Financial Capital v.s. Economic Capital: Capital Creates Efficiency and Efficiency Creates Productivity

March 3, 2016

Akira Kondo

Morgan Stanley's "Capital Creates Changes" advertisement at its Times Square headquarter building Morgan Stanley's "Capital Creates Changes" advertisement at its Times Square headquarter building

The word, “capital,” is often used in financial and economic articles in newspapers as well as periodicals. If you are a student majoring in Economics, you might have read Thomas Piketty’s “Capital in the Twenty-First Century” to learn global level income inequality over the past centuries. Then, you may have confused what “capital” exactly means because you may find out two different “capitals” from the Piketty’s book and your expensive Introductory Economics textbook. Although Piketty’s book is about economic issues, the word, “capital,” used in the book is different from the one that you see in your Economics textbook. The former “capital” refers to “financial capital” while the later “capital” in your textbook is “economic capital,” and they are completely different capitals.

Financial capital

Morgan Stanley’s “Capital Creates Changes” campaign advertisement on its headquarter building at Times Square is very eye-catching. The advertisement says: All of those capitals are considered to be “financial capitals,” such as money as well as financial products, like insurance and bonds. That can simply translate that the company's financial products and services can create changes. Investment banks, like Morgan Stanley, are offering their capitals to multi-national companies from technology to healthcare, private equities, and wealth management to help create jobs, resources, innovation, and so forth to promote their businesses.

Economic capital

In economics or a study of social science, capital refers to fixed-assets, like machinery and buildings, which generate output, as known as productivity. Commonly, “capital” expresses as “K” in an economics textbook while “productivity” is known as “gross domestic product (GDP).” The GDP is also equal to income. If you divide the total income by total labor or “L,” it will result in “income per person” or known as “GDP per capita,” meaning how much income an each person earns annually on average bases. That means a capital generates income, so does labor. Therefore, productivity or income is a function of capital and labor. GDP = Income = f (K, L) Efficiency

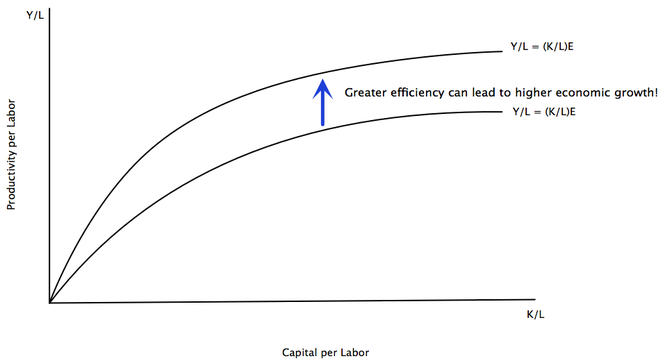

Among Morgan Stanley’s advertisements, there are a couple of interesting phrases that make economists curious. Capital creates “knowledge,” “innovation,” and “efficiency.” The “efficiency” is an interesting part to consider. In economics, efficiency is often classified as “Total Factor Productivity (TFP),” which is generally denoted as “A.” However, we can simply switch that “A” to an “E” as an “efficiency” measurement. A greater “efficiency” or TFP often impact productivity positively through a better utilization of K and L. What is efficiency? Technological progress, better education system, and even social stability are the great examples of the efficiency. For instance, Apple’s cutting-edge iPhone has improved greater efficiency in our modern lives. People can check their bank balances and transfer money between financial institutions anytime by tapping an iPhone screen. Facebook connects friends across the globe and allows them to know each other what they are up to without sending email or making a phone call. In the 21st century, it is certainly the new era of the technology and the companies, who generate greater efficiency through technological advances, should lead the higher economic growth.

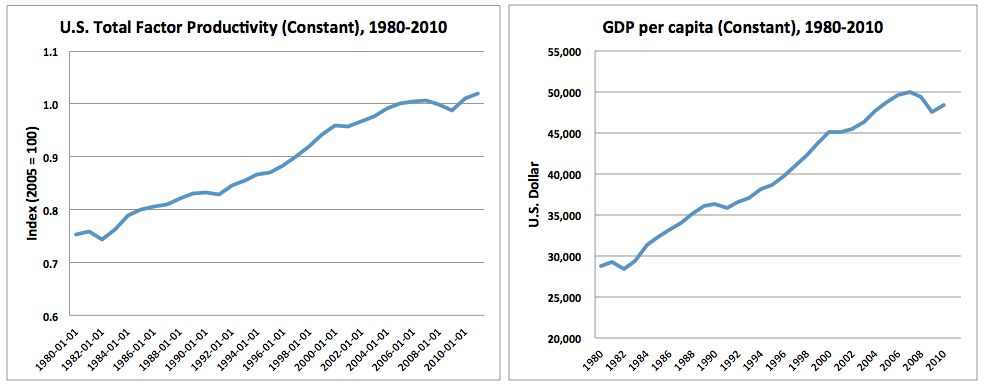

According to St. Louise Federal Reserve Bank Research, TFP has significantly increased over the past decades (See the graph). In the meantime, the U.S economy has experienced a fabulous decade in 1990s and the post-IT bubble growth in the first half of 2000s. The United States clearly has been the leader in the promotion of the technology over a past century. Google, Facebook, Twitter, PayPal, Uber, and many others have emerged in the 21st century and clearly promoted a greater efficiency in our lives and an economic growth.

(L) U.S. Total Factor Productivity Index and (R) U.S. Gross Domestic Product from 1980 to 2010. An efficiency measurement TFP, which grew 36 percent during those periods, positively led U.S. GDP grow nearly 70 percent within the two decades. | Sources: Economic Research, Federal Reserve Bank of St. Louis, World Bank Data

However, without better education, today’s technology would not have been such better. Education is an important base for creating better technology. Howard Shultz, Chairman and CEO of Starbucks, offers educational opportunities for Starbucks’ employees. According to Starbucks, “the disparity between what U.S. college and high school graduates earn has more than doubled in the past 30 years.” That also means college graduates deliver twice-higher productivity than high school graduates do. That being said, education is clearly the most important factor that promotes greater efficiency but today’s expensive tuition fees on most universities could possibly lead lesser efficiency.

From the function earlier, we can add up the efficiency “E” into the equation: GDP = Income = f (K, LE) “LE” together is now “labor efficiency.” Technological advances and a better education system create greater labor efficiency. The greater the labor efficiency is, the greater the utilization of capital can be. In the spirit of capitalism, where we live today, social stability promotes a better working society, which generates a better labor efficiency as well. Therefore, the labor efficiency along with the capital promotes higher economic growth. Back to Morgan Stanley’s “Capital Creates Changes” advertisement, it says capital creates efficiency. That is also right. Investment banks, like Morgan Stanