2014 Economics Universe Portfolio Performance

January 5, 2015

|

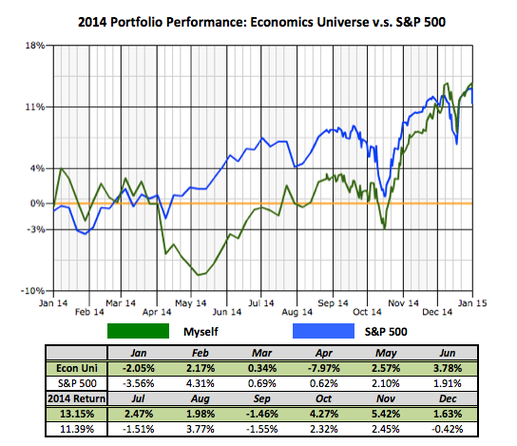

Except for AAPL, the bigger positions, like SBUX, BAC, BMY, and ISRG, experienced shortfall in the second quarter, which made more difficult to catch up with the market later on. Unluckily or luckily, MCD, which performed solidly in the first half of the year, was removed out of the portfolio in the earlier year after a multi-year holding. By the mid-summer, YOKU was accumulating bigger loss and was also removed after realizing the loss. OVTI was also sold in the earlier year despite knowing of the massive run through the year-end. There would be several options to recover from the bigger loss, such as initiating new positions and adding back those shares on the weakness. However, all those stocks were the core holdings in the portfolio and they have been the best picks for years while shares were down for no reason. Therefore, there was no action made to eliminate or trim any of those shares into the second half of the year. By the beginning of the third quarter, VALE was removed out of the portfolio after losing 33 percent within the year-to-date, considering a 50 percent gain in coming quarters was not attainable. To replace that position, Ensco (NYSE: ESV) was added into the portfolio thanks to its attractive yield, which could cover VALE’s. Though shares of ESV soon plunged into an all time low in the year or approached to near the post financial crisis low in the earlier 2009. In the meantime, those stay-in-the-game stocks, SBUX, ISRG, BMY, and UAL, started to lift off and performed far higher than the S&P 500 benchmark into the end of the year. UAL’s amazing run was enough to cover the continuing loss of ESV, especially during the Russian Ruble crisis, when shares of ESV farther nosedived into the $20s from well above $50s. During the forth quarter, the portfolio needed a little fuel to catch up with the market benchmark. Tesla Motor (NASDAQ: TSLA) was added after trimming some shares of UAL, which had made a massive gain through the quarter. The cost of TSLA was $223 while it already had gained nearly 50 percent from the beginning of the year to the purchase date. However, it was a new name that the portfolio needed such nice combination of automotive and technology. Into the final weeks of the 2014 stock market year, the portfolio finally surpassed the benchmark. The only concern at that time was light volume might create some turbulences on those wining stocks. Thus, SBUX was trimmed to pocket some cash in order to support the possible downfall later on. Though it was not really needed. After the market closed on December 31, the Economics Universe portfolio gained 13.2 percent while the S&P 500 was up 12.4 percent or the Economics Universe portfolio performed 80 basis points higher than the benchmark in 2014, making another year of the outperformance. In addition, the portfolio ended with 10 stocks after the last trading day of the year: AAPL, SBUX, TSLA, BAC, ISRG, BMY, ESV, STJ, UAL, and CPL. One of the best performers in the portfolio was AAPL, which gained more than 40 percent in the year after the disappointing performance in 2013. Again, UAL performed outstandingly at nearly 70 percent gain in the year, making itself one of the biggest holding in the portfolio as well. Healthcare positions, BMY, ISRG, and STJ solidly performed, especially the second half of the year. In fact, the healthcare sector overall (SPDR ETF: XLV) performed nearly 25 percent during the year or accounted for 14 percent of the S&P 500, which was the third largest weights after IT and Financials. Heading into the 2015 stock market year, core holdings, such as AAPL, SBUX, ISRG, BAC, and BMY, will continue to be the main drivers of the portfolio. UAL and CPL are likely to be a source of cash into the 2015. ESV, which is already down more than 40 percent after initiating it last year, will be on hold while the pull back in the oil price should drive its shares up sharply while expecting continuing dividend payouts. More shares of TSLA are probably added in any weakness during 2015 as Tesla brand gains momentum in the market. Shares of AAPL are likely to be heavily watched again among investors throughout 2015 and its quarterly earnings will kick off in the last week of January. Thanks to its outstanding sales worldwide and its upcoming new products like Apple Watch, the shares may continue to gain momentum. The only concern would probably be that how the new product, like Apple Watch, will grab consumers’ mind, meaning how consumers’ utility on Apple Watch will remain intact over years, like how iPhone has done in the past. If Apple Watch’s sales growth remains low in coming years, that may impact the shares in coming years. However, Apple shares should be bullish in 2015 or one of the best stocks to own among the S&P 500 components. AAPL will remain as a core holding into 2015. As easy money has been made over past five years, the 2015 stock market year is not going to be as easy as before. The worldwide economy is slowing. European economy is approaching a deflationary territory, Chinaese economy is slumping into a six percent level, and oil price is tumbling. The fall of oil price starts to hurt stock markets in the end of last year and will continue to do so in 2015. At some point, the oil price is bottoming out but the stock markets will probably experience higher volatility till then. A fast growing middle-income economy, China, is becoming a center stage as well among investors and economists. Despite the Chinese market’s above 40 percent return in 2014 thanks to falling oil price, its economic activities are carefully watched into 2015 and the U.S. stock markets would perform depending on how China plays out. If Chinese economy slows even further, Euro’s economy is further in trouble as well, making the world economy sluggish. A strong dollar against major currencies will likely be intact throughout 2015. Falling oil price as well as Euro’s and China’s slowing economic activities will affect the central bank’s decision to hike or not to hike its interest rate. However, sooner or later this year, the Fed will carefully manipulate its rate, which may affect global economy and may become good for the U.S. stock markets. That being said, studying economy is far more difficult than ever before, so is studying investment. As always, Economics Universe will continue to utilize economic data available on universe to deliver meaningful articles to share economic and investing ideas to readers. Sharing ideas are the best sources to come up with the best investment strategies and it is the way to beat the market benchmark, the S&P 500. Thanks for reading and wish you a very happy New Year! Akira Kondo is long AAPL, SBUX, TSLA, BAC, ISRG, BMY, STJ, ESV, UAL, CPL. |

|