Q2 2016 Apple Earnings: Disappointing Quarter Finally Comes, China Sales Down 26%

April 30, 2016

Akira Kondo

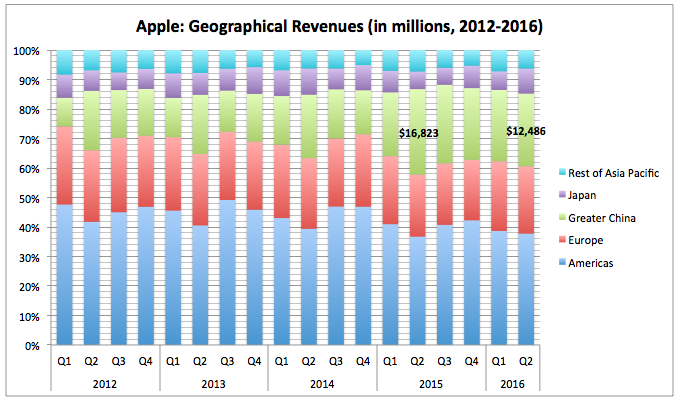

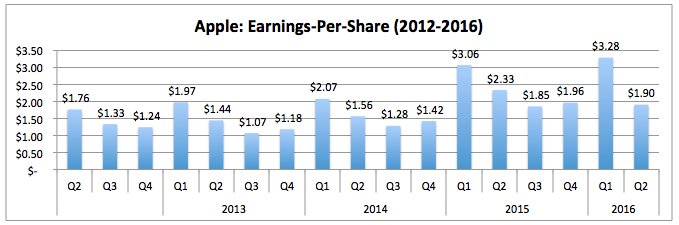

Apple (NASDAQ: AAPL) reported its second quarter earnings for the fiscal 2016 after the market closed on Tuesday and missed consensus estimates on most numbers. During the January-March quarter, the most valuable company earned $1.90 per diluted share or $0.10 below the estimates due to “the face of strong macroeconomic headwinds,” CEO Tim Cook described. Net income during the quarter plunged 22.7 percent from the same quarter a year earlier to $10.5 billion while revenues also declined to $50.6 billion from $58 billion. iPhone sales, which accounted for 65 percent during the quarter, was hit hard while its shipments were sharply down to 51 million units, nearly 20 percent lower from the year earlier. Plus, Mac’s as well as iPad’s sales and shipments also followed the same course. Despite those negative numbers, there were some bright spots seen from the growth of the Services and the Other Products categories, which included Apple Watch. In the meantime, gross margin, technology companies’ profitability measurement, was down 150 basis points lower to 39.4 percent from the same quarter a previous year. International sales during the second quarter accounted for 67 percent. Overall, the second quarter earnings from the world’s most valuable company was very disappointing, missing every number from revenues to shipments. However, there is a shine spot in addition to the growth seen from the Services and the Other Product categories. The company increased its capital return program by adding additional $50 billion to the total $250 billion by the end of 2018. Plus, the company hiked its dividend by 10 percent to $0.57 per quarter.

