Q3 2016 Apple Earnings: Disappointing Earnings are Behind, Now Growth Ahead

July 29, 2016

Akira Kondo

Newly opened Apple Store in Hopson One department store at Wujiaochang, Shanghai, China. Newly opened Apple Store in Hopson One department store at Wujiaochang, Shanghai, China.

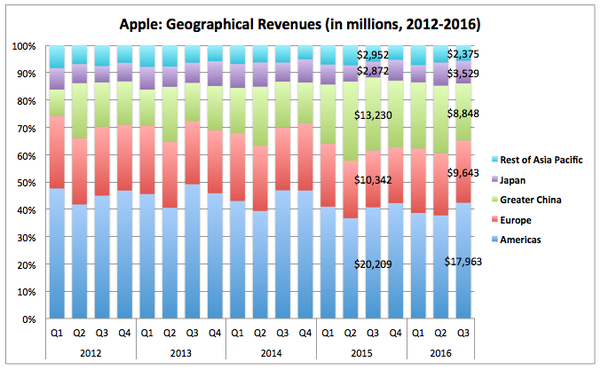

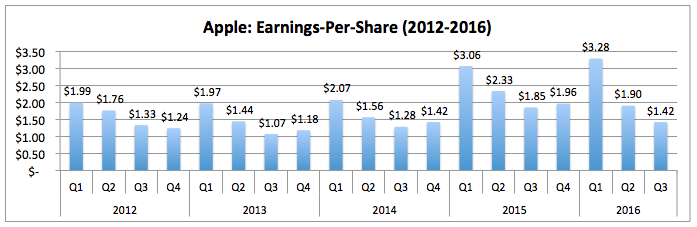

Apple (NASDAQ: AAPL) reported better-than-expected earnings for the April-June quarter after the market closed on Tuesday. The company earned $1.42 per share or $0.04 above consensus estimate. Revenues during the quarter came in lower at $42.4 billion, compared with $49.6 billion same quarter a year earlier, while the company expressed sales from Services, including App and Apple Pay, grew 19 percent. Net income plunged 27 percent to $7.8 billion from $10.7 billion in the year-ago quarter, which had indicated that the company spent massive cash balance on R&D as well as capital return program during the quarter. In the meantime, gross margin, tech company’s profitability measurement, fell to 38 percent from 39 percent from the same quarter in the previous year thanks probably to higher-than-expected demand on newly introduced cheaper iPhone SE. International sales during the third quarter hit 63 percent while Chinese demand fell 33 percent. Overall, the third quarter when pent-up demand for new iPhone is generating strongly is well done for the company and investors are pleased with the result, sending shares up 6.5 percent next-day trading session.

Bright Spots

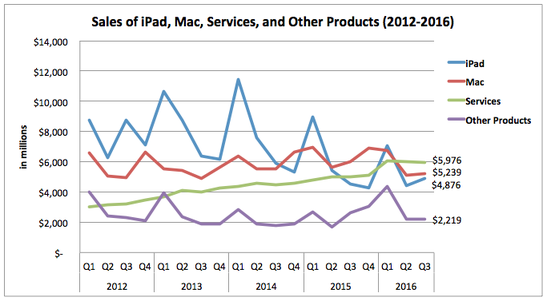

One of the bright spots during the third quarter was Services, which included App, Apple Pay, Apple Care and so forth. Services was up 19 percent from the same quarter a year earlier and its sales ranked second in the company’s overall revenues after iPhone’s. As Apple CEO, Mr. Cook, mentioned about WWDC event in June how he was thrilled by developers’ response to software and services. That translates how recently launched Pokémon Go quickly spreads its stunning popularity across the globe through its App store. From now on, Apple is expected to collect 30 percent of sales from the in-app purchases made by consumers. Although it is not sure how much the company can earn from it but it is very likely that Pokémon Go’s contribution to Apple’s coming quarter earnings is going to be positive. Another bright spot is a newly introduced iPhone SE, which nicely caught budget consumers as well as those who needed a smaller device but under Apple brand. With its price tag starting from $399, though still pricier than most smartphones from China, its popularity hit some markets, such as Japan. The third quarter for the company tends to be the weakest period thanks to the generation period for the pent-up demand for new iPhone, which is often introduced in the mid-September. This year’s iPhone SE introduction nicely might have added some cushions in the earnings, otherwise the slump of iPhone sales number would have been even worse. China

