Q1 2016 Apple Earnings: Just 1 Percent Growth in iPhone Sales, Great Opportunity to Buy the Stock?

January 28, 2016

Akira Kondo

The most popular rose-gold iPhone 6S Plus among modernity-oriented Chinese consumers. The most popular rose-gold iPhone 6S Plus among modernity-oriented Chinese consumers.

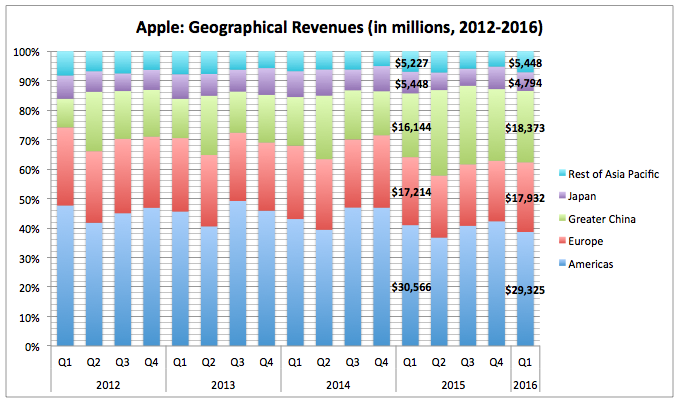

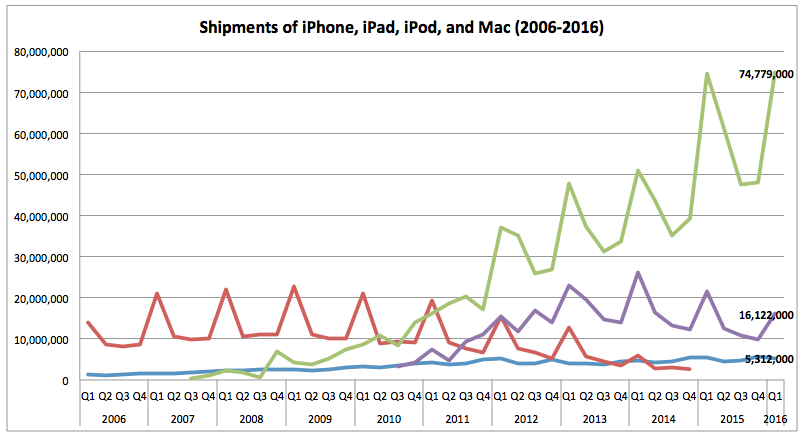

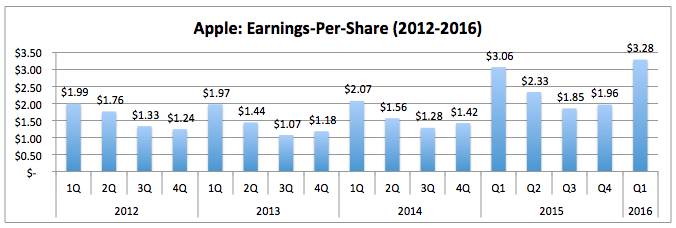

Apple (NASDAQ: AAPL) reported better-than-expected first-quarter earnings after the market closed on Tuesday, despite a difficult economic environment across the globe. For the October-December quarter, the company earned $3.28 per diluted share or $0.05 above the consensus estimates. Net income during the quarter slightly grew 2 percent from the same quarter a year ago to $18.4 billion while quarterly revenue also climbed 1.7 percent to $75.9 billion. In the meantime, units sold and revenue from iPhone continued to post the record-high in the first quarter history at 74.8 million and $51.6 billion, respectively. However, the growth rates of those numbers from the same quarter a year earlier were only 0.4 percent and 0.9 percent, respectively. On the other hand, sales of the other products category, including Apple Watch, surged 62 percent from the same quarter a year earlier when there was no Apple Watch on the shelves. Sales in China during the quarter, closely monitored by many analysts, were up 14 percent while its sales accounted for 24 percent of Apple’s total revenue. Technology companies’ profitability measurement, gross margin, was handsome 40.1 percent during the quarter. Overall, Apple’s first quarter results are mixed after the company had continuously posted storing earnings over past years. China’s massive demand is overdone for a moment

After Apple has posted massive revenue growth in China over past quarters, Greater China region has become the center stage for the company’s growth. However, the Greater China sales, including Hong Kong, Macau, and Taiwan, grew quiet 14 percent from the same period a year earlier after the massive 99 percent growth in the previous quarter or the 112 percent growth two quarters ago. Despite the slowdown in Greater China sales figure, revenues from the region still accounted for 24 percent of total Apple’s sales, which was same as the last quarter, due to moderate and negative growth experienced in the other regions. That being said, China is still an important part for Apple’s business. Chinese consumers are always seeking for the modern experience, like having iPhone in hands and sipping coffee at Starbucks. Such trend is likely to continue over the long run, especially in global cities, like Shanghai and Beijing. However, those modernity-looking consumers are also growing in inland cities, like Chengdu, Xi’an, Changsha, to name a few, and they are always looking for an opportunity to attain modern, yet expensive, iPhone.

