Q3 2015 Apple Earnings: The Best Third Quarter in History Thanks Again to China’s Massive Demand

July 23, 2015

Akira Kondo

Apple Store at East Nanjing Street in Shanghai, China Apple Store at East Nanjing Street in Shanghai, China

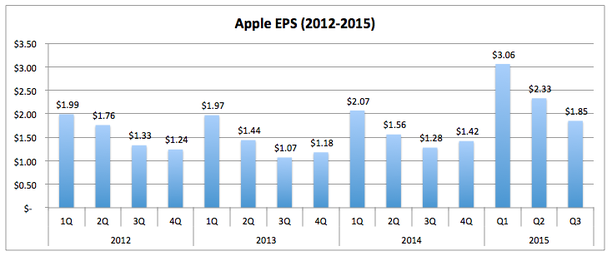

Apple (NASDAQ: AAPL) on Tuesday after the market closed reported its third quarter earnings of $1.85 a share, beating the consensus estimates of $1.81. Revenue hit $ 49.6 billion, the best third quarter earnings in the history, or up 33 percent from the same quarter a year earlier while quarterly profit was also intact with $10.7 billion this quarter, making Apple’s cash and its equivalent position to the record $202.8 billion. During the months from April to June, the company sold 47.5 million iPhone units or up 35 percent from the same period a year earlier while the number of new Apple’s product lineup, Apple Watch, which started to hit the shelves in April, was not disclosed during the presentation. In the meantime, gross margin, a measurement of technology companies’ health, was 39.7 percent during the quarter and international sales accounted for 64 percent. Overall, Apple’s third quarter was solid. However, shares of Apple sold off more than 4 percent in the next day trading session as investors were once again concerned with future growth.

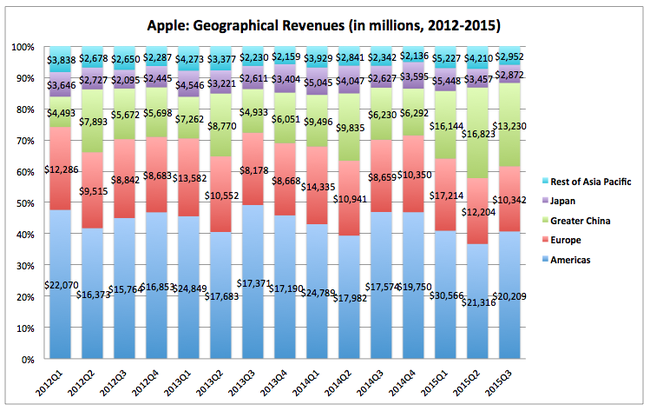

China and Rest of Asia The finest part of Apple’s third quarter earnings came from continuing strong iPhone sales in China and the overall sales, including other products, now hit $13 billion during the quarter, well ahead of overall Europe’s $10 billion, or right behind overall Americas’ $20 billion. As a single country, China is the largest market for the company. Thanks to fast growing China’s middle-income consumers, revenues grew more than 112 percent from the same period a year earlier while other regions remained normal, but compelling, double-digit growth. Apple’s dependence on Chinese market is likely to continue over next several years and that number, which includes Taiwan, Hong Kong, and Macau, should be driven by mainland Chinese consumers. Overall Asian region, excluding China and Japan, is also an important source of Apple’s growth. Its sales grew impressive 26 percent during the quarter, though not as impressive as China’s triple-digit growth. Apple’s third quarter is generally the slowest period as consumers are likely to generate pent-up demand for new iPhones, which tend to debut in September. Despite such difficult quarter, demands for Apple products were still intact and the numbers should be seen as very positive.

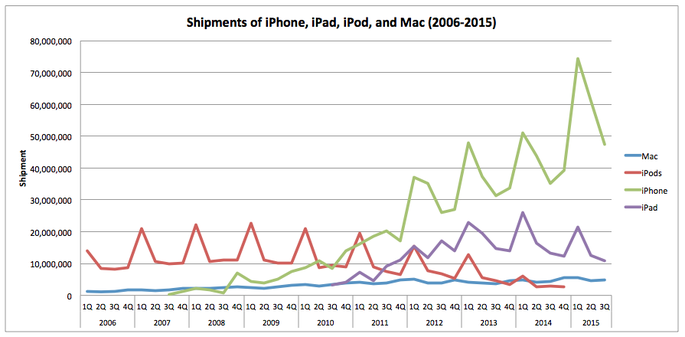

iPhone, iPad, and Mac During the third quarter, Apple sold 47.5 million iPhone units, compared to 35.2 million units the same quarter a year earlier or up 35 percent between those periods. Thanks to larger screen iPhone offered by the company since last September, Apple’s second and third quarters have turned solid this year and this trend may continue into the next iPhone series, what is probably called iPhone 6s/6s Plus. Since the third quarter has been the challenging period for the company over past years, this quarter’s iPhone sales performance seemed exceptional. Sales of iPad continue to weaken since its peak in the first quarter of 2014. Its sales units and revenue declined 18 percent and 23 percent, respectively on a year-on-year basis. Replacement cycle for overall tablet market seems slow and iPad is not the special case to avoid such tendency. While the company is expected to release new iPad series this coming fall, investors’ expectation on upcoming remodeled tablets is now set low that they believe the tablet market has already been saturated. Currently iPad’s business just accounts for less than 10 percent of the total Apple.