Sales in Greater China were down 33 percent to $8.8 billion from $13.2 billion from the year-ago quarter. Despite the sharp decline in revenues experienced in Greater China region followed by 26 percent down during the second quarter, such trend would not likely to continue. While investors and analysts often mentioned that Chinese market was saturating, Chinese consumers are in fact turning modernity-oriented that they are always looking for modern and fashionable items, such as upcoming new iPhone. Plus, a number of upper middle-income consumers are growing every year. Those who have owned cheaper Xiaomi or Huawei smartphone owners are always seeking an opportunity to switch to modern iPhone once they step up into middle class. iPhone is no longer unattainable item anymore for consumers from global cities, such as Shanghai, Beijing, and Shenzhen. Especially, wealthy Shanghai residents believe iPhone is a must-have item in the city. After iPhone 6 and 6S series have been in their hands for past years, the pent-up demand for upcoming iPhone is hugely generated. As Mr. Cook mentioned during the conference call that the company’s sales in China are usually strongest right after an upgraded iPhone is unveiled. Apple itself is the chief analyst of Chinese market, so is Starbucks as well as other successful global companies. They know the market very well and Chinese market is likely to be back in the product cycle for Apple. Although China’s economic slowdown is clearly seen quarter to quarter, modernity-oriented middle-class consumers are growing each day and they will definitely boost upcoming Apple earnings once the new iPhone becomes available in coming months. To learn more about Chinese economy and culture => <Visit China Bulletin> Drawbacks

Apple’s gross margin declined to 38 percent during the third quarter from 39.9 percent from a year-ago quarter. That is the lowest level since the fourth quarter in 2014 when iPhone 5S series were dominated in the market. The company also announced the future guidance for the 2016 forth quarter gross margin to be between 37.5 and 38 percent. It is somewhat disappointing. However, it is likely to increase the margin higher into the 2017 first quarter when the new iPhone generates massive demand across the globe. Overall numbers during the third quarter were weak. Both net income and revenue were the lowest levels since the 2014 third quarter and the 2014 forth quarter, respectively. 2014 was the year when touch-ID enabled iPhone 5S series were available for consumers. S series tend to have a minor upgrade, making less attractive to consumers. With recent rumors among Apple fans, upcoming iPhone is likely to continue a minor upgrade, which may discourage consumers to upgrade. Earnings

During the fiscal 2016 third quarter, Apple earned $1.42 per diluted share, beating the consensus estimate of $1.38. Although the result was not attractive, it is likely to be bottoming out, so is the stock price. If the stock is all about growth, Apple’s growth is coming back into the fiscal 2017 year. The growth rate is probably not going to be extensive, like 2015 or before, but moderate growth should be in tact for coming two years, especially if Apple is going to deliver fully-redesigned iPhone in 2017 as such rumor is circulating. After the earnings session, shares of Apple jumped 6.5 percent on the next trading session. Positive sentiment for the stock is back in swing. The shares are still trading cheap at 12 times trailing-twelve month earnings, compared with expensive S&P 500 benchmark, which is trading at 20 times.

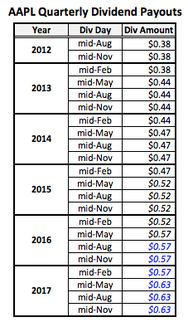

In the conference call, Apple also announced that the company had returned $17 billion to investors through dividends and buybacks and had completed $177 billion out of $250 billion capital return program. That means the company bought back massive amount of shares when its stock price was cheap over past quarters. Downside is now clearly limited as long as the company continues to buy back shares into coming years.

|

Apple Past EarningsQ2 2016 Apple Earnings:

Disappointing Quarter Finally Comes, China Sales Down 26% Q1 2016 Apple Earnings: Just 1 Percent Growth in iPhone Sales, Time to Buy the Stock? Q4 2015 Apple Earnings: Best 4th Quarter Leads to the Best Year in History Q3 2015 Apple Earnings: The Best Third Quarter in History Thanks Again to China's Massive Demand Q2 2015 Apple Earnings Roundup: Another Solid Quarter Thanks to Chinese Demand More Articles

|