The Great Gatsby and the Stock Market in the 1920s

September 20th, 2014

Akira Kondo

The Great Gatsby movie in 1974 and the novel The Great Gatsby movie in 1974 and the novel

It is a good time to read back one of the affluent American literatures, The Great Gatsby written by F. Scott Fitzgerald, especially after the reproduced movie unveiled in a theater in 2013. The story illustrates the summer of 1922 when a bond salesman, Nick Carraway, who lived just right next to a mysterious millionaire, Jay Gatsby, narrated throughout the story along with his puzzling life.

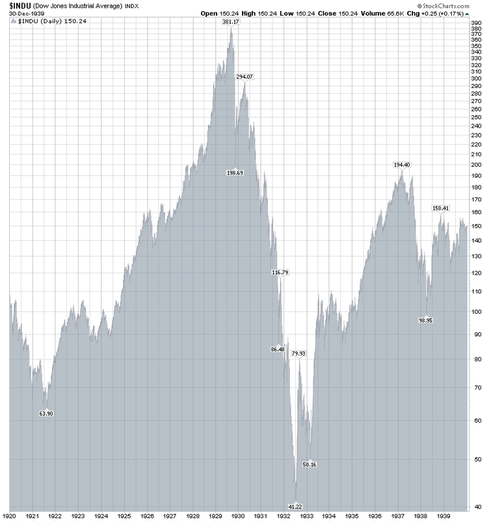

1922 was the year that the Wall Street prosperity began when a massive rally in the stock and bond markets experienced and lasted until 1929.[1] The novel or the movie nicely represented the glorious years of the Wall Street. The 1929 stock market crash, which was not presented in the movie, is the notable Wall Street history. This movie started off with the glorious moments of the Wall Street. “Stocks reached record peaks and Wall Street boomed in a steady golden roar.”[2] In the beginning of 1922, the Dow Jones Industrial Average (DJIA) was at around 80 points or about 16 points higher than the mid-1921. That was about 25 percent gain within a half year. Around June 7th, 1922, when Nick visited Tom’s house in West Egg, the DJIA hit above 90 points or about a 12 percent year-to-date gain. By the last day of summer when the Plaza Hotel confrontation took place, the DJIA was hitting a 100 mark or 25 percent gain so far in that year.  Source: StockCharts.com Source: StockCharts.com

The actual spike of the DJIA might have really kicked off a few years later from the summer of 1922. Then, the stock skyrocketed all the way up to 381 points by the middle of 1929 or nearly 300 percent return within the five years (The recent financial crisis led the DJIA nosedive all the way down to less than 6,500 in March 2009. Today, the index is at 17,279 as of September 20, 2014 or about 165 percent return within five and a half years.) In the meantime, the DJIA hit 120 by the beginning of 1925 when the novel went published in April of that year. Fitzgerald himself might have enjoyed the stock market rally while seeing the glorious moment of the Wall Street, like in the movie.

[1] Geisst, p. 247. [2] The Great Gatsby movie (2013). Stock market bubble Is it a stock market bubble? U.S. economy in the 1920s clearly overheated. According to the book, “Animal Spirits,” written by the Nobel Prize winners, George Akerrlof and Robert Shiller, “it is a time when careless spending by consumers is the norm and when bad real investments are made.”[1] The word, “careless,” is actually in The Great Gatsby book and the movie when Nick disgusted by Tom’s and Daisy’s behaviors. “It was all very careless and confused. They were careless people Tom and Daisy – they smashed up things and creatures and then retreated back into their money or their money or their vast carelessness or whatever it was that kept them together, and let other people clean up the mess they had made,” Nick expressed.[2] Fitzgerald must have realized the wealthy people, like Tom, were the careless spenders, who always led money to solve everything about bad circumstances and the 1920s were the time when those people created the overheated economy. Thus, it was a stock market bubble created by careless spenders. [1] Akerlof and Shiller (2009), p. 65. [2] Fitzgerald, p. 187.  Low-imcome immigrant construction workers live in their dormitories right in front of modern buildings in Shanghai's financial hub. Low-imcome immigrant construction workers live in their dormitories right in front of modern buildings in Shanghai's financial hub.