Disappointing Numbers

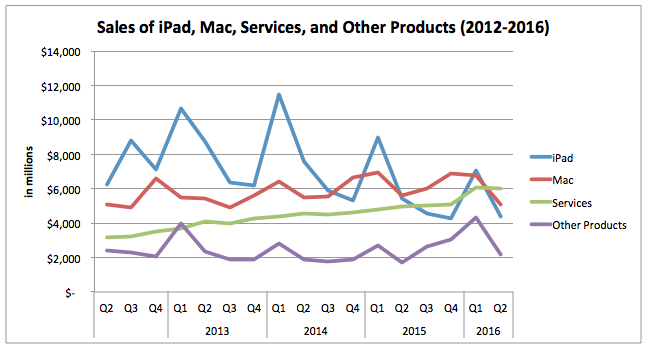

Numbers from the second quarterly earnings were widely disappointing to most investors. iPhone sales, which accounted for 65 percent of the company’s total revenue, fell 18 percent on a year-over-year basis while its sales in Greater China, which grew quiet 14 percent during the previous quarter, now plunged 26 percent from the same quarter a year earlier. Upcoming earnings beats during the second and third quarters are becoming more challenging for the company as upgrading for its top selling products cycles slow due to strong pent-up demand generation for new iPhone series. In the meantime, iPad sales have showed significant slump since its peak in the first quarter of 2014. Solid Mac sales also hit the lowest revenue number since the third quarter in 2013. All of these disappointing numbers during this quarter led the most valuable company’s earnings to experience the first-ever minus growth (year-over-year basis) since 2012, just a four years ago when iPhone 5 was on shelves. On the newspapers, even worst numbers were shown. Quarterly net profit growth dropped first time since the second quarter of 2003 or 13 years ago. Services and Other Products

Services, which include AppleCare and Apple Pay, and Other Products, such as Apple TV, Apple Watch, Beats, and so forth, are eye-catching during this second quarter. Sales of these Services and Other Products categories grew 20 and 30 percent, respectively, from the same quarter a year earlier. While sales growth of Services have been enjoying solid growth over a past decade, sales growth from Other Products, which include Apple Watch since its inclusion into the number in the third quarter of 2015, continued to grow at a massive rate. Although new Apple Watch was not released this year, rather adding up new bands on shelves, demand for Apple’s new cutting-edge products among Other Products is quietly booming. Dividend Hike & Buyback

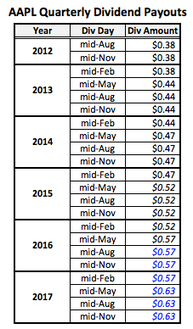

The announcement of dividend hike was taken into a positive sign given the company’s extra ordinal cash pile on its balance sheet. Apple increased the quarterly dividend amount by 10 percent to $0.57 from $0.52 per share. In addition to the dividend hike, the company also announced additional $50 billion share buyback, making total $250 billion to repurchase its own shares through the end of March 2018. These financial announcements from the company during a second quarter represent good signs of Apple’s ability to make shareholder values intact, especially when the shares are under pressure. With Apple’s massive cash piles on its balance sheet, these capital return programs should continue into coming years and the dividend growth has already been at the rate of 10 percent plus since its introduction in 2012 (It is really not the first time for the company to pay dividends. First dividends were paid in 1987-1995). Earnings & Forward

Shares of Apple are expected to be under pressure for coming quarters unless some considerable positive news shows up in public at some point. However, downside is pretty much limited for the stock thanks to its already-depressed valuation, trading at below 10 times trailing-twelve month earnings. At such low multiple, shares are very cheap and attractive for most investors, including big institutional investors. Coming quarters are probably once again likely to experience negative growth earnings. However, buying stock is always a bet on the future. As new iPhone, namely iPhone 7, is likely to unveil in the market this fall while the company’s capital return programs are highly intact, falling shares should find some comfortable floors to land anytime soon. After Earnings (May 17, 2016) After Apple’s second quarter earnings report on April 26, two iconic investors stepped into the stock market. First, Carl Icahn, an activist investor, announced on April 30, three days after Apple’s disappointing earnings, that he had sold out all of his position in Apple (NASDAQ: AAPL) given his concerns on the growth and the relationship with China. On May 16, a few weeks after Icahn’s bearish move, Warren Buffett, known as a value investor, announced that he (his company, Berkshire Hathaway) had purchased 9.8 million shares of Apple. Two notable investors’ moves on Apple stock have highlighted newspapers’ headlines over past weeks in both positive and negative. Who is right? <Continue to Read: Next Page>

|

Apple Past EarningsQ1 2016 Apple Earnings:

Just 1 Percent Growth in iPhone Sales, Time to Buy the Stock? Q4 2015 Apple Earnings: Best 4th Quarter Leads to the Best Year in History Q3 2015 Apple Earnings: The Best Third Quarter in History Thanks Again to China's Massive Demand Q2 2015 Apple Earnings Roundup: Another Solid Quarter Thanks to Chinese Demand After earnings...

|