Apple's Dividend Growth and Power of Compounding

Akira Kondo

May 2, 2014

|

I have been a shareholder of Apple Computer (NASDAQ: AAPL) for many years while I started to collect dividends from Apple since August 2012. Apple is a typical tech company, which offers a decent growth from its business operation, and it is a favorite stock to watch and own among many fund managers across the globe. Fast growing tech companies rarely offer dividends to investors as they tend to focus on reinvesting the earnings into their research and developments. An iPhone marker, Apple, was used to be the company, which did not payout any dividends to investors.

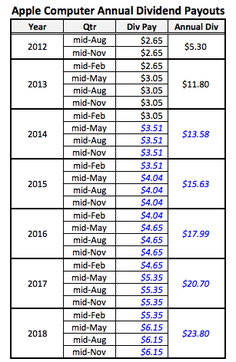

In August 2012, Apple started to payout the dividends to investors for the first time (not actually the first time though) while investors claimed for the company’s huge cash position on its balance sheet. At that time when I heard the news, I could not believe that such a fast growing tech company paid out the dividends. On the other hand, I was excited to collect the dividends while I no longer needed to depend on Apple’s volatile stock price anymore. In fact, I have been very excited to receive the dividends from Apple every quarter, especially after shares of Apple was under pressure after the shares hit all time high at $700. The pure dividend itself is not important. This article will explain the power of compounding while using the example of Apple’s dividends. The company inaugurated its dividend payout to investors in August 2013 and the initial payout was $2.65 per share per quarter. If you owned 100 shares of Apple, you would pocket $265 every quarter or $1,060 annually (assume no taxes on dividends). It is a handsome dividend you can get every quarter (however, there are much more attractive dividend stock to own, such as MCD and BMY, which yield above 3 percent). However, it is not attractive to hold onto Apple shares if the stock price keeps falling or inflation hits the economy. The dividend yield, which allows you predict dividend collection in a percentage base and is comparable to banks’ interest rates or bond coupon rates, matters. In the mid-August 2012, shares of Apple were trading around $650 per share and the dividend yield was at around 1.63 percent (“$2.64 x 4 quarters” / $650). Then, the shares of Apple nosedived into $450 a share in the mid-February when Apple paid out its third dividend. The yield hit 2.35 percent, which was much higher and attractive than the original 1.63 percent (See the chart). |

|

|

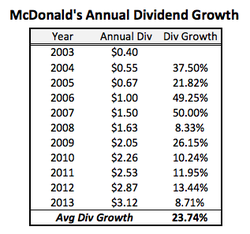

Power of compounding Apple increased the dividend payout in the mid-May 2013 to $3.05 per quarter or $12.2 annually, up 15 percent from the past quarters. When owning a dividend paying company, the dividend growth all matters. Though some investors enjoy the fixed dividend amount for many years, it is not wise to do so. The 15 percent dividend increase is relatively high among stocks listed on the NASDAQ. However, its 15 percent divided increase has to happen every year to attract investors. On Apple’s balance sheet, more than 20 percent of the share price accounts for cash equivalent, which is convertible into cash right away. That said, Apple has no problem paying out dividends anytime and can increase its dividend annually for at least upcoming years. |

|