2015 Portfolio Summary: Once Again Outperforming the Benchmark by 20%

January 5, 2016

Starbucks store at the Wall Street, right opposite to the New York Stock Exchange. Shares of SBUX were up nearly 50 percent in 2015. Starbucks store at the Wall Street, right opposite to the New York Stock Exchange. Shares of SBUX were up nearly 50 percent in 2015.

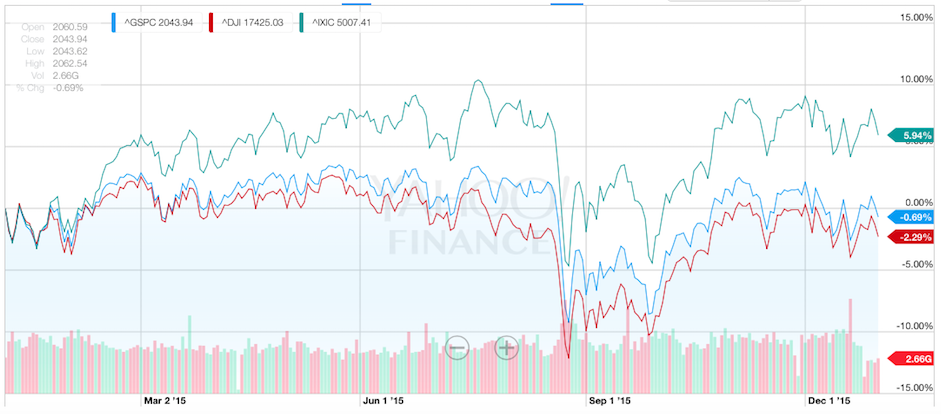

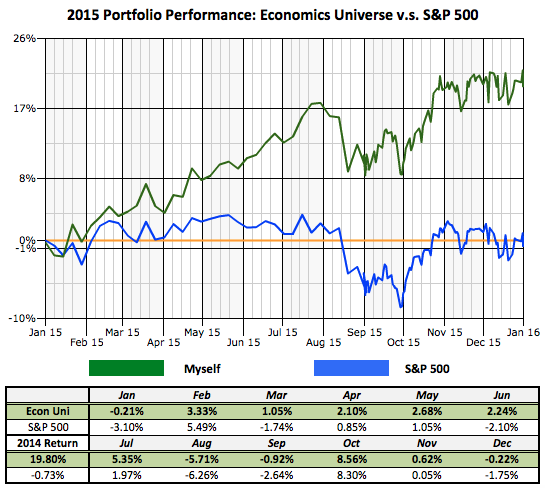

The Economics Universe made an excellent 19.8 percent return in its well-diversified portfolio during the 2015 stock market year, followed by 13.15 percent return in 2014 and 31.27 percent return in 2013. That 20 percent return is very well done, especially when our benchmark, the S&P 500, performed nearly a flat return. For the 2015 stock year ended, the S&P 500 fell three-quarters of a percentage point or 16 points to 2,042.94 and the Dow Jones Industrial Average declined 398 points or 2.28 percent to 17,425.03 while, on the other hand, the tech dominated NASDAQ nicely advanced 271.36 points or 5.73 percent to 5,007.41. With that in mind, the Economics Universe portfolio once again outperformed the market, by 20 percent in 2015, which made the seven consecutive years of outperformance over the S&P 500 since 2009 followed by an inline performance during the global financial crisis year of 2008 when the benchmark fell 38 percent. Let’s break down how individual stocks in the portfolio performed throughout the year to beat the market.

