Q1 2017 Apple Earnings: All-Time-High Revenues and EPS, Growth is Back Again

February 1, 2017

Akira Kondo

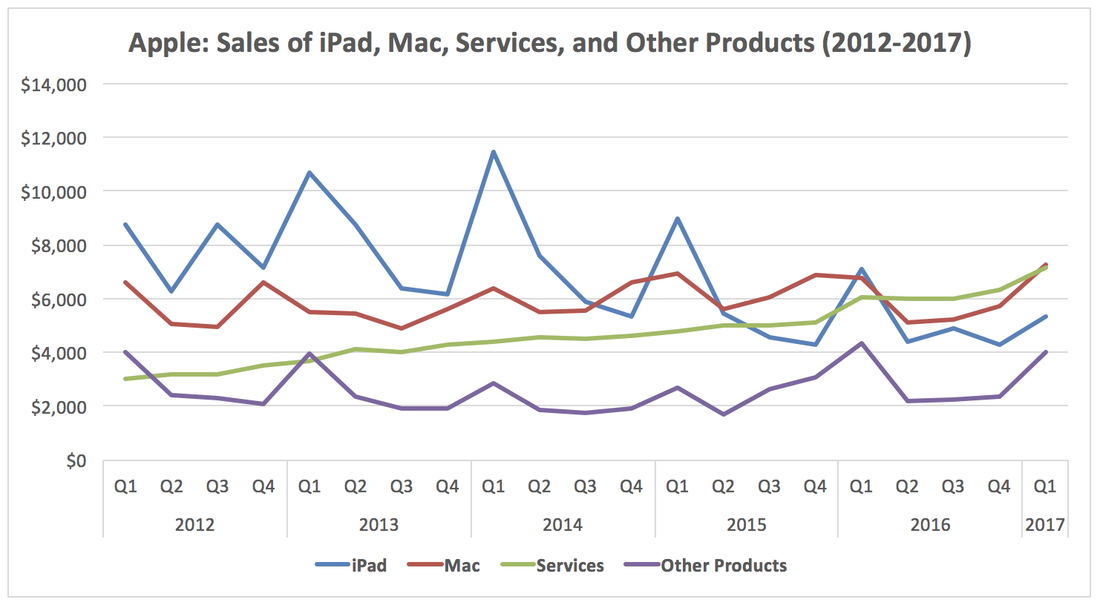

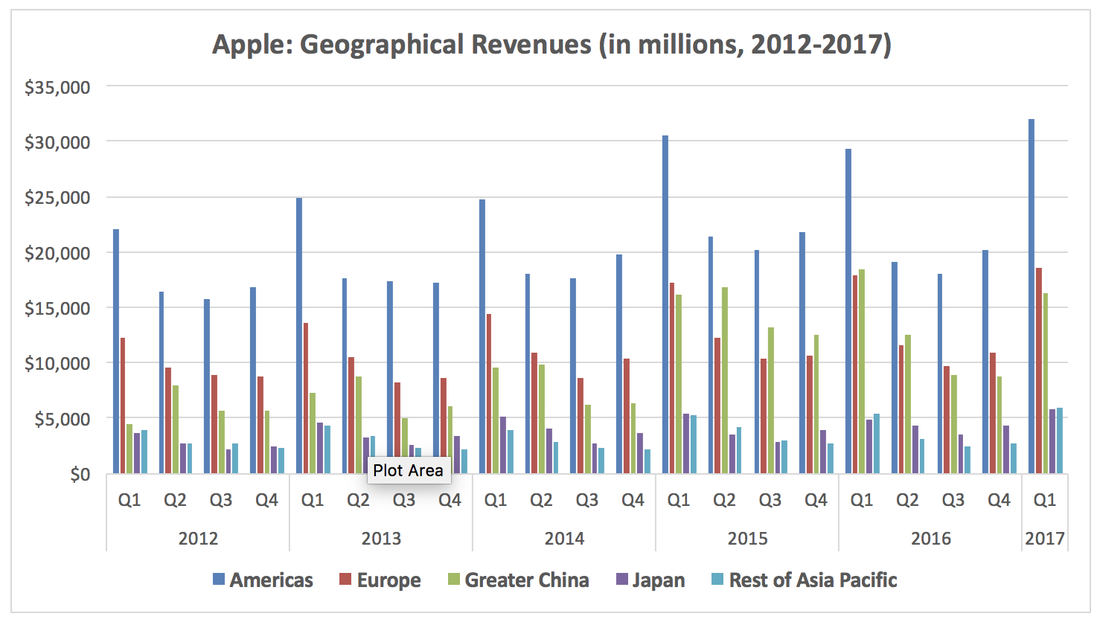

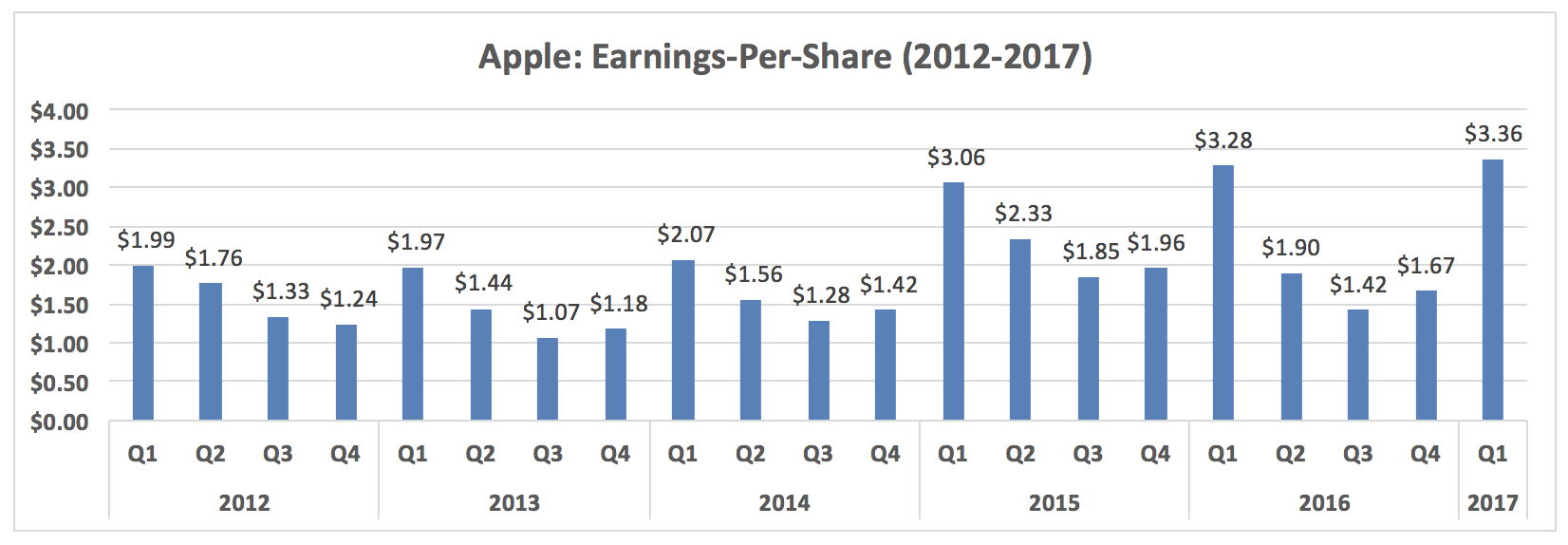

Apple Inc. (NASDAQ: AAPL) reported better-than-expected earnings for the October-December quarter after the market closed on Tuesday. The company earned $3.36 per diluted share or $0.15 above the consensus estimates. Revenues during the quarter hit the record-high of $78.4 billion or up 3 percent from the same quarter a year ago. Net income, on the other hand, was slightly down at $17.9 billion, compared to $18.4 billion the same quarter the previous year, while the gross margin, the profitability measurement for the technology company like Apple, was 38.5% or down from 40.1 percent in the first quarter a year earlier. International sales during the quarter hit 64 percent. Highlights of the quarter were clearly the record revenues as well as the record earnings, which led the tech giant to a growth mode once again. Services, including Apps and Apple Pay, grew strongly during the quarter and its revenue number accounts for 9.2 percent of total Apple or 8 percent the same quarter last year. Mac sales are hard to ignore as well. Newly introduced high-end MacBook Pro generated the record high revenues thanks to greater pent-up demand accumulated over past years. Overall, the first quarter earnings result turns green signal to investors after experiencing a year-long slump and Apple stock is likely to enjoy momentum into the year ahead.

Bright spot

