Is It Good to Buy Alibaba Shares?

“China, Tech, IPO” the Three Words That Investors Need to Think About When Investing Chinese IPO Stocks

February 15th, 2015

Akira Kondo

While Chinese economy started to show its further slowdown last year, the Chinese-version of Amazon.com, namely Alibaba (NASDAQ ADR: BABA), debuted as the world’s biggest IPO ever in the history. Its value of the deal hit $25 billion while the IPO price was set $68 per share for the inaugural trading day of September 19th, 2014. By the time after the trading floor closed that day, the shares of Alibaba rose more than 38 percent to $94.

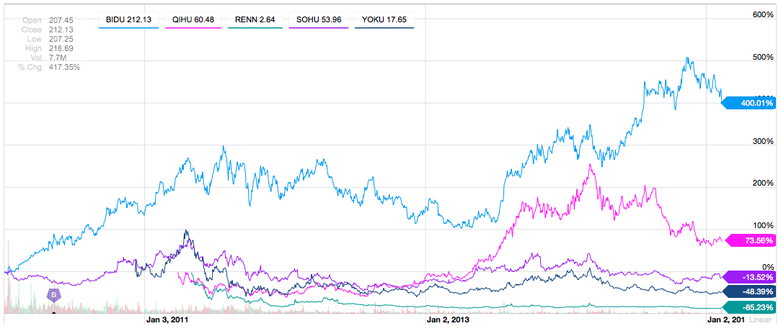

Since its IPO debut, Alibaba’s shares are now trading at $89 per share (as of Feb. 15, 2015) and its shares have been forming a downward trend after hitting $120 even on November 10 last year. It is probably the typical chart trend often seen for inaugural stocks as shares of Google (NASDAQ: GOOG, GOOGL) or Facebook (NASDAQ: FB) traded like that way when they debuted. If the stock likes to follow the way Google’s or Facebook’s shares experienced in the past, the stock is likely to change the course in the future. To make that happen however Alibaba has had to deliver exceptional numbers each quarter since then to convince its shareholders. Alibaba’s past quarterly earnings since its debut came in in-line in last November and better-than-expected in January. Revenues rose 54 percent and 40 percent during those periods but those numbers seemed not meeting investors’ high expectation. As Amazon.com, who offers the same e-commerce business as Alibaba and is the biggest online retailer in the United States, struggles to improve its thin margin, which makes harder for the company to make profit in annual bases, Alibaba may face the same in its homeland. So far, Alibaba’s past earnings came in positive but their earnings have not made any surprise yet to investors. In past years, many Chinese tech companies have been listed on NASDAQ as ADRs while unknown Chinese companies wanted to show off their brands in the U.S. markets. It was like getting a global status for them to be listed on NASDAQ or NYSE although they actually not doing their businesses in the states. For instance, Chinese-version of YouTube, Youku, offers videos for its viewers; however, most contents are blocked outside China because most videos are illegally loaded. How about the Chinese-version of Facebook, Renren? Facebook has been blocked in China for past many years as Chinese officials did not like the Chinese to share political thoughts from outside China. Renren users are purely Chinese and there is not much business to do in the United States. Once before, CNBC commentators often said on TV, “China, technology, IPO.” There were the three key words that the stocks moved higher in 2011. The shares of those stocks imbedded with these three key words tended move higher and higher day by day. Those stocks were namely at that time, the Chinese-version of YouTube, Youku (NASDAQ ADR: YOKU), the Chinese-version of Facebook, Renren (NASDAQ ADR: RENN), and the Chinese-version of Adobe Systems, Qihoo 360 (NASDAQ ADR: QIHU), plus old IPO stocks of the Chinese-version of Yahoo!, Sohu (NYSE ADR: SOHU), and the Chinese-version of Google, Baidu (NASDAQ ADR: BIDU). All of those stocks had the three key words and the CNBC commentators always said, “China, technology, and IPO,” whenever those stocks moved higher without any news from the companies. |

More Articles on China> China Bulletin Apple and Starbucks in Chongqing, China: Price-Sensitive Inland Consumers Starbucks in Changsha, China: Growing Upper Middle-Income Chinese Consumers |

|

How have been those Chinese tech stocks trading these days? Not pretty despite China’s overall stock markets’ run in the second half of last year. Some stocks have made solid run over past five years, such as Baidu and Qihoo 360. However, others just stayed under the water for years. A decade-old Chinese IPO company, Baidu, is probably the best run technology company in China, especially thanks to unfriendly Chinese government regulations that frustrated Google’s business in mainland China. Eventually, Google left China in 2010, making Baidu the most competitive search-engine company for hundreds of millions of local Chinese Internet users. Will the shares of Alibaba follow the same path? As popularity of stocks eliminates, it seems like the most Chinese IPO tech stocks tend to have hard time creating momentum on their shares. With China’s 1.3 billion population while the middle-income consumers are growing, it is hard to ignore those Chinese ADR companies; however, it is still risky to own them. Rather is smarter to own Facebook (NASDAQ: FB), Adobe Systems (NASDAQ: ADBE), Yahoo! (NASDAQ: YHOO), and Google (NASDAQ: GOOG). They are delivering true value to their shareholders and their financial statements are crystal clear than those of the Chinese companies. Or still owning the Chinese stock is considered to be favorable? There are other ways to own Chinese stocks as a basket. BlackRock’s iShares China Large-Cap ETF (FXI) is probably the best one to participate in the Chinese stock markets. It contains China’s 50 blue-chip companies, such as the world-biggest telecommunication service providers, China Mobile (NYSE ADR: CHL/HK: 941) and China Unicom (NYSE ADR: CHU/HK: 762), the world-largest bank in terms of assets, Industrial & Commercial Bank of China (HK: 1398) as know as ICBC, the world-fastest growing railway companies, such as China Railway (HK: 390), and the former IBM’s Think Pad business, Lenovo (HK: 992). Plus, it nicely yields 1.59% (as of Feb. 14, 2015). Xiaomi, the Chinese-version of Apple, is probably listing on the NASDAQ exchange in the very near future and it may become the biggest IPO in history, exceeding the Alibaba initial IPO value. This company makes products from smart phones to tablets, like Apple and Samsung do, and their products are just the combination of their products. Xiaomi stores in China are the exactly same as Apple stores we see in the U.S. or worldwide. It is nothing to blame any Apple customers, who mistakenly get into Xiaomi stores in China. The three key words, “China, technology, IPO,” are the words that investors really need to think carefully of when investing in the Chinese IPO stocks. When the CNBC commentators said those words frequently on TV in the past, they in fact warned investors that Chinese IPO stocks were just forming bubble, not the value. History always continues. Let see how the shares of Alibaba will perform over next years. |

More Articles on Economy> Economics Bulletin The Evidence of the Middle-Income Trap How Do Stock Markets React when the Yield Curve Changes? |