Q4 2016 Apple Earnings: No Surprise, 2016 Earnings Behind, Is Growth Back Again?

October 27, 2016

Akira Kondo

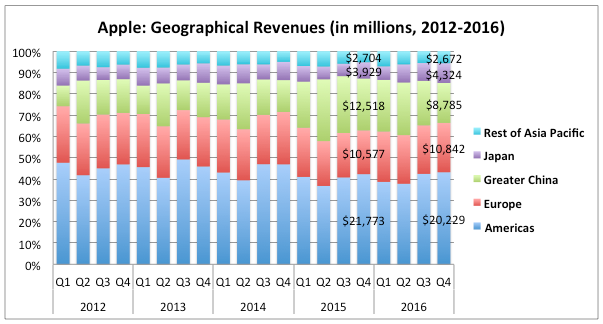

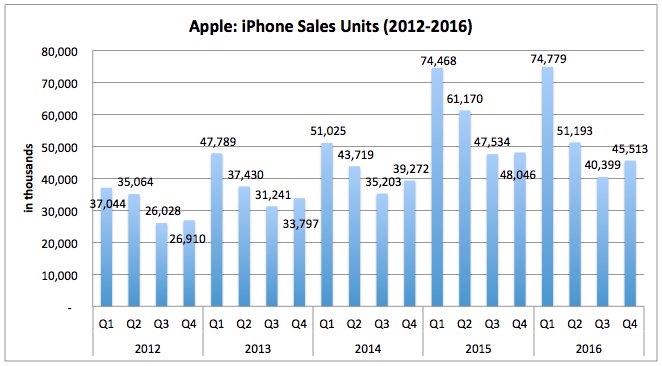

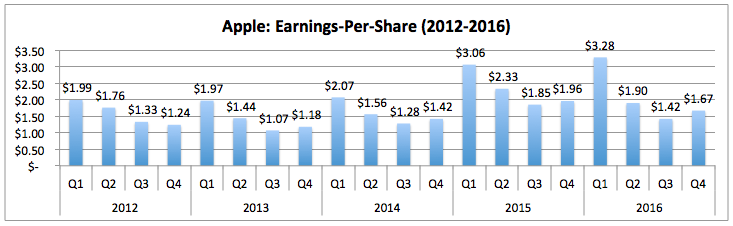

Apple Inc. (NASDAQ: AAPL) reported better-than-expected earnings for the July-October quarter after the market closed on Tuesday. The company earned $1.67 per diluted share or $0.01 above the consensus estimate. Revenues during the quarter came in $46.9 billion, compared with $51.5 billion the same quarter a year earlier. Once again, the company expressed the strength of Services category, including App and Apple Pay, which grew 24 percent from the same period in the previous year. Net income plunged to $9.01 billion from $11.1 billion from the same quarter a year ago while the company’s profitability measurement, gross margin, also decreased to 38 percent from 39.9 percent in the forth quarter in 2015 when iPhone 6S went on sale. International sales during the quarter hit 62 percent while Chinese demand continued to fall 30 percent after the 33 percent slump in the previous quarter. Overall, the forth quarter is still solid despite not-much-surprise in new iPhone 7. Investors now already look for next year’s iPhone and new MacBook Pro introduction in coming days. These events are more likely to encourage the shares of Apple over coming quarters and the downside is pretty much limited for long term investment.

China Concern

Sales in Greater China region were down 30 percent once again after experiencing 33 percent plunge during the previous quarter. While Mr. Cook mentioned during the third quarter conference call that the company’s sales in China were usually the strongest right after an upgraded iPhone was unveiled. Although the supply constrains of popular Jet-black iPhones are intact, continuing sales plunge in Apple’s most important region is clearly bothersome for the company and investors. In China, Huawei is gaining momentum for grabbing growing middle-income consumers as their phones are considered to be more high-end than then-popular Xiaomi’s cheap smartphones. Now, Xiaomi is no longer Apple’s threat but Huawei along with OPPO and vivo, who continue to produce smartphones that resemble to iPhone and Samsung’s Galaxy smartphones (or both divided by two), are likely to become the reason that Apple is struggling to sell more iPhones in the region.

