Vanguard Total Bond Market ETF (BND): Benefits of Investing in a Bond Basket

June 1, 2015

Akira Kondo

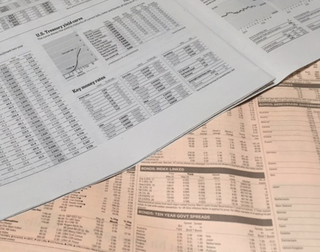

Both The Wall Street Journal and Financial Times issued on May 27, 2007, show detailed bond market data. The Wall Street Journal depicts the yield curve, which is a popular economic indicator among investors. Both The Wall Street Journal and Financial Times issued on May 27, 2007, show detailed bond market data. The Wall Street Journal depicts the yield curve, which is a popular economic indicator among investors.

One of the finest ETFs (Exchange-Traded Funds) to have in your portfolio after SPDR S&P 500’s SPY is probably Vanguard’s Total Bond Market, as known as BND. As its name shows, this ETF offers exposure to U.S. investment grade bonds, such as corporate and government bonds. The beauty of owning BND truly comes from its ability to pay out dividends (or should say coupons instead) monthly. Yes, this is one of the few ETFs that pay out dividends monthly and this turns into your monthly income after taxes. Along with its monthly dividends, BND currently yields handsome 3.51 percent, well above SPY’s current 1.93 percent (as of May 30, 2015). In very general, bond is up when stock is down, vice versa. While most U.S. equity indices have been experiencing bull market over past years, BND can be a perfect fit into your portfolio when thinking of future potential downside on stock markets.

