Q4 2015 Apple Earnings: A Best Forth Quarter Leads to the Best Year in History

October 29, 2015

Akira Kondo

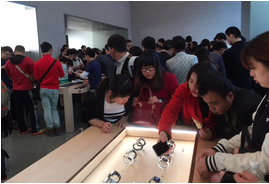

Apple Store at Lujiazui, Shanghai. Apple Store at Lujiazui, Shanghai.

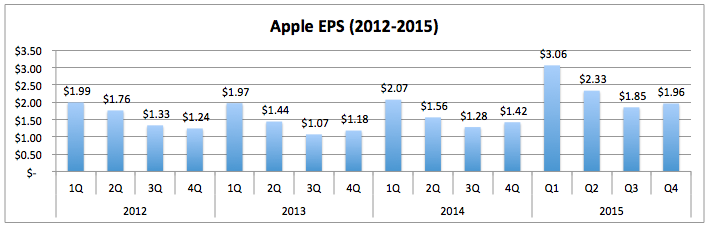

Apple (NASDAQ: AAPL) reported a better-than-expected forth-quarter earnings after the market closed on Tuesday, leading its fiscal 2015 earnings to the record history of $9.28 per share or $9.22 per diluted share. For the forth quarter ended on September 26, a day after the new iPhone 6S and 6S Plus released, the company earned $1.96 per diluted share or $0.10 above the consensus estimates. Net income during the July-September quarter surged 30 percent from the same quarter earlier to $11.1 billion while quarterly revenue also climbed 22 percent to $51.5 billion. In the meantime, units sold and revenue from iPhone were also posted the record-high in the forth quarter history at 48 million and $32.2 billion, respectively. Sales of the other products category, including Apple Watch, surged 61 percent from the same quarter a year earlier. Again, sales in China during the quarter, closely monitored by many analysts, were up 99 percent while its sales accounted for 24 percent of total Apple’s revenue. Technology companies’ profitability measurement, gross margin, was 39.9 percent during the quarter. Overall, Apple’s forth quarter is, again, very solid and the shares should gain momentum into the first quarter.

China: Massive Demand from Growing Modernity-Oriented Customers

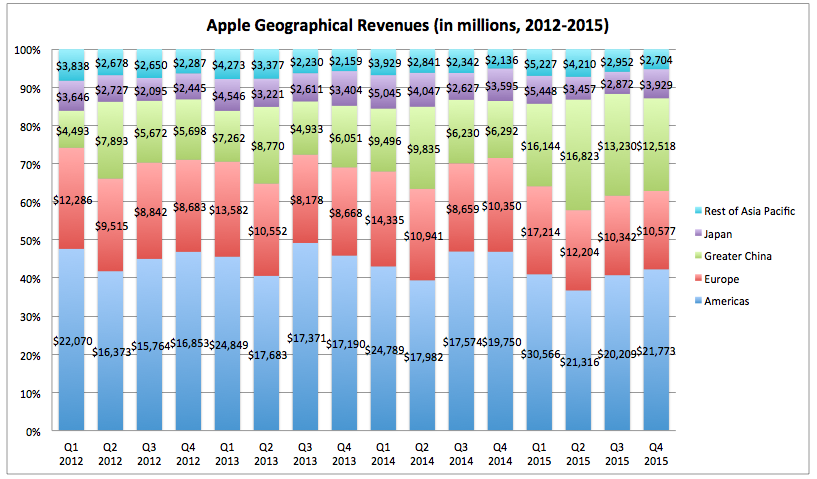

Again, China has become the center stage for Apple’s growth. Without the numbers from Greater China, the company’s sales growth would have been closer to a single digit. For the forth quarter, Greater China’s sales (including Hong Kong, Macau, Taiwan) grew 99 percent from the same quarter a year earlier, followed by previous quarter’s 112 percent growth. Greater China’s sales figure on Apple’s total revenue also continues to show bigger presence. During the quarter, revenues from China accounted for 24 percent of total Apple’s sales, compared to 15 percent in the same quarter of the previous year (but this year’s new iPhone went on sales in China along with the initial worldwide launch). Massive growth of China’s iPhone sales is likely to continue into coming years. An iPhone has already become a must-have item, especially in China’s biggest commercial city, Shanghai. Local Shanghai people, commonly known as “Shanghainese,” like to seek modernity and items like iPhone and Starbucks coffee fall into that category. On the Line 2 Shanghai Metro, passengers between the city’s financial hub, Lujiazui, and Shanghainese bed town, Jing’an Temple stations, tend to hold the newest iPhone in hand while shiny rose-gold back of devices colorfully shine throughout the train cars. Pricier iPhone 6S Plus seems more popular among them as well. <Also read to know more about Shanghainese - Starbucks in Shanghai, China: Modern Shanghainese Favorite Third Place>

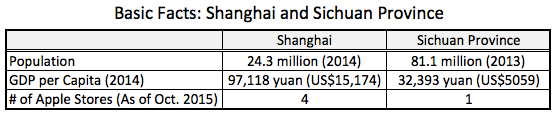

iPhone’s popularity in Shanghai is extensive but it highly makes sense as the city’s income per head now reached US$15,000 (according to World Bank’s 2014 data), a level that one month salary can enough to attain a newest iPhone. Despite China’s economic slowdown, the country’s economy still grows at reasonable 6-7 percent this year. In the meantime, per capita GDP grows as well. Even with a 6 percent growth in coming years, China’s per capita income should reach $20,000 by 2020 according to compounding Rule of 72 while Shanghainese will be even wealthier than the nationwide average.