Portfolio in 2015 During the 2015 stock market year, the portfolio contents did not change much, rather selling smaller portions of winning positions when at higher prices in diversified periods. Thus, it was conservatively managed throughout the year because the investment thesis made earlier last year was “the 2015 stock market year is not going as easy as before as easy money has been made over past five years,” which made a conservative approach in 2015. <Also read: 2014 Economics Universe Portfolio Performance> Therefore, the portfolio contents actually unchanged since the beginning of 2015 except the cash position fattened. Apple (NASDAQ: AAPL) and Starbucks (NASDAQ: SBUX) remained the largest positions throughout the year. Bank of America (NYSE: BAC) and United Continental Holdings (NYSE: UAL) were the next large positions in the earlier. There were three main healthcare-related stocks: Bristol-Myers Squibb (NYSE: BMY), Intuitive Surgical (NASDAQ: ISRG), and St. Jude Medical (NYSE: STJ), of which shares of BMY and ISRG were also held largely. Medium and smaller positions were Ensco International (NYSE: ESV) and Tesla Motors (NASDAQ: TSLA). Those nine positions were held in the portfolio to beat the market in 2015. One of the biggest winners in the portfolio was SBUX, which has been a long-term holding since 2009. In fact, without SBUX, the portfolio would have not made such an excellent return in 2015. When the 2015 stock market started, SBUX was already the largest positions thanks to 100 percent return made since the beginning of 2012. Plus, shares of SBUX kept hitting all time high through the summer and to the year-end. As the conservative approach was imbedded in the investment thesis, I trimmed smaller portions of SBUX at each all-time-high. In addition, I even trimmed more shares on the last trading session of the year. That resulted in one-forth of the SBUX position was sold through the year-end. It was a difficult decision to have made because SBUX had been one of the best performers in the stock universe. However to make the outperformance over the market happens, it was the best time to sell the winning stock. Thanks to that, Economics Universe portfolio made a great advance in the earlier year. Shares of AAPL were the traded unfavorably over the past year. Since it was also one of the largest positions in the portfolio, it dragged the performance down after the summer. However, the stock nicely contributed the rally in the earlier year to outperform the market, which made the portfolio management much easier in the second half of the year. In fact, AAPL was just down nearly 4 percent in 2015 but now the shares are trading at only 11.4 times the trailing twelve month earnings while Apple’s ability to buy back significant amount of its own shares as well as to increase dividend payouts is highly intact. Although the positions were unchanged in the all of Economics Universe’s favorite healthcare selections: BMY, ISRG, and STJ, these stocks were the hidden winners of downside protection. STJ was down nearly 4 percent but it had been a smaller position while larger BMY and ISRG performed positively at 15 percent and 4 percent, respectively. All those healthcare stocks were also intact with the 2015 thesis investment, which the sector continued to outperform. Before shares of SBUX were into trimming positions, UAL became the earlier target of reducing the position. Thanks to the oil price weakness, the shares performed very well in 2014, there was no reason to cut the position in 2015. As UAL or the transportation sector purely belongs to a cyclical sector, weak global economy easily affects the stock negatively. With that in mind, most of the UAL position was sold and now the stock is the smallest component of the portfolio. In addition to UAL, TSLA was removed out of the portfolio after realizing 5 percent gain on the last trading session. TSLA was a great stock to own; however, to make the portfolio simple and conservative for the 2016 stock market year, the stock was unwanted at this moment. However, any weakness seen of shares of TSLA in coming quarters, I would be a buyer to be respectful to CEO Elon Musk’s company. Nightmare of the portfolio component truly went to ESV. The deep-water driller was totally unfavorable to own over the past two years and again, in last year the stock nosedived 50 percent. When I owned the stock in 2014, it was the larger holding; however, the share price was already down to the half before the 2015 stock market year kicked off. That made the position already small in the beginning of 2015, which helped the downside effect to the portfolio relatively minimal. However, owning ESV was the biggest mistake and the stock should not have been added in 2014. Plus, not selling out this losing stock over past years reflected weakness of my portfolio management skills. Economy and the Market

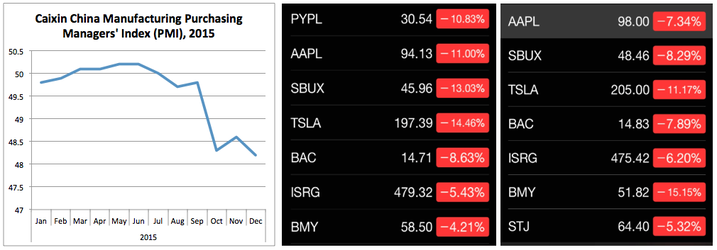

During the 2015 stock market year, the momentum from 2014 continued to be intact through the first half of the year but that market strength started to weaken gradually into the summer. By the late summer, major indices across the globe nosedived into the ground. That all happened suddenly on Monday, August 24, after the weaker-than-expected China’s manufacturing PMI released on the day earlier on Sunday. Before the U.S. markets opened, Shanghai Composite was down 8.5 percent and neighboring Nikkei 225 was also down 4.6 percent on the Monday trading session. A minute after the U.S. markets opened at 9:30am E.T., selling pressure intensified, like multiplier effects were in full swing. Believe or not, within the first hour of the session on Monday, the shares of AAPL fell sharply more than 10 percent, SBUX nosedived more than 20 percent, and even the non-cyclical stock like BMY fell sharply more than 15 percent.

(L) Caixin China Manufacturing Purchasing Managers’ Index (PMI) released by Markit Economics. In August, China’s PMI fell below 50, which indicated that a contraction in the performance of the manufacturing sector. On the next day trading sessions, major indices across the globe nosedived. (C) A minute after the New York market opened, Yahoo! Finance on iPhone showed popular stocks, like AAPL and SBUX, were down more than 10 percent. (R) A few minutes later, even a defensive name, like BMY, also fell 15 percent.