On the other hand, expensive Mac products continue to gain momentum. Unlike iPad’s declining sales, Mac revenue grew 9 percent on a year-on-year basis, which was significantly higher than the negative growth in the same quarter two years earlier (which is 2013). Since most Mac products are generally indifferent since 2013, new MacBook and retina MacBook Pro as well as the others should continue to sell well for existing and new Mac users. Importantly, Apple’s ecosystem significantly attracts new iPhone users into expensive Mac products. At this recent quarter, Mac sales accounts for 12 percent of total Apple or a few percentage points higher than that of iPad. Apple Watch

No release of statistical data for Apple Watch during the third quarter conference turned out to be disappointing among investors and analysts. Thus, unit sales of Apple Watch is unknown, however, the watch data has been included in the “Other Products” category in the statement, which included iPod, Apple TV, Beats, and some other accessories. Revenues from iPod and accessories during the same quarter a year earlier were $442M and $1,325M or total $1,767M while this current quarter’s revenue grew to $2,641M. With that in mind, some out of $873 million should include the revenue from Apple Watch or a rough estimate of less than 2 percent of total Apple revenue should come from the watch. This Apple Watch is still in very early innings of the game, like an initial iPhone debut in 2007. Investors require greater patient until Apple Watch unlocks its full value to a large number of potential consumers. Concerns

Since past quarterly earnings, investors have been focusing on the world’s second largest economy and China is truly going to be the biggest market for the company over coming years whether its economic growth shrinks to 5 percent or not. During past three months, China’s stock market experienced a roller coaster ride and eventually nosedived into the ground. Uncertainty in the Chinese stock market is likely to continue along with anticipation of slower economic data in coming quarters. Such difficult environment creates shares of Apple to be under pressure while the company’s presence continues to weigh on China. However, Chinese stock market turmoil is not likely to impact much on Apple’s sales in China. Rather, China’s economic slowdown does. Obtaining a new iPhone in China still cost more than a month of salary on average for the Chinese and those who are trying to get out of middle-income trap may feel harder to become a new Apple customer. EPS and Upcoming Quarters

Earnings-per-share of Apple continues to gain momentum despite this challenging third quarter. It was clearly the best third quarter performance ever for the company while investors had expected too much on surprising numbers before the earnings call. Thanks to the sell off after the earnings, shares of Apple trade only 14.5 times earnings, which is well below past years’ average multiple. Although Apple’s earnings start to weigh on China, where its economy and stock market experience strong headwinds, the country still should continue to contribute the earnings number down the road. Modernity-looking Chinese are always eyeing on cutting-edge products, like iPhone and Apple Watch, and their middle-income consumers are growing each day despite its economic growth has been decelerating over past years. For the upcoming forth quarter, analysts are currently looking for earnings of $1.86 per share, which is just a cent above this third quarter earnings. During the Apple’s fiscal forth quarter, the company is expected to release its newest iPhone series in the end of September and once again it is going to hit global market, including China. That being said, the earnings estimate, as always, is heading higher incrementally through October 19, which is an expected earnings day. Like past years, earnings tend to increase by around 10 percent from third to forth quarter. If that happens once again, the forth quarter earnings estimate may lift up to $2.00 per share by October. That will bring Apple’s 2015 earnings to $9.25 or the shares will be traded just 13.5 times earnings by then. Shares of Apple are very cheap today and it is probably one of the entry points for new investors as well as investors, who are thinking of accumulating the shares. In the meantime, Apple will pay out the quarterly dividend of $0.52 per share in the mid-August with an ex-dividend date of August 6. |

Apple: Past EarningsMore Articles on AppleIs China Going to be the Biggest Market for Apple Watch? Apple and Starbucks in Chongqing, China: Price-Sensitive Inland Consumers Apple Store in Hangzhou: Popularity of Its Products in China Apple's Dividend Growth and Power of Compounding Apple: Loosing Monopoly Power Apple: Is This Stock Too Cheap to Own? Apple: Is This Stock Still Cheap? Articles on ChinaWhat you all need to know about Chinese stock markets: Background Price-to-earnings Market inefficiency Investment BulletinHow to Beat the Market? Diversification: Systematic Risk and Unsystematic Risk PE Multiple Analysis: How to Determine the Future Stock Price? The Great Gatsby and the Stock Market in the 1920s *This article is author’s ideas about investing in AAPL, not an investment recommendation. There may be some possible mistakes on general concepts of AAPL. The author is long AAPL. Investment contains risks. Please consider risks of investment when investing. Economics Universe is not responsible in any loss of your investment.

|