Income gap

One of the well-described scenes in the movie is probably a valley of ashes. The valley of ashes is unique because it is one of the only places where rich people, like Tom, can get closer to the poor people through the windows of a train car. However, these two different people never converge. Income gaps must have been worsening at that time. When Tom asked Mr. Wilson, “how’s business?” He said, “I can’t complain.”[1] This conversation happened in front of Mr. Wilson’s house at a valley of ashes, where about a half way between West Egg and New York. Again, the movie nicely described this place, where ash-grey workers ruthlessly kept shoveling in front of the big eyes of Doctor T. J. Eckleburg on the gigantic board. Those workers were poor. Unlike the middle-income man, like Nick, they never dressed well. Their faces expressed no future as seen in the movie. When an overheated economy exists, the more income gap created is very likely. For instance, China, which experienced housing bubble over a past decade thanks to careless spenders, must have created greater income gap between rich and poor. The contrast of Lujiazui, the fast developing financial hub in Shanghai, and a glorious moment of the Wall Street overshadowing the valley of ashes is alike. A number of poorer immigrant workers keep shoveling right in front of modern high-rise buildings in Shanghai. On the other hand, wealthier white color people continuously walk into and out of those buildings. They represent the similarity of the scene when Nick and Tom were arriving in the valley of ashes, and New York right behind, by train. Another similarity comes to the Plaza Hotel confrontation in the end of summer. Gatsby, who once was poor, said to Tom in one of the rooms at Plaza Hotel, “she (Daisy) only married you because I was poor and she was tired of waiting for me.”[2] It is like today’s Shanghai or other big cities in China. In the modern city, like Shanghai, a wealthier woman only marries a wealthier man. If you go to People’s Square in Shanghai on the weekend, you will know how the wealth controls the marriages. Wealthier people and poorer people merely converge both in old days in New York and today’s Shanghai. <See – Shanghai Marriage> [1] Fitzgerald, p. 29. [2] Ibid, p. 137. Corruption and bad real investment

“It is a time when corruption and bad faith run high, since they rely on trusting behavior on the part of the public and of apathetic government regulators. This corruption, however, is mostly recognized publicly only after the fact, when the euphoria has ended. It is often also a time when people feel social pressure to consume at a high level because they see everyone else doing so, do not want to be seen as laggards.”[1] P. 65 Corruption was a typical event to be seen, especially in the 1920s, when the economy was overheated. In the Great Gatsby book also described one of the scenes when the police officer followed the Gatsby’s custom-made car before crossing the Queensboro Bridge. The policeman let him go without pulling his car over as soon as Gatsby showed his business card to him. Gatsby said, “I was able to do the commissioner a favor once, and he sends me a Christmas card every year.”[2] An overheated economy and corruption seem to have a positive correlation as at least seen in the movie and probably in today’s China as well. Money seems to be always an option to solve some unwelcomed circumstances that those wealthy people want to eliminate away in the public. Watching a movie that represents the past is somewhat unique. There are many scenes that you can compare and analyze between the real world and the movies, like The Great Gatsby, whose author had lived in the dynamic moment of the stock market history. If he was to write The Great Gatsby in the early 1930s, the story must have been different and Gatsby or Tom would have not been as rich as they were in 1920s. [1] Akerlof and Shiller, p. 65. [2] Fitzgerald, p. 72. Sources: Akerlof, George A. and Robert J. Shiller (2009), “Animal Spirits – How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism,” Princeton University Press. Fitzgerald, F. Scott (1995), “The Great Gatsby (The Authorized Text Edition),” Simon & Schuster Inc.. Geisst, Charles R. (2012), "Wall Street: A History Updated Edition," Oxford University Press. Luhrmann, Baz, "The Great Gatsby" movie (2013), Warner Bros. StockCharts.com, "DJIA Index 1920-1940," http://stockcharts.com/freecharts/historical/djia19201940.html. |

Investment Bulletin<New> Vanguard Total Bond Market ETF (BND): Benefits of Investing in a Bond Basket How to Beat the Market? Diversification: Systematic Risk and Unsystematic Risk PE Multiple Analysis: How to Analyze the Future Stock Price? The Rule of 72 Economics BulletinMore Articles on China

=> China Bulletin

<New> What you all need to know about Chinese stock markets: Background Price-to-earnings Market inefficiency |