Apple Q2 2015 Roundup: Another Solid Quarter Thanks to Growing Chinese Demand

April 29, 2015

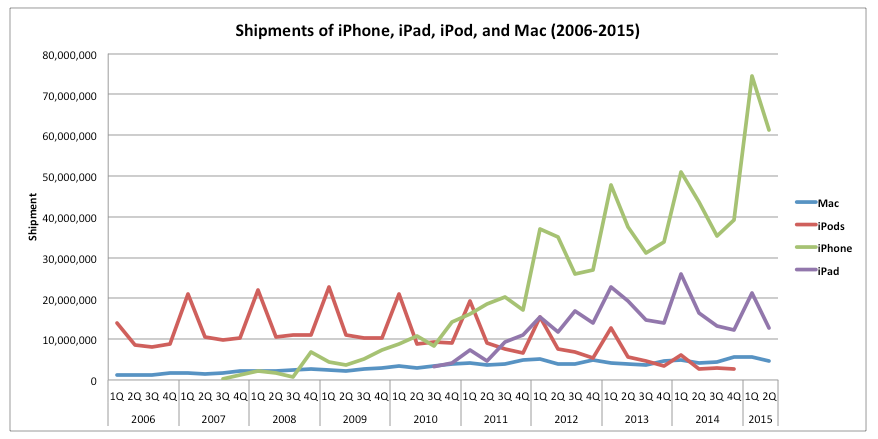

Akira Kondo

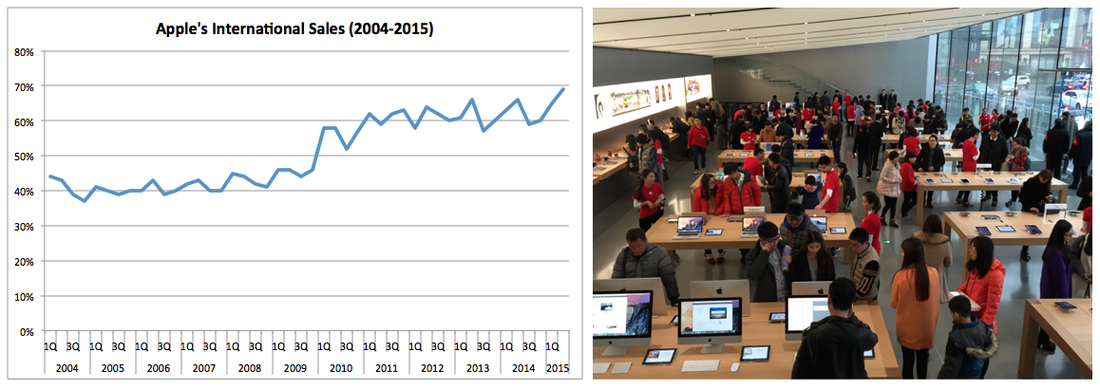

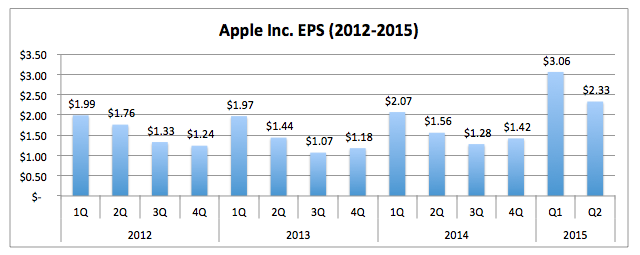

Apple Inc. (NASDAQ: AAPL) reported its second quarter earnings after the market closed on April 27. The company earned $2.33 per share, compared to the consensus estimate of $2.16. Net income topped $13.6 billion, making Apple’s cash position on its balance sheet worth $194 billion, while revenues were solid at $58 billion thanks to exceptional popularity of iPhone 6 and 6 Plus in China as well as Asia Pacific excluding Japan. Shipments of iPhone were 61 million units, up 40 percent from the same period a year earlier. Gross margin, tech companies’ profitability measurement, was 40.8 percent, the highest level since the 2012 third quarter. International sales reached 69 percent, the highest level in history. Overall, Apple delivered another solid quarter while the company declared more capital returns to investors, including an 11 percent rise in divided payout.

