Performing ahead of the Benchmark

Jul. 30, 2013

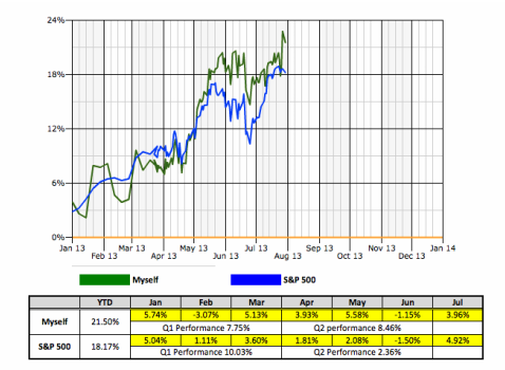

YTD performance against the benchmark S&P 500

YTD performance against the benchmark S&P 500

Every year I manage my well-diversified portfolio to outperform the market. The "market" is the S&P 500, which is my benchmark that I want to beat annually. I have been doing this for past ten years while I have outperformed the markets except 2003, 2004, and 2007. In 2008, my portfolio was down nearly 40 percent but in line with the market. Outperforming the market requires greater patience and a lot of homework.

In 2003, I started off with my equity portfolio investment but I only owned a few names as I was a college student and had a little money to invest. At that time, I owned Yahoo! (NASDAQ: YHOO) for several quarters and Sony (ADR: SNE). In 2004, I stepped into today's popular (probably not the past few quarters) Apple shares (NASDAQ: AAPL) at around $36-40 purchased in different periods. I still remember I owned 160 shares of Apple (it's worth more than $70,000 now if I still owned all). One of my biggest losses in my portfolio history comes from Apple. When Apple announced the first quarter earnings in 2004, the share nosedived about 20 percent during the next day trading session. As a young investor, I was in panic and sold most shares on that day to realize the big loss.

At that time, I started to accumulate Apple shares as I bet that the company would deliver great quarterly earnings. The company actually delivered the record high earnings both in profits and revenues but the investors were unsure about the growth of the future earnings. This reminds me everyday till now what the most important lesson in investing is the "growth." My favorite investor, Jim Cramer, said, "buying stock is a bet on the future, not the past" in his book, Real Money.

Since then, my portfolio strategy started to change, focusing more on greater diversification and the growth. Currently I own nearly 15 stocks and I cap my maximum names in the portfolio at 20. More than 20 names, I do not think I can manage all everyday and every week. My current top-ten holdings are Apple, McDonald's (NYSE: MCD), Starbucks (NASDAQ: SBUX), Vale (NYSE: VALE), Bristol-Myer Squibb (NYSE: BMY), Bank of America (NYSE: BAC), Intuitive Surgical (NASDAQ: ISRG), UAL (NYSE: UAL), Goldman Sachs (NYSE: GS), St. Jude Medical (NYSE: STJ) and several others. Apple is my biggest position in my portfolio, McDonald's is the next, and St. Jude is the smallest in order.

Over the past several years, most of the components in the portfolio performed relatively well. Especially, Apple's performance was just exceptional enough to outperform the market last year. Every year or quarter, I make some changes in my portfolio but I did not make much change over the past year. BMY was newly added in the earlier this year as I wanted to increase dividend exposure along with adding more shares of Apple at around $400 this year. Apple yields around 3 percent, which made me attractive again to step in. Plus, I want to have more shares before new innovative products show up by the end of this year.

McDonald's has become my long-term holding since I started to own in 2009. This name also yields 3 percent and every year in November the company increases the dividend payout by at least 10 percent. Though this stock has been moving side way for a year, I'm collecting handsome dividend. I expect the quarterly dividend payout increases to near 90 cents a share.

This year, I am ahead of the market by a few percentage points as of the end of July (See the chart and table). So far the portfolio looked okay but some disappointment over the past quarter. Apple and Vale have been significantly underperforming the market. The only hope that I own these names is just dividends.

For Apple stock, I have been very patient while I added the shares to the portfolio to make the biggest position last quarter. Plus, I plan to add more shares in Vale as well. In fact, the biggest disappointment is McDonald's. This stock is not doing anything while just paying out dividends. I bet this stock that the company's earnings to grow in systemwide but the same-store sales shows weakness every month. My patient on this stock is about to be gone and may switch to the other defensive names, such as Coca Cola (NYSE: KO) and Proctor & Gamble (NYSE: PG) as well as oil play, Conoco Phillips (NYSE: COP).

The reason I am still ahead of the market this year is thanks to a great performance of Starbucks. The company just delivered another solid earnings last week and the shares were up 7 percent on the next trading day. Plus, shares of Apple lifted off after its earnings a few days before the Starbucks’ earnings. Otherwise, both Bank of America as well as Bristol-Myer Squibb performed rock-solid this year and have lifted my portfolio performance year to date.

The biggest surprise in the portfolio is United Airlines parent’s UAL. This stock has skyrocketed since I owned in 2009 and is up 46 percent this year. However, I fly United every month and know the company very well. Since last summer, it has been more difficult to see empty seats around my seat. Most of the flights I have flown this year were fully loaded while a long wait to use the bathroom on the plane. I hate to fly the crowed plane; on the other hand, the plane is profitable. That said, I will continue to hold onto this position until the summer travel season clearly ends.

Although this year’s portfolio management so far went easy while just establishing a BMY position and adding Apple to boost dividend income, I have been patient on stocks that have underperformed for long. Vale is disappointing but I try to hold onto it. Apple, as well, but this stock has a great turnaround story through the end of this year while collecting fat dividends. Going forward, a profit taking in the market is likely and I continue to focus on stocks that pay out dividends and buy back stocks. Apple, Starbucks, and BMY are going to be my long-term holdings while I will take profits in UAL and BAC. Intuitive Surgical is out of favor in the past weeks, but I will continue to add the shares when all the dust settles.