Still, iPhone is the most favorable item to own among today’s middle-class consumers in China and they are always seeking for modern cutting-edge product, like iPhone. If Apple is to introduce totally redesigned iPhone next year, Chinese consumers surely will be interested in having one as soon as it is on sale. That being said, greater pent-up demand has already been generated for next year’s iPhone and that may make growth back again in Chinese region over coming years. Bright spot

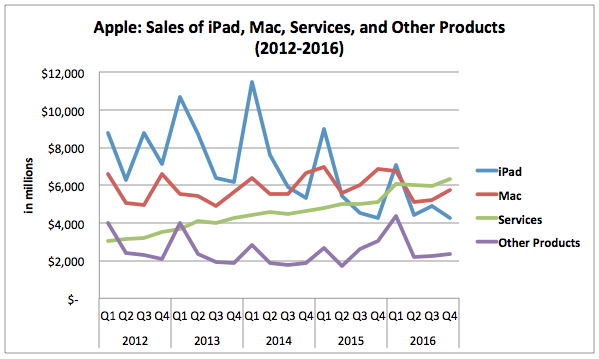

During the last quarter conference call, Mr. Cook was very excited about the success in the WWDC event, where Apple introduces new software and services for developers. Pokémon Go was later on the center stage that investors were curious about how much Apple could make money from it. During the forth quarter, the company’s revenues in Services category were $6.3 billion, compared with $5.1 billion the same quarter a year earlier. That was up 24 percent between the periods and the Services now accounts for 13.5 percent of total Apple revenues while accounted for 9.9 percent a year ago. The Services is clearly becoming Apple’s bright spot and the company’s greater ecosystems in its product lineups should benefit from growing developers. iPhone 7 Apple’s flagship iPhone sales were down once again on a year-over-year base. That is probably because of supply constrain of popular Jet-black iPhone 7 Plus and just miner changes in iPhone design. The company clearly needs to surprise consumers across the globe when it introduces new iPhone next year, which is likely to be a redesigned iPhone thanks to the 10th anniversary of the product. iPhone 7 is somewhat disappointing for consumers as well as investors so far but the company has to sell more iPhones during the upcoming holiday season to mitigate declining sales worldwide. New MacBook Pro? New MacBook Pro is expected to unveil a few days after the earnings call. Apple’s top-end MacBook Pro has not been updated for past years while it has got thinner though. Sales of Mac have been declining over past two years on a year-over-year basis since its sales peak in the first quarter of 2015. Almost last twelve months, consumers were held off buying new MacBook Pros due to the anticipation of upcoming redesigned new MacBook Pros.

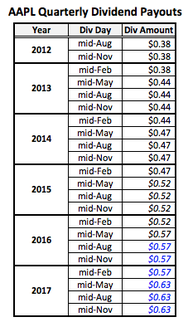

Earnings Apple’s earnings continue to fall on a year-over-year basis. The company earned $1.67 per diluted share, compared with $1.96 the same quarter a previous year. While analysts are very smart enough to predict earnings numbers over past several quarters, Apple’s earnings surprise is pretty much limited. For upcoming quarters, the company is likely to post less-impressive numbers due to continuing slower new iPhone sales. On the other hand, analysts have already priced that factor in, leading its multiple lower, and shares of Apple are now trading at around 13 times trailing twelve-month earnings. Earnings surprise over coming earnings now depends on sales of MacBook Pro and growing Services category during the holiday season until new iPhone is released next year. At this moment, analysts are expecting earnings of $3.22 per share during the first quarter of 2017, which is still a few cents lower than all-time-high earnings of $3.28 per share in the first quarter of 2016. Whether the company can beat and post the record quarterly earnings in upcoming quarter depends on new MacBook Pro, Services, iPhone 7 and China. Stock price is always ahead of us. Next year’s iPhone introduction and its expected massive sales should start to add some multiples on discounted Apple shares. On the other hand, disappointing 2016 earnings year is now behind. Growth is likely to be back into Apple’s business cycle over coming years to lead multiples higher, thus the stock price. In the meantime, investors collect dividends down the road, which yield attractive 2 percent.

++ Articles shown in the page as well as on this website are author’s ideas about stocks mentioned unless cited otherwise. Economics Universe is not responsible on any losses from your investment activities.

|

Apple Past EarningsQ3 2016 Apple Earnings:

Disappointing Earnings are Behind, Now Growth Ahead Q2 2016 Apple Earnings: Disappointing Quarter Finally Comes, China Sales Down 26% Q1 2016 Apple Earnings: Just 1 Percent Growth in iPhone Sales, Time to Buy the Stock? Q4 2015 Apple Earnings: Best 4th Quarter Leads to the Best Year in History Q3 2015 Apple Earnings: The Best Third Quarter in History Thanks Again to China's Massive Demand Q2 2015 Apple Earnings Roundup: Another Solid Quarter Thanks to Chinese Demand More Articles

|