Is China going to be the biggest market for Apple Watch?

April 22, 2015

Akira Kondo

Apple Store Nanjing East Street on April 10 when the Apple Watch previews kicked off. Apple Store Nanjing East Street on April 10 when the Apple Watch previews kicked off.

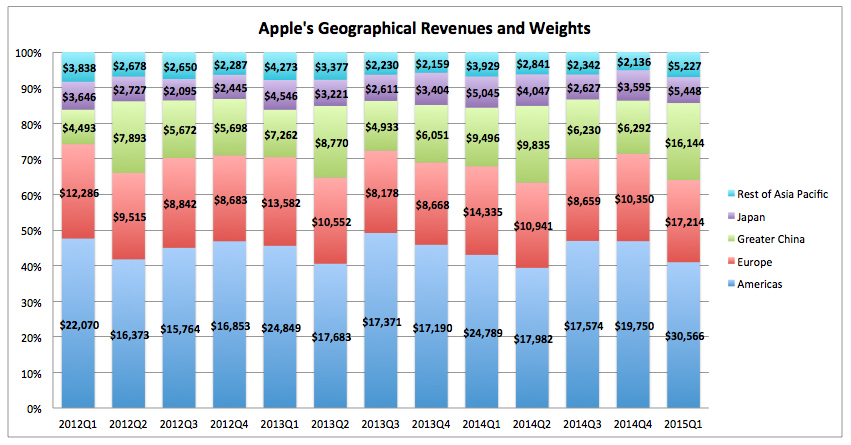

During the initial day of Apple Watch previews at one of four Apple Stores available in Shanghai, China, the crowds from local residents to tourists continuously formed in a circle around the Apple Watch showcases moments by moments. While it is the long-awaited new cutting-edge product from Apple (NASDAQ: AAPL) for many of its funs across the globe, China is soon likely to be on the center stage for the $700 billion cap company. Apple’s sales in China, including Hong Kong and Taiwan, already accounted more than 20 percent of the total globally, compared to 23 percent from Europe and 41 percent from Americas. It is very likely that China’s overall sales will overtake Europe’s within next quarters as soon as the Apple Watch debut within coming days.

The watch in China is a precious item. It can be a great gift for parents and girlfriends nowadays. However, giving a watch or clock to someone was once before (or even today) considered to be a taboo because it indicated his life was running out of the time, meaning attending a funeral. Or it simply means sending a bad luck to someone by giving a clock. In coming weeks, Apple Watch may change this traditional Chinese superstition and gifting an Apple Watch may become the popular custom, especially among young generations.

When I visited the Apple Store on the Nanjing East Street during the mid-day, a crowd from the local residents to tourists stood around Apple Watch showcases to learn the new cutting-edge products from Apple. People in Shanghai always seek modernity and their interests in the Apple Watch will soon spread across China and will probably turn Apple’s China sales into the second largest position, after greater Americas, within next quarters.

|

More Articles on AppleApple and Starbucks in Chongqing, China: Price-Sensitive Inland Consumers Apple Store in Hangzhou: Popularity of Apple Products in China Apple's Dividend Growth and Power of Compounding Apple 2014 1Q Earnings Apple: Loosing Monopoly Power Apple: Is This Stock Too Cheap to Own? Apple: Is This Stock Still Cheap? |

|

In coming days, the history will continue. As China’s traditional “show-off” culture officially kicks off this month, more expensive models of Apple Watch are likely to be seen in wealthier cities, like Shanghai. While ordinal upper middle-income consumers probably put off buying the most expensive Apple Watch Edition but super high-income people would like to have one on their wrists to show off its shiny golden watch to their neighbors. Although it is all based on human behavior, ordinal Chinese would prefer having handsome Apple Watch rather than cheaper aluminum-cased Apple Watch Sport. Over past weeks, many surveys were taken though media companies across the globe, it seems like growing upper middle-income Chinese are likely to think Apple Watch as the best choice. In the meantime, prices of the mid-tier Apple Watch kick off with $549 up to $1,099, depending of a band and a size of screen. Of course Apple Watch buyers should be those who currently own iPhones but the cutting-edge Apple Watch may attract non-iPhone users to join an iPhone family in order to have it. There are millions of Chinese, who want to buy an expensive iPhone rather than cheaper Xiaomi or HTC, but their income level today may not allow them to get an iPhone. On the other hand, those who are getting out of the middle-income trap into the upper middle-income category are growing fast and always interested in having Apple’s expensive but modern products in their lifestyles. In the Apple Store, what I always heard from the Apple Watch audience was “how much?” They are relatively highly price-elastic middle-income consumers. As soon as they join the upper middle-income category, they would definitely become the new customers of iPhone as well as Apple Watch.

Historically, both third and forth quarters are difficult time for the company thanks to the periods of generating pent-up demand for the first quarter (Apple’s fiscal first quarter is October to December) when Apple typically delivers new generation of iPhone. If Apple can sell the watch more than what analysts estimate, currently $1.67 per share for the third quarter earnings followed by $1.78 per share for the fourth quarter earnings or up 30 percent and 25 percent respectively from the same periods earlier, shares of the company may continue to fuel momentum during those quarters. It will highly depend on the sales made from China, where upper middle-income consumers are growing fast, while it is likely to be the largest market for Apple Watch along with iPhone or for the company itself within next years. When it becomes intact, Apple may become the first-ever one trillion market-cap company much sooner than later while shares need to be up another 35 percent from the current price at around $127 (as of April 22, 2015). |

Recommended ArticlesMore Articles on Investment> Investment Bulletin Starbucks in Changsha, China: Growing Upper Middle-Income Consumers Chinese ADRs: Is It Good to Buy Alibaba's Shares? The Great Gatsby and the Stock Market in the 1920s More Articles on China |