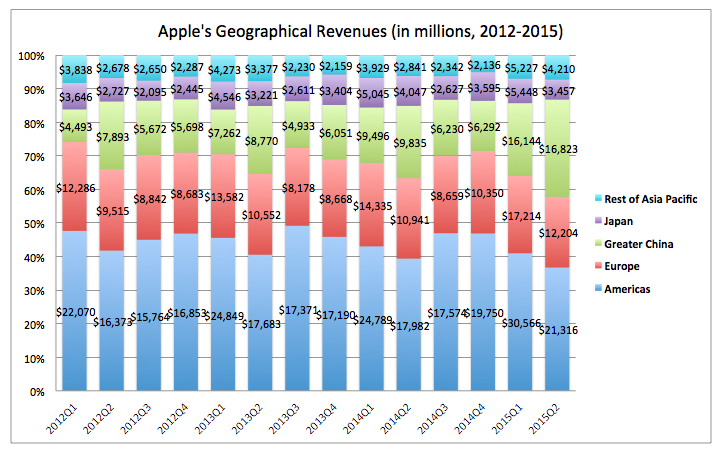

Some concerns While shares were up 1.8 percent on the same day session, they retreated 1.58 percent on the next day. Concerns were slowly generated after the earnings report whether Apple could maintain its growth or not. Some analysts believe that Apple’s iPhone sales, which are the biggest business for the company, would not sustain over next years. The other analysts are expressing concerns that sales of iPad continue to decline or its gross margins shrink over next quarters thanks to Apple Watch. Shares of Apple are likely to be a wait-and-see mode over coming days until more analysts round up the earnings in more details to come up with a reasonable valuation on it. China In the meantime, Apple’s second quarter earnings were very solid, satisfying most analysts’ expectations on every measurement. This quarter’s significance comes from the exceptional sales made in Greater China, which includes Taiwan, Hong Kong, and Macau. Its regional sales were up 71 percent year over year or up 4 percent from the previous quarter while sales of other regions significantly declined quarter over quarter. That makes China is now the second biggest market for Apple after Americas or ahead of Europe. This trend is likely to continue as long as Chinese consumers are getting out of the middle-income level to the upper middle-income level over next years. In coming years, this Greater China region’s sales will overtake Americas’ and this is what Apple believe, “in the short-term, China is not becoming bigger than the U.S. but over the long arc of time…” Rest of Asia

Other than China, sales of both Americas and Europe were also solid at double-digit growth, 19 percent and 12 percent, respectively. However, another solid growth, except China and those developed economies, comes from growing rest of Asia excluding Japan. Its regional sales were up whopping 48 percent, much higher than Americas’ and Europe’s. This region is also considered to be a middle-income economy (excluding Singapore and South Korea), where a large number of consumers are trying to get out of the middle-income trap. A leading economy among this region is Malaysia followed by Thailand, Indonesia, Philippines, and India. It seems like China along with rest of Asia is going to be the successful market for Apple in coming years and that is a great reason that now Apple is doubling its retail stores across China from the current 21 stores into 40 by the mid-2016. |

More Articles on AppleIs China Going to be the Biggest Market for Apple Watch? Apple and Starbucks in Chongqing, China: Price-Sensitive Inland Consumers Apple Store in Hangzhou: Popularity of Apple Products in China Apple's Dividend Growth and Power of Compounding Apple 2014 1Q Earnings Apple: Loosing Monopoly Power Apple: Is This Stock Too Cheap to Own? Apple: Is This Stock Still Cheap? |

|

Mac and iPad

Shipments of Mac during the second quarter were solid at a 10 percent growth year over year while iPad’s shipments tumbled once again, down 23 percent year over year. New MacBook, which was just introduced a month ago, may become a popular choice for those who have MacBook Air, but overall Mac products, including MacBook Pro and iMac, should continue to attract current Mac users as well as new users in coming years. On the other hand, sales of iPad continue to struggle after its peak in the 2013 holiday season. Despite its popularity as often seen in business meetings, conferences, cafés, airports, and so on, iPad’s replacement cycle seems slow as its thinness and retina display have been almost the same over past years. That makes current iPad users hold off buying new one until more sophisticated iPad shows up in the market. |

