQ: SBUX), Bristol-Myers Squibb (NYSE: BMY), St. Jude Medical (NYSE: STJ), and Bank of America (NYSE: BAC), all headed south, which in fact made the portfolio difficult to over-perform remaining year. The strategy to catch up with the market is to hold onto those core holdings into the year end as they generate dividends along the way while positive earnings expected. By the mid-year, the portfolio was about to be in line with the market. However, the lagging performance in the earlier year still weighed into the mid-year performance by a few percentage points. The finest part of the first-half of the year was clearly the positive M&A event from St. Jude Medical, which got a take-over bid from Abbott Laboratories (NYSE: ABT), while on the other hand shares Apple (NASDAQ: AAPL), the portfolio’s biggest position, sank more than 6 percent due to unimpressive earnings a day after the ABT-STJ news. After the summer, the markets seesawed as investors were nervous, yet excited, about the upcoming presidential election in November. The portfolio on the other hand made another dive in August thanks to a nearly 20 percent drop of BMY shares due to the test failure of its cancer drug Opdivo. Shares of SBUX and McDonald’s (NYSE: MCD) continued to plunge into the election day and Ensco International (NYSE: ESV) underperformed throughout the year. However, the markets turned around as soon as Mr. Trump won the presidential election. In the meantime, the portfolio added a series of positions before and after the election in order to catch up with the market. From October, the portfolio added Gilead Science (NASDAQ: GILD), Tesla (NASDAQ: TSLA), Google’s parent Alphabet (NASDAQ: GOOGL), and PayPal (NASDAQ: PYPL) after generating massive cash positions since the 2015 market year. However, EconomicsUniverse portfolio failed to out-perform the market by 2.33 percent, leading the annual return to 7.20 percent, compared with the S&P 500’s 9.53 percent.

Economy and the Fed

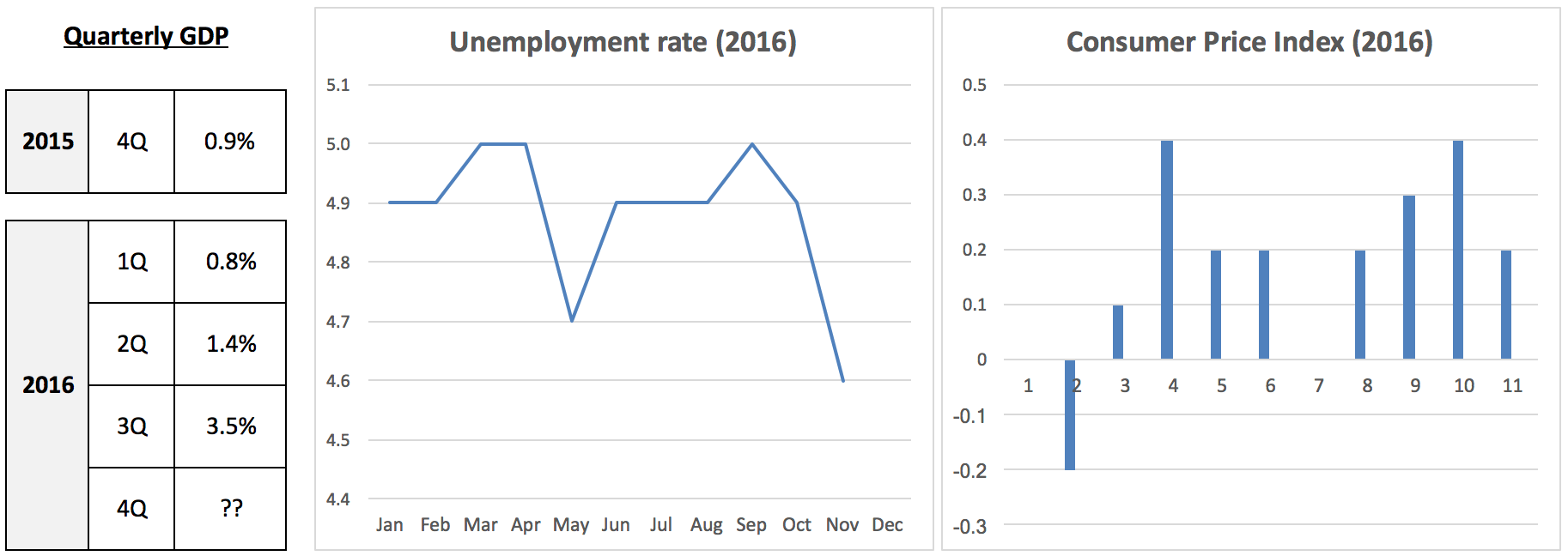

Investors and analysts have been curious about the rate hike from Washington D.C. throughout the year. The rate hike finally happened in Fed’s December meeting as widely expected by economists. In the meantime, economic recovery remains unsure despite recently-updated third quarter GDP figure, which turned out to be an impressive 3.5 percent growth. Fed’s dual mandate, inflation and jobs, is probably very well done thanks to Fed Chair, Janet Yellen. Although CPI (Consumer Price Index), most measureable inflation rate, was weak at less than 50 basis points throughout the year, CPI excluding volatile food and energy stayed above 2 percent during 2016. On the other hand, job market by number was much healthier at 4.6 percent in the recent November figure, the lowest level since the global financial crisis in 2008-2009. While once again the December rate hike was expected, the Fed got a first rate-hike of the year in December and raised its three-month short-term interest rates by 0.25% to a range of 0.5-0.75 percent. It was not a big surprise at all among investors and economists. In fact, the rate hike news was over shadowed by the Trump victory, which accelerated stock markets performance into the year end. During the 2016 market year, analysts are expecting a couple of rate hikes and each hike by a quarter-percentage point. Thanks to the Trump rally, long-term 30-year treasury yields were back in swing from near 2 percent in July to 3 percent in the year end, which makes the yield curve less flattish and more normal. With that in mind, it is likely that the Fed may hike its interest rates to 1 percent or more by the mid-year.