To beat the market, again it requires greater patience and creation of well-balanced portfolio. I have been discussing with my fellow investors in daily basis to learn more about investing for many years. Now, I am a Ph.D. student, and I would like to pick more favorable stocks based on today’s economy while learning valuable topics at school. As always, I would love to share the opinions with readers and that is important for me to learn to become a good investor. Stay tuned.

In 2003, I started off with my equity portfolio investment but I only owned a few names as I was a college student and had a little money to invest. At that time, I owned Yahoo! (NASDAQ: YHOO) for several quarters and Sony (ADR: SNE). In 2004, I stepped into today's popular (probably not the past few quarters) Apple shares (NASDAQ: AAPL) at around $36-40 purchased in different periods. I still remember I owned 160 shares of Apple (it's worth more than $70,000 now if I still owned all). One of my biggest losses in my portfolio history comes from Apple. When Apple announced the first quarter earnings in 2004, the share nosedived about 20 percent during the next day trading session. As a young investor, I was in panic and sold most shares on that day to realize the big loss.

At that time, I started to accumulate Apple shares as I bet that the company would deliver great quarterly earnings. The company actually delivered the record high earnings both in profits and revenues but the investors were unsure about the growth of the future earnings. This reminds me everyday till now what the most important lesson in investing is the "growth." My favorite investor, Jim Cramer, said, "buying stock is a bet on the future, not the past" in his book, Real Money.

Since then, my portfolio strategy started to change, focusing more on greater diversification and the growth. Currently I own nearly 15 stocks and I cap my maximum names in the portfolio at 20. More than 20 names, I do not think I can manage all everyday and every week. My current top-ten holdings are Apple, McDonald's (NYSE: MCD), Starbucks (NASDAQ: SBUX), Vale (NYSE: VALE), Bristol-Myer Squibb (NYSE: BMY), Bank of America (NYSE: BAC), Intuitive Surgical (NASDAQ: ISRG), UAL (NYSE: UAL), Goldman Sachs (NYSE: GS), St. Jude Medical (NYSE: STJ) and several others. Apple is my biggest position in my portfolio, McDonald's is the next, and St. Jude is the smallest in order.

Over the past several years, most of the components in the portfolio performed relatively well. Especially, Apple's performance was just exceptional enough to outperform the market last year. Every year or quarter, I make some changes in my portfolio but I did not make much change over the past year. BMY was newly added in the earlier this year as I wanted to increase dividend exposure along with adding more shares of Apple at around $400 this year. Apple yields around 3 percent, which made me attractive again to step in. Plus, I want to have more shares before new innovative products show up by the end of this year.

McDonald's has become my long-term holding since I started to own in 2009. This name also yields 3 percent and every year in November the company increases the dividend payout by at least 10 percent. Though this stock has been moving side way for a year, I'm collecting handsome dividend. I expect the quarterly dividend payout increases to near 90 cents a share.

This year, I am ahead of the market by a few percentage points as of the end of July (See the chart and table). So far the portfolio looked okay but some disappointment over the past quarter. Apple and Vale have been significantly underperforming the market. The only hope that I own these names is just dividends.

For Apple stock, I have been very patient while I added the shares to the portfolio to make the biggest position last quarter. Plus, I plan to add more shares in Vale as well. In fact, the biggest disappointment is McDonald's. This stock is not doing anything while just paying out dividends. I bet this stock that the company's earnings to grow in systemwide but the same-store sales shows weakness every month. My patient on this stock is about to be gone and may switch to the other defensive names, such as Coca Cola (NYSE: KO) and Proctor & Gamble (NYSE: PG) as well as oil play, Conoco Phillips (NYSE: COP).

The reason I am still ahead of the market this year is thanks to a great performance of Starbucks. The company just delivered another solid earnings last week and the shares were up 7 percent on the next trading day. Plus, shares of Apple lifted off after its earnings a few days before the Starbucks’ earnings. Otherwise, both Bank of America as well as Bristol-Myer Squibb performed rock-solid this year and have lifted my portfolio performance year to date.

The biggest surprise in the portfolio is United Airlines parent’s UAL. This stock has skyrocketed since I owned in 2009 and is up 46 percent this year. However, I fly United every month and know the company very well. Since last summer, it has been more difficult to see empty seats around my seat. Most of the flights I have flown this year were fully loaded while a long wait to use the bathroom on the plane. I hate to fly the crowed plane; on the other hand, the plane is profitable. That said, I will continue to hold onto this position until the summer travel season clearly ends.

Although this year’s portfolio management so far went easy while just establishing a BMY position and adding Apple to boost dividend income, I have been patient on stocks that have underperformed for long. Vale is disappointing but I try to hold onto it. Apple, as well, but this stock has a great turnaround story through the end of this year while collecting fat dividends. Going forward, a profit taking in the market is likely and I continue to focus on stocks that pay out dividends and buy back stocks. Apple, Starbucks, and BMY are going to be my long-term holdings while I will take profits in UAL and BAC. Intuitive Surgical is out of favor in the past weeks, but I will continue to add the shares when all the dust settles.

To beat the market, again it requires greater patience and creation of well-balanced portfolio. I have been discussing with my fellow investors in daily basis to learn more about investing for many years. Now, I am a Ph.D. student, and I would like to pick more favorable stocks based on today’s economy while learning valuable topics at school. As always, I would love to share the opinions with readers and that is important for me to learn to become a good investor. Stay tuned.