The important part to notice is that economic slowdown does not simply lead to a decrease in income, rather it still grows but at a slower pace. Popularity of iPhone is now spreading fast across mainland China. Inland cities, like Chongqing and Chengdu, are great examples of the next growth drivers for Apple. In fact, iPhone is very popular among people in those cities. For instance, Chengdu, a home of Pandas in Sichuan province, is very populous and its province itself accommodates 81 million people while their average per capita income is just about $5,000 (2014, World Bank Data) or three times smaller than Shanghai’s. However, the growth rate of the per capita income of Sichuan Province is one of the fastest among inland provinces. In the meantime, Apple Store has already been settled to welcome both current and future customers in the fast growing largest inland city. <Also read - Apple and Starbucks in Chengdu, China: Fast Growing Largest Inland Economy>

iPhone, iPad, Apple Watch, and Mac

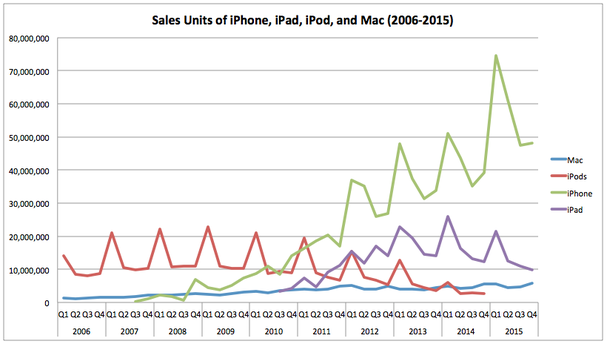

During the forth quarter, Apple sold 48 million iPhones, compared to 39 million iPhones in the same quarter a year earlier or up 22 percent between those periods. Despite typical internal device upgrades of new iPhone 6S/6S Plus series, sales went solid during the quarter. Sales of iPad continue to fall after its peak in the first quarter of 2013. The next quarter is closely watched among analysts if iPad Pro can generate an upward swing but the expectation of the overall iPad sales is closer to last year’s first quarter performance. Since Apple Watch is categorized in the Other Products, which include Apple TV and Beats and so on, an exact sale of Apple Watch is unknown. However, Apple Watch number during its first holiday season is an interesting part to be monitored. That Other Product category has already surged 60 percent during the forth quarter from the same period year earlier when there was no Apple Watch. It is possible that this holiday season is going to be significant for the watch.

Mac has been very solid over past years. Sales of Mac were up nearly 9 percent between 2015 and 2014. Despite its slower product cycle, popularity of Mac products is highly intact. Although geographical shipments of Mac are unknown, it is highly likely that today’s Chinese iPhone users are slowly attaining modern Mac products in the world’s biggest PC market. This year’s new MacBook series should generate more sales in China as well as rest of the world and the upcoming number is very intriguing to watch.

EPS and Future

Earnings-per-share (EPS) of the forth quarter climbed to $1.96 or up $0.11 from the previous quarter, leading Apple’s fiscal 2015 EPS to $9.22, compared to $6.33 per share in 2014. Apple’s earnings growth is highly intact and the upcoming first quarter is expected to be another record history thanks mainly to massive popularity of Apple products in China. At this moment, analysts expect the company to earn $3.25 per share during the first quarter or a 6% increase from the same period a year earlier. That 6 percent growth is not an impressive number thanks to the blockbuster sales of last year’s iPhone 6 series. However, as the first quarter earnings is nearing, the earnings estimates are expected to rise and shares should move higher as well. iPhone sales has been a main driver for the company in past years, Mac sales is hard to ignore. Mac products are being popular as iPhone users grow and modernity-looking Chinese are probably going to be massive buyers of those in a long run. Plus, new MacBook series are on the shelves and the year-end sales are expected to be significant. Apple Watch sales figure will be an interesting part for the first quarter. The watch will probably be turning into a great holiday gift and that may bring Apple’s sales even higher. All in all, Apple’s first quarter is expected to be a record history again and if the company’s earnings is to reach $3.51 per share, a 15% rise from the same quarter a year earlier, while the multiple moves higher to 15 thanks to the expectation of the holiday season quarter along with next year’s new iPhone 7 release, the shares of Apple may reach $145 in coming quarters.

*This article is author’s ideas about investing in AAPL, not an investment recommendation. There may be some possible mistakes on general concepts of AAPL. The author is long AAPL. Investment contains risks. Please consider risks of investment when investing. Economics Universe is not responsible in any loss of your investment.

|

Apple

|