Investors were in a panic mode and the only thing to do for them at that moment was to sell all the winning stocks that had gained over past years. That scene was exactly same as when the global financial crisis hit the markets in 2008. However, the U.S. companies were not broken at this time and smart investors quickly bought back the shares into the afternoon session. For instance, shares of AAPL, which were down more than 10 percent in the earlier session, gained 2 percent by the noon (but the shares were down 2.5 percent when the markets closed). However, the stock markets continued to be very volatile until the Chinese stock markets started to settle in October.

Despite the gradual improvement in the U.S. economy, global economy continued to be uncertain. Especially, investors and analysts were carefully watching China’s economic activities last year whether the economy could sustain meaningful growth over coming years. Any events of collapse of Chinese economy might quickly impact fragile Europe economy, troubled South American region, and neighboring Asian countries. By the time when the Chinese markets were bottoming out, investors and analysts changed their focus from China onto the possible interest rate hike by the Federal Reserve Bank. Rate hike news from the Fed was also carefully seen among investors and analysts in the later 2015. The first rate hike after the near zero interest rate policy was implemented in 2008 finally happened in the FOMC meeting in December. Fed Chair, Janet Yellen, also a co-author of “The Fabulous Decade” in 1990s, increased its key interest rates by a quarter percentage points to 0.25-0.50 percent. In the meantime, stock markets seemed already anticipated that move and the benchmark finished flat on the last trading day. Over the 2016 stock market year, gradual rate hike is very likely and analysts are more carefully studying its impact on stock markets as well as on global markets. Into the 2016 Stock Market Year

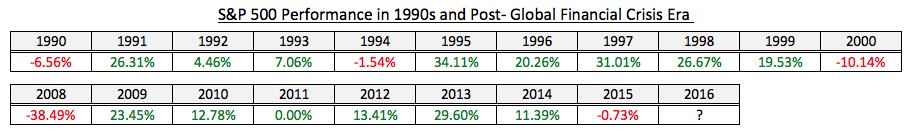

Into the 2016 stock market year, investors are likely to be cautious and conservative against any unexpected events from China, Europe, and South America, so are the Economics Universe portfolio components likely to be the same as last year while being conservative yet a bit aggressively than 2015. Stocks that are traded discount and non-cyclical stocks with fat dividend yields are going to be main components of the portfolio. Investors’ all time favorite AAPL is currently trading at just 11.5 times its earnings, which generate a good entry point after considering of continuing massive stock buyback as well as expected dividend hike and new iPhone 7 release this later year. Its yield of 1.94 percent is also attractive. Three healthcare stocks in the portfolio components, BMY, ISRG, and STJ, are going to be core holdings throughout 2016. Both BMY and STJ offer meaningful yields while ISRG has an exposure to tech. Since STJ is hitting 52-week low, it is likely to be the first stock to be added into the weakness. While interest rate hike is intact this year, Wells Fargo (NYSE: WFC) is on the radar screen. WFC currently trading at 13 times its earnings or 1 multiple point higher than BAC that is in Economics Universe portfolio. The company is well positioned into the rate hike with its solid balance sheet, plus yields 2.71 percent. Along with BAC, WFC is likely to be newly added into the portfolio in the earlier 2016. Stocks that are unfavorable to own into 2016 are UAL and cyclical industrial, like Caterpillar (NYSE: CAT), as well as durable automotive consumer discretionary, like GM (NYSE: GM). Despite U.S. economy is in a fine shape, global economy is likely to be uncertain, thanks mostly to China. CAT and automotive makers are first ones to be hit hard while non-durable must-have item Apple’s iPhones and Starbucks coffee continue to do well across the globe. UAL in the portfolio will be the first one to be removed to increase more cash position and deploy that cash to add fresh names, like WFC. Fed will play an important role in 2016. Any movements from the Fed can make an adjustment or advance in the markets. However, current Fed Chair, Janet Yellen, must be the right person to guide the U.S. economy into the right path. The market, S&P 500, experienced a first negative return in 2015 after being up for six years but even the fabulous decade in the 1990s also experienced a negative return in 1994 (U.S. economy recovered from a recession in 1990-1991 though the exact comparison between 1990s and post- global financial crisis is not necessary and important). At least, U.S. economy is still intact and as long as the stock markets can keep up with its gradual economic recovery against weaker global economy and strong dollar, another fabulous decade is on the way.

S&P 500 Performance in 1990s and Post- Global Financial Era. The 1990s was known as "The Fabulous Decade," which was also the title of the short book written by the current Fed Chair, Janet Yellen. Since 2009, the S&P 500 performed fabulously till 2015 when the market ended in negative. Will the stock market once again continue to perform fabulously after 2016?

|

Economics Universe

|