A decent growth seen in Services category is highly welcomed among investors. Apps, like Pokémon Go as well as Super Mario Run, were on the center stage last year and light-asset Services segment shows great potential for Apple’s future growth. Services grew 18 percent on a year-over-year basis, becoming the revenue making category after iPhones (but Mac made slightly more revenues than Services thanks to newly introduced MacBook Pro during holiday season). Mac sales is hard to ignore as well. During the holiday-shopping quarter, the company shipped 5.37 million units of Mac products, which is the second largest shipments in Apple history (the record-high shipment happened in first quarter of 2015). Revamped MacBook Pro is expected to be popular item for Mac fans and it should generate higher year-over-year revenues over coming quarters. China

Sales in Greater China have been widely watched by investors and analysts over past years as it still accounts for 20 percent of total Apple sales. Despite continuing sales decline in the region, the number came in just 12 percent slump after more than 30 percent declines over past quarters. Pent-up demand for new iPhone 7 drew Chinese consumers during the October-December quarter and this trend should continue into upcoming quarterly result thanks to China’s delayed holiday season. Year of Chicken has already started right before the earnings call. Young Chinese consumers are likely to spend money for modern items, like iPhone, while those people tend to buy reasonable made-in-China smartphone, like Oppo, for their parents. It is no reason the popularity of cheaper smartphones are highly intact in China but still tens of millions of non-iPhone users are eyeing on modern iPhone products. Earnings