Portfolio in 2017

Let’s look at individual stocks in EconomicsUniverse portfolio. As mentioned earlier, TSLA, PYPL, GOOGL, and GILD were newly added into the portfolio during the fourth quarter of 2016 in order to catch up with the market (though they were not enough able to help the portfolio to outperform before the market year ended). These stocks are less effective to uncertain Chinese economy although TSLA and PYPL both do businesses in the country. However, these companies are more likely, so-called Mr. Trump’s U.S. first, at this moment and may generate potential growth in homeland into next years. It is unusual for the portfolio to have non-dividend stocks (TSLA, PYPL, GOOGL) in the portfolio but EcoomicsUniverse never underestimate the power of (compounding) dividends. GILD is clearly the one that offers attractive yields of 2.63 percent with an excellent balance sheet. Plus, it increases payouts by 9 percent annually since the company initiated the first dividends in June 2015 (in fact, an increase in dividend payout happened only once since the dividend initiation but the company expects to increase it this year again. Let see how it is going to be). During 2016, the portfolio sold some shares of Intuitive Surgical (NASDAQ: ISRG) and sold all the STJ position. The former stock is one of the most favorite positions in the portfolio. However, given the nearly 100 percent return since its initiation back in 2011, sold one-third of the position after the summer. As mentioned earlier, STJ was acquired by ABT, there was no reason to hold onto the position, sold every share after the summer as well. Thanks to fat cash position generated, the portfolio added some core positions into the fourth-quarter. All-time favorite SBUX position was accumulated and some shares were also added to MCD position. SBUX already hiked its dividend payout by 25 percent last quarter, so did MCD by 5 percent.

AAPL was once again the biggest position throughout the year and it is likely to be so in coming years. Since the 2015 chart was now behind, the stock in fact returned investors 10 percent last year, which was higher than the benchmark’s 9.54 percent. New iPhone this year is expected to be bigger hit and the pent-up demand is rapidly growing and the largest-ever. On the flip side, sales of iPhone 7/7Plus are expected to be lower for the remaining year. However, newly-introduced high-end MacBook Pro is likely to deliver solid earnings in coming quarters. Plus, Apple’s Services category, which includes Apps, may change the company’s cash stream. With that in mind, AAPL is a core holding once again this year.

Stocks that disappoint the portfolio were clearly ESV and BMY. ESV was down 20 percent last year while paying only a cent of dividend each quarter. However, the all the bad news and challenging environment were now behind. The portfolio may look for a re-entry point or an exit point into this year. Shares of BMY headed down below $50 in October but current share price is an attractive re-entry point while the stock yields 2.6 percent. BMY along with GILD and ISRG are going to be core holdings in the portfolio into coming years.

BAC was only financial position in 2016. Thanks to Trump rally, the shares of BAC surged during the election period while the portfolio missed the chance to add more shares. However, BAC now returned 450 percent since its initiation in early 2009, making one of the biggest positions in the portfolio. A smaller position in United Continental (NYSE: UAL) also surged last year, followed by a down-year in 2015. Since it is still the smaller position, UAL is probably the first one to be sold out this year and deploy the cash made by the sale to more dividend stocks. For the upcoming quarters, Pfizer (NYSE: PFE) and Coca Cola (NYSE: KO) as well as newly added PYPL, TSLA, GOOGL, and GILD are on radar screens for new positions and additions to the portfolio. These stocks along with AAPL, SBUX, ISRG, and BAC are well-positioned into the 2017 stock market year while those lineups can aggressively, yet defensively, complete against the benchmark.

Into the 2017 Market Year

As mentioned earlier, the market has steadily been up for almost past eight years since the 2008-2009 global financial crisis. That being said, more and more easy money has been made over the past years. On the flip side, it is likely to be more challenging to make money in stock markets over coming years. As business cycle is getting shorter and more market crisis comes in a shorter span (last one is of course in 2008-09), the market correction could become huge. While U.S. economy seems very solid in near term, the global uncertainty is clearly a negative factor, such especially from China. Plus, political uncertainty becomes a big concern among investors as well. Trump’s clear upset stance against China may trigger some trade issues and so on. With that in mind, the portfolio in 2017 requires some defensive natures, yet aggressive, to ride the markets. Newly added TSLA and PYPL clearly fall into aggressive category but their businesses are leaning toward more homeland. AAPL may reach all-time-high this year thanks to iPhone business cycles along with fast growing app services. Plus, AAPL continues to increase its dividend payouts by 10 percent on an annual average basis while another buyback package may be introduced during the second quarter earnings call. SBUX, MCD, and GILD also increase dividends annually and their fat dividends should support any downside in the markets. Thanks for reading last year and your ideas and thoughts are always helpful to make this website even better. Happy New Year and enjoy 2017 market year! *This article is purely based on author’s ideas about investing in the stock markets, not an investment recommendation. There may be some possible mistakes on general concepts of investment/economic theories and stocks as well as bonds. The author is long AAPL, BAC, BMY, ESV, GILD, GOOGL, ISRG, MCD, PYPL, SBUX, TSLA, and UAL. Investment contains risks. Please consider risks of investment when investing. Economics Universe or the author is not responsible in any loss of your investment.

|

Economics Universe

|