More Articles on Investment> Investment Bulletin Starbucks in Changsha, China: Growing Upper Middle-Income Consumers Chinese ADRs: Is It Good to Buy Alibaba's Shares? The Great Gatsby and the Stock Market in the 1920s |

|

Third and forth quarters

Coming third and forth quarters were used to be a challenging period for Apple because they were the periods for generating the pent-up demand for the fourth quarter when the company generally released a new generation of iPhone. However, the coming quarters are totally different from the past. The company has already started shipping its new cutting-edge Apple Watch into the markets across the globe this month and next quarterly earnings will include its sales, which expect to generate more earnings. While iPhone sales are going to be slow during those quarters, Apple Watch’s debut should offset or plus the slow quarters this time. At this moment, consensus sets its estimated earnings for the third quarter at $1.68 per share, 31 percent higher than the same quarter a year earlier. It seems the hurdle has been set high for the quarter but Apple Watch’s debut this month in selected countries, including China, should bring its earnings higher. Plus, larger iPhone 6 Plus may continue to sell well in Asian regions, especially in China. Although Apple cannot simply depend on China, the company however focuses deeply on the world’s second largest economy, where more and more consumers are getting out of the middle-income level to attain Apple’s modern products. In fact, sales in China accounted for 29 percent globally during the second quarter while Apple’s international sales now hit 69 percent. Dividend

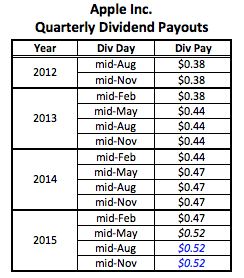

Dividend is now a great part of owning shares of Apple. Since its initial dividend payout in 2012 (though it is not the first-time ever that Apple paid out the dividends), the average growth rate of Apple’s dividend payout over the past three years is 11 percent, which means if you own Apple shares for next seven years, the amount of dividends you receive in 2022 will double according to the Rule of 72. During the second quarter, the company announced the dividend increase of 11 percent to 52 cents a share from 47 cents. Investors probably expected a much higher increase after the company reported the record high net profit last quarter thanks to iPhone 6. I myself expected at least a 15 percent divided increase; however, it turned out to be a bit disappointing. In the meantime, it is highly understandable that Apple’s international sales accounted for 69 percent during the second quarter, which illustrated that the seven-tenth of the company’s cash is still sitting out of the United States. Apple also announced an issue of a $40 billion equivalent debt to finance dividends and buybacks without converting foreign profits into a domestic currency. Among Apple’s cash and its equivalent of $194 billion as of the end of second quarter, the company also boosted the buyback program to $140 billion by adding up additional $50 billion. Coming quarters Thanks to continuing increase of dividends and buybacks, shares of Apple should create limited downside onwards. The shares of Apple is now trading at less than 16 times trailing twelve-month earnings after another drop in its share price on the second day after the earnings (as of April 29 after the market closed). China is going to make a bigger part of Apple’s global sales from now on despite slowing its economy’s continuing slowdown. However, the important part is that tens of millions Chinese are getting out of the middle-income trap every year and those people are always willing to have an Apple’s modern product in hand as soon as possible. It is no wonder China is going to be the biggest market for Apple and even Starbucks, the world-largest coffee chain, probably thinks that way as well. Overall, Apple’s second quarterly earnings were very solid. At trading 15.9 times earnings, shares of Apple are inexpensive and fairly valued at this moment. However, Apple should be traded higher considering Apple Watch’s debut and an increase of dividends as well as buybacks for coming quarters. If the shares of Apple can trade back to 17 times earnings and the company earns consensus-expected earnings of $1.68 per share during third quarter, the share price should reach around $145 by this summer. Plus, the share price could be traded even higher if Apple buybacks more shares in coming quarters. In the meantime, a next coming quarter is closely watched once again, especially the numbers from Apple Watch, iPhone 6, and China.

Akira Kondo is long AAPL. |

Recommended ArticlesMore Articles on EconomyMore Articles on China> China Bulletin What you all need to know about Chinese stock markets: Background Price-to-earnigns Market inefficiency |