The company earned $3.36 per share, beating the consensus estimates by $0.15, and its number turned out to be the record-high for Apple’s history. Important part is that the company’s earnings growth is back in business after three consecutive quarters of slumps. Despite upcoming quarters are always challenging quarters for the company but growth in Services and Mac popularity, plus expected better iPhone sales in China, should deliver solid numbers into remaining fiscal 2017 quarterly results. In fact, investors as well as analysts are also looking for this year’s upcoming iPhone, which is expected to be a totally redesigned one, and they expect it to be the greatest hit in history. With that in mind, Apple’s multiple should move higher into coming quarters from cheap multiples seen in over past years. During the next second quarter, Apple is expected to announce dividend hike, which is likely to be a 10 percent growth from the current $0.57 per share dividend. Plus, it is possible to hear fat capital return program after the company returning more than $200 billion past years. All in all, shares of Apple should enjoy positive momentum into coming quarter while downside is limited.

|

Apple Past EarningsQ4 2016 Apple Earnings: No Surprise, 2016 Earnings Now Behind, Is Growth Back Again? Q3 2016 Apple Earnings: Disappointing Earnings are Behind, Now Growth Ahead Q2 2016 Apple Earnings: Disappointing Quarter Finally Comes, China Sales Down 26% Q1 2016 Apple Earnings: Just 1 Percent Growth in iPhone Sales, Time to Buy the Stock? Q4 2015 Apple Earnings: Best 4th Quarter Leads to the Best Year in History Q3 2015 Apple Earnings: The Best Third Quarter in History Thanks Again to China's Massive Demand Q2 2015 Apple Earnings Roundup: Another Solid Quarter Thanks to Chinese Demand More Articles

|