A few weeks back, Starbucks announced to add 500 stores in mainland China each year through next five years from the current 2,000 stores. Starbucks across China is one of the finest spots for local Chinese to enjoy the modern experience. The stores now have expanded into inner cities, including Changsha and Chengdu, which allowed the company to overlook the local economies what Howard Shultz, Chairman and CEO of Starbucks believed “Starbucks as a lens on almost every community (economy).” Therefore, Starbucks knows the Chinese economy and their consumers more than analysts who carefully research on monthly or annual data from the public. Although coffee and iPhone are totally different products, they are however in the same modern product category that the Chinese consumers are always looking for. If Apple is to introduce revamped iPhone series, or expectedly known as iPhone 7, the modernity-looking Chinese will probably once again turn into the massive buyers. Americas, Europe, Japan, and Rest of Asia Pacific

Revenues from Americas were sluggish over the October-December quarter. Sales in Americas grew negative 4 percent, compared to positive 10 percent growth in the previous quarter or 23 percent growth in the same quarter a year ago from the first quarter in 2013. Europe region was held up pretty well at positive 4 percent growth during the quarter from the same quarter a year ago despite the stronger dollar against euro during the quarter or the past year. Sales in Japan were hit hard at negative 14 percent growth. Although Japan now accounts for only 6 percent of Apple’s total revenues, the country’s iPhone business seems to be very saturated as a half the mobile phone users in the nation already own iPhone. Plus, unlike China, upgrading cycle in Japan is slow. Rest of Asia Pacific sales number is also sluggish at positive 4 percent growth. However, this region along with China has the great potential in growth over coming years. As new iPhone 7 is ready this year, this quarter’s sluggish sales may turn coming forth and first quarters into massive sales growth experience. iPhone, iPad, Apple Watch, and Mac

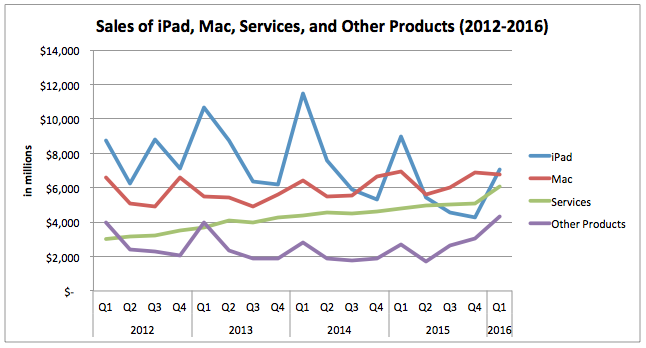

During the first quarter, Apple sold nearly 74.8 million iPhones, compared to 74.5 million iPhones in the same quarter a year earlier or up only four-tenths of a percentage point between those periods. It seemed all the demand for internal device upgrades of iPhone 6S/6S Plus series has significantly settled down over the quarter while a pent-up demand for new iPhone 7 series has started to generate. That means the second quarter earnings is likely to be relatively weak as most analysts have already expected. In the meantime, sales of iPad turned out to be disappointing. Shipment of iPad was slightly above 16 million, which was far less than the same quarter a year earlier of 21 million. While iPad Pro has started to attract customers in Apple Stores across the globe during the quarter, it did not help much to the company’s earnings. Clearly, customers’ motivation to upgrade iPad is weak and slow. However, higher-end iPad Pro is clearly popular to some customers, such as executives and researchers. It depends how the company can attract iPads for educational or business usages to customers as it has been doing so.

Another disappointment comes from a sales decline of Mac products. Shipment of Mac products was 5.3 million during the quarter, which was lower than the same quarter a previous year of 5.5 million. It is the first annual sales drop seen since 2013. The sales of Mac series have been very solid over past years but that trend finally changed the course during the quarter. Popular pricier MacBook Pro series are expected to remodel this year and if that happens, the pent-up demand for the new MacBook Pro will quickly generate and it may generate higher revenues on that category. “Other Products” category, including Apple Watch, Apple TV, and Beats, is probably the bright side in Apple’s first quarter earnings. The sales of the other products were up whopping 62 percent from the same quarter a year ago when Apple Watch was not on the shelves yet. Those numbers translate that the other products category is accounted for 5.7 percent of Apple’s total revenues, compared to 3.6 percent a year ago. That is a great jump within the Apple’s total revenue pie and if that other category can continue to grow, it makes the company’s earnings more attractive to investors in coming quarters.

Risk

As mentioned in the previous article, “Q4 2015 Apple Earnings: Best 4th Quarter Leads to the Best Year in History,” continuing storing dollar may hurt Apple’s earnings over coming quarters. China devalued its currency last year while Euro region continues massive quantitative easing, known as QE. Central Bank of Japan seems to inject more money into the market. Asian region, including Thailand and South Korea, struggles to grow their economy thanks to Fed’s interest hike in last December. A strong dollar is clearly a headwind for Apple, whose international sales currently accounts for 66 percent. On the flip side, any chances in dollar depreciation can quickly generate momentum in shares of Apple though it is unlikely as the Fed’s interest hike may happen a few times this later year.

Shares of Apple may bounce back over coming quarters as greater expectation of new iPhone 7 series starts to generate. Currently, shares are trading at just above 10 times earnings (as of January 27). That makes Apple stock very attractive to investors. Even though upcoming earnings are expected to be not as handsome as before, the company is expected to announce a dividend hike during the second quarter conference. It may become a 7 percent dividend hike, which is still attractive to the shareholders as it currently yields 2.3 percent. Along with dividend hike in the upcoming quarter, the company also expects to buyback more shares into weakness of its own shares. All those factors in one piece, buying shares of Apple is now a great opportunity at this current level.

|

Apple

|