Economics Bulletin

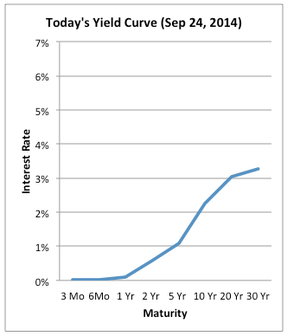

What is Yield Curve?

|

Learn EconomicsHow Do Stock Market React when the Yield Curve Changes?

12 Regional Feds and the Central Bank: Manipulating Today's Economy China and Economy=> China Bulletin

What you all need to know about Chinese stock markets Apple and Starbucks in Chengdu, China: Fast Growing Largest Inland Economy |

Analyzing My Starbucks Rewards Programs in China and Thailand

|