How to Beat the Market?

September 5th, 2014

Akira Kondo

|

Performing ahead of the market benchmark, in this case the S&P 500, is not easy to achieve, especially if you continue to do so every year. Many fund managers every year are tying to beat the market but many of them fail to outperform. That is one of the reasons that many individual investors own the basket itself, such as SPY, which contains all the S&P 500 stocks and keeps up with the benchmark.

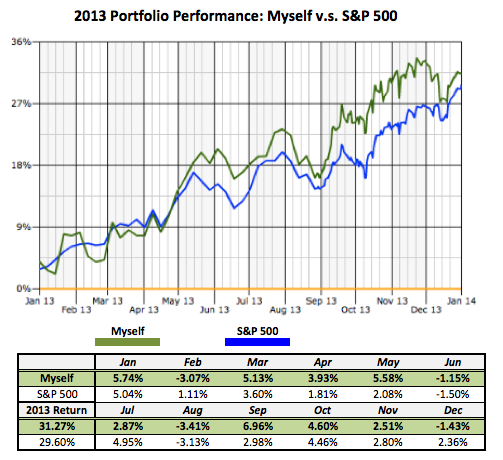

What if investors can outperform the benchmark? It is an opportunity that you can make more money than the market, which is the best outcome for them. Though the market itself can make negative returns, such as in 2008, your passion to outperform the market will be greatly rewarded. Investing in stock markets is probably one of the easiest and smartest ways to increase your wealth. Those who let their money sitting in a saving account may fall behind those who invest in stock markets. It seems difficult to invest in stock markets but it is, in fact, easy thanks to the fast development of the financial goods and services offered throughout the globe. The word “easy” just comes up with how easy it is to obtain stocks in our daily life. You can buy and sell a stock just hitting a key boards in front of you or just pressing an iPhone screen. After an introduction of iPhone in 2007, trading stocks become far easier than ever before. In addition, you get live quotes as well as up-to-date news that may influence the stocks you have to make actions in any moment. Then, how to beat the market? The luck? Probably, the luck is the most important part. It may happen that you randomly pick your 10 stocks from the S&P 500 components on January 1st and outperform the market by the end of the year while professional fund managers under-performed. However, depending on the luck is not the only way. There are things that you need to do to construct the portfolio in order to beat the market every year. By doing so, your chance to outperform the market may significantly increases while not depending too much on the luck. Though you still need that luck. To beat the market, you need to diversify your portfolio. Owning only one stock in your portfolio is too risky. It is always better to have at least five different stocks from different industries in your portfolio to eliminate risks. Clearly, diversification is a free lunch. Next, some stocks in your portfolio should be supported by dividends. If you own the stocks that offer good yields, say 3 percent, those stocks will still give you returns even the markets are badly hit. That 3 percent dividend yield is still far better than today’s bank deposit rate, which is closer to zero. Plus, those high yielding stocks with clean balance sheets tend to have limited downside as well to nicely support your portfolio all the time. <See - Portfolio Diversification> One of the stocks in your portfolio should be something speculative. Although it is not necessary to have it, it is good to try with the luck. The luck is not probably the strategy but you need it to outperform the market. For instance, you would have had 66 percent returns/gains or nearly 700 percent returns/gains if you owned shares of Tesla Motors (NASDAQ: TSLA) since the start of this year or the start of 2013, respectively (return based on as of September 5th, 2014). Tesla is definitely a great company to own now, but who have ever expected the stocks to skyrocket like this within a few years? It reminds me Apple Computer (NASDAQ: AAPL) back in 2005 when the company enjoyed massive iPod sales. At that time, the shares were trading around $35 (before the 7:1 stock split). Since then, the stock skyrocketed all the way to $700 per share while the introduction of iPhones greatly attracted many investors). Investors study stocks but they cannot expect multi-hundred percentage point returns within a short period of time, like Tesla. However, owning such stock even a smaller amount of money makes difference in your portfolio. If your luck is greater, it will help you outperform the market. Even an airline company, like United Continental (NYSE: UAL), offered 70 percent returns this year (as of September 5th, 2014). How was my portfolio performance in 2013? Since 2007, I have been consistently beating the market (some years were in line with the market, such as 2008 and 2013) while some investors may think beating the market after the financial crisis is not really difficult. However, I believe outperformance over the market in a consistent manner yields difficulty. If you kept up with the market over the past five years, your portfolio value must have been doubled by now or gained easily more than doubled if you outperformed the market. It clearly tells as well that aiming a long-term investment is the way to increase your wealth but as short as possible. The Rule of 72 can be applied here. If the market performed about around average 15 percent return per year over the past five years (or since the financial crisis from 2009) and you invested in the market itself, such as an SPDR S&P 500 ETF Trust under the ticker code, “SPY,” then your portfolio mush have been now doubled by now. How come? According to the Rule of 72, it takes 4.8 years to get your money doubled if the rate of growth (or inflation) is at 15 percent. You just divide that 72 by the average growth rate, 15 percent, and you will get 4.8 percent. <See - The Rule of 72> On the other hand, it would have been growing extremely slowly or no growth if you just left your money in your saving account at Bank of America or Wells Fargo since 2009. According to the Rule of 72, it takes your money without investing in the stock markets doubled after 360 years (Divide 72 by 0.2 thanks to the former Fed chairman, Ben Bernanke, who have set the short-term 3-month interest rate at very close to zero over past five years). That being said, the risk of not investing in the stock markets is high. Your money remains at the same level over the past five years while those who have invested in, such as an easy SPY, would get their money doubled by now. Even the current Fed Chairman, who continues to keep the key short-term interest rate at near zero while she is very carefully watching the labor market and household purchases along with any data affecting the economy, owns many stocks in her investment portfolio. According to USA Today, the Fed Chairman owns Conoco Phillips (NYSE: COP), DirectTV (NASDAQ: DTV), DuPont (NYSE: DD), Office Depot (NYSE: ODP), Pfizer (NYSE: PFE), Raytheon (NYSE: RTN), Phillips 66 (NYSE: PSX), Norfolk Southern (NYSE: NSC), and Twenty-First Century Fox (NASDAQ: FOX). Interestingly, those stocks owned by the Fed Chairman performed have performed well more than the market over the past five years (except for Office Depot but depending when she initiated). Even the Fed Chairman does not want her assets fallen into the risk of not investing in stocks for many years while she continues to keep the interest rate at near zero. It is a bit ironic that the Fed Chairman herself is growing her financial assets during in the office while the federal funds rate controlled by her is closer to zero. That probably is a message from the Fed Chairman that how important the investment is. While my portfolio and her portfolio are far different in terms of the components, probably because of the ages that I, in the mid-30s, would like to take higher risks in investing, we may agree that divided stocks are favorable to own nowadays. My portfolio is consisted of Apple Computer (NASDAQ: AAPL), Bank of America (NYSE: BAC), Bristol-Myers Squibb (NYSE: BMY), CPFL Energia (NYSE ADR: CPL), Ensco (NYSE: ESV), Intuitive Surgical (NASDAQ: ISRG), Starbucks Coffee (NASDAQ: SBUX), St. Jude Medical (NYSE: STJ), and United Continental Holdings (NYSE: UAL). Dividend yields of the stocks owned by the Fed Chairman are 3.6%, 0%, 2.8%, 0%, 2.6%, 2.4%, and 2.2%, respectively, while the dividend yields of mine are 2%, 0.3%, 2.9%, 5.7%, 5.9%, 0%, 1.3%, 1.6%, and 0%, respectively (As of September 5th, 2014). Dividends are important and you can also apply the Rule of 72 to the dividend growth rate, which you can analyze what company will double the divided payout in certain years. <See – Power of Compounding> In order to beat the market annually, a dividend is probably one the most important factors to be imbedded into your portfolio. Dividend stocks not only support the downside risks when the market experiences downturn but also the power of compounding really starts to kick off nicely as long as they increase payouts every year. Such cases, the long-term investment is far more preferable than short-term investment. Generally a company with a clean balance sheet increases dividend payout once a year while paying dividends every quarter. Thus, you need to pick a dividend stock that continuously increases the payout over time. Again, the luck is important. Without the luck, it is not easy to beat the market every year. It is possible that a defensive McDonald’s stock, which continuously increases its dividend payout by the average 23 percent every year over the past 10 years, can be hit by a bad news and the stock plunged 10 percent in two months, while it just has happened. Probably it is the reason that professional fund managers struggle to beat the market. With or without the luck, your portfolio performance may be just in line with the market. Although it is not necessary if you just want to be in line with the market performance, you still take a risk to outperform than those who just let their money sitting in a saving account. However, it is time to take a moment to think of having your own portfolio composed of the stocks you choose if you want to go beyond that level. The Fed Chairman is also doing so because she does not own the market itself, such as SPY, rather taking risks by owning individual stocks. Source: USA Today, "Fed Chair Yellen's assets up 8% during 2013," http://www.usatoday.com/story/money/markets/2014/08/28/fed-chair-yellens-assets-up-8-percent-during-2013/14751605/. Akira Kondo is long AAPL, BAC, BMY, CPL, ESV, ISRG, SBUX, STJ, and UAL. |

Investment Strategies

|