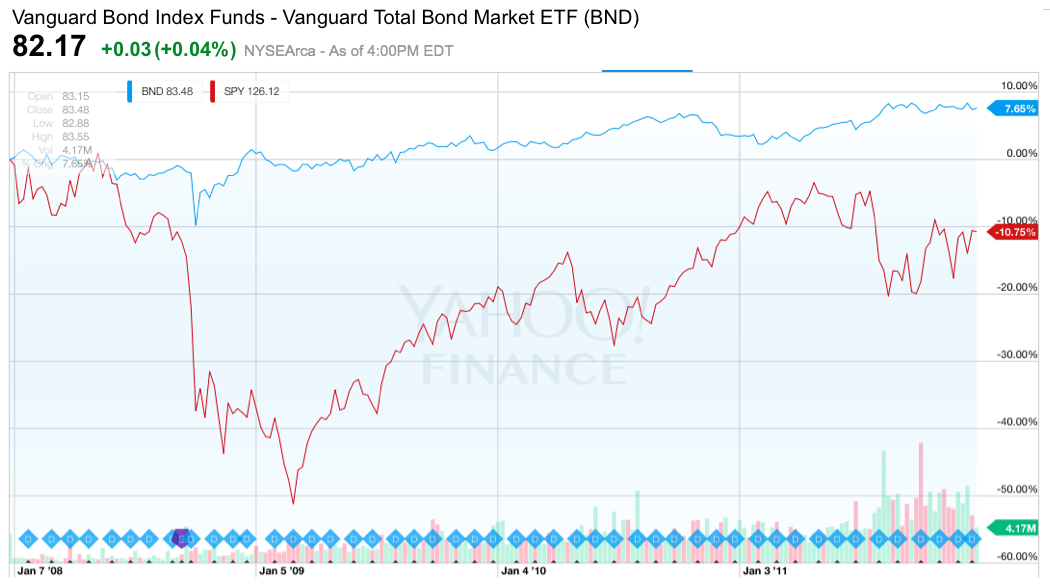

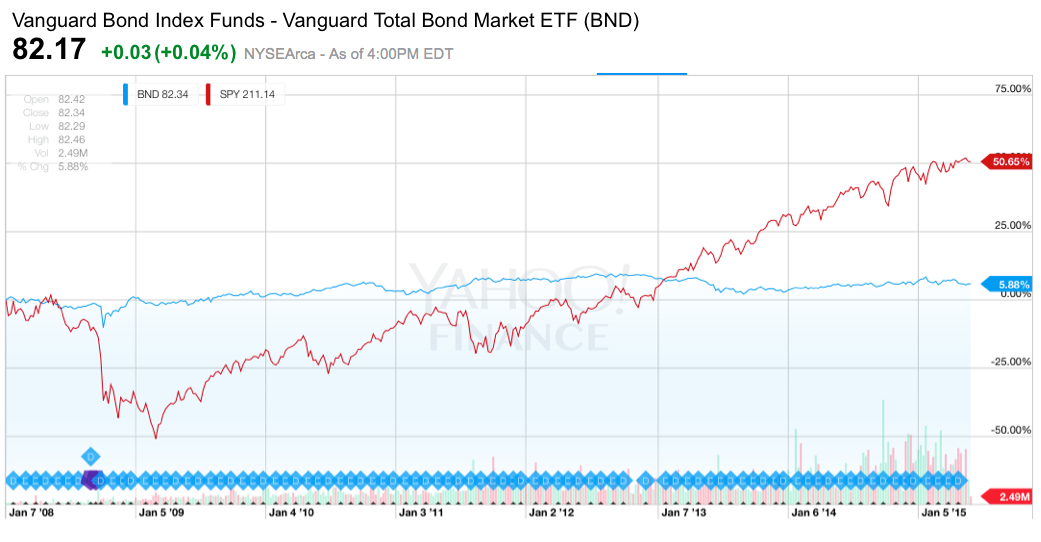

I did not know the relationship between stocks and bonds until I watched San Francisco Giants vs Los Angeles Dodgers game on television back in July 2007. While in the game, one of ballpark audiences was holding up a paperboard, which said, “BONDS DOWN, STOCKS UP.” At that time, U.S. stock markets were hitting all-time high while Barry Bonds, an all-time home run king, was in his worst slump (later at Chicago Cubs, he hit numbers 752 and 753 home runs). One year later, the stock markets nosedived while a bond market, not Barry Bonds, held up relatively well. During the 2009 global financial crisis, I was at Merrill Lynch’s Oakland office, watching stock markets’ wild coaster ride on Bloomberg screens. Soon later, I started to study more carefully about bond markets as well as BND to learn the importance of having them in a wealth management portfolio. In very general, stock and bond tend to move different ways. When stock is up, bond is down, vice versa. Since Barry Bonds retired after the 2007 season, bond markets performed better than stock markets. For instance, an aggregate bond ETF, BND, held relatively well when popular 500 U.S. companies or SPY were under great pressure thanks to the global financial crisis. Between 2008 and 2011 when the U.S. economy was in its worst slump, BND performed a positive 7.65 percent return along with monthly dividends paid out. On the other hand, SPY lost a half of its value by the early 2009 and ended up with a negative 10 percent return by the end of 2011. Though “bonds down, stocks up” is generally intact for those periods, market interest rates actually matter. During 2008, the former Fed Chairman, Ben Bernanke, lowered its key interest rates all the way down to near zero, which still continued till today (Also read: How Do Stock Markets React when the Yield Curve Changes?). When interest rates are low, a price of bonds tends to move higher, vise versa. In the meantime, bond’s yield becomes thinner. Since BND is not really a bond, credit risk, which is another risk measurement of owning a bond, should not matter in this case. However, bonds may experience default risk when a bond issuer cannot make interest payments while overall economy is in trouble. This kind of event may affect the price of BND as its price went sharply down in the end of 2008 when the stock market crash officially kicked off.

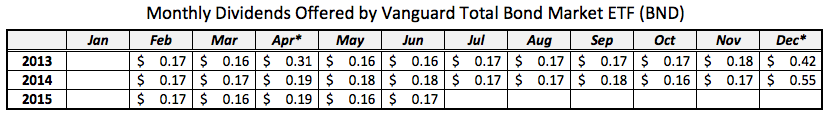

While the price of BND fluctuates, its investors earn a form of divided every month. Periodical source of cash is important whether you work full-time or not. It gives some additional monthly spending allowance, such as covering your utility payments or additional coffee at Starbucks, as long as you own BND in your portfolio. This is probably the beauty of owning BND. This ETF pays out monthly dividends about a week after its ex-dividend date, which is the first trading day of a month. In every April and December, this ETF also gives out any short-term and/or long-term gains to investors. Currently, it yields 3.51 percent or every $10,000 you invest, you would receive $351 over a 12-month period. However, owning only BND is not a wise investment strategy. While risk of investing in BND is relatively lower than investing in equity indices, asset allocation between bonds and stocks matters importantly. Thanks to a fast development of ETFs and portfolio analysis tools generosity offered by most brokerage firm, today’s asset management is much easier. For beginning investors, owning both SPY and BND already makes a perfect portfolio in your wealth management account. They will instantly give you well-diversified equity and bond portfolios as soon as you own them. Or you want to add an emerging market component into your portfolio? Just add up (a smaller portion of, for safe) iShares’ MSCI Emerging Market ETF with its ticker symbol, EEM. Ratios of owning BND and SPY or EEM depend highly on your risk tolerance, age, and financial goal. For this part, you may have to consult with your financial advisor or your friend, who has been consulting with his/her financial advisor. Importantly to think of, BND gives you an option to diversify your portfolio. Owning BND may yield some risk into future. This BND does not have maturity while most bonds have. There is no guarantee that you get the face value back, or the amount you invested when purchasing BND. Like stocks, bonds also move up and down depending on the state of the economy or changes in the interest rates and credit risk. While there are many rumors that Fed is going to raise its key short-term interest rate by the end of this year, the bond price is likely to fall while the yield fattens, if the Fed is going to do so. On the other side, stocks (or companies) hate interest rate hike because profitable businesses become unprofitable, which lead to lower stock prices. Then, there is conflict between bonds and stocks. A general idea of “stocks up, bonds down” does not hold. Like the global financial crisis in 2008-2009, bond markets or BND outperformed stock markets. However, excluding such difficult economic environment, both stock and bond markets tend to move same directions.

*This article is author’s ideas about investing in BND, not an investment recommendation. There maybe some possible mistakes on general concepts of BND and stocks as well as bonds. The author is not holding any ETFs mentioned in the article. Investment contains risks. Please consider risks of investment when investing. Economics Universe is not responsible in any loss of your investment. |

Related ArticleMore Articles on InvestmentHow to Beat the Market? Diversification: Systematic Risk and Unsystematic Risk Apple's Dividend Growth and Power of Compounding PE Multiple Analysis: How to Determine the Future Stock Price? The Great Gatsby and the Stock Market in the 1920s Popular Articles on ChinaApple and Starbucks in Chengdu, China: Fast Growing Largest Inland Economy Apple and Starbucks in Chongqing, China: Price-Sensitive Inland Consumers Apple Store in Hangzhou, China: Popularity of Apple Products in China Starbucks in Changsha, China: Growing Upper Middle-Income Consumers Chinese ADRs: Is It Good to Buy Alibaba Shares? What is Middle-Income Trap? To visualize how today's economy looks like or stocks behave, Data in Universe offers graphs and figures established through various sources.

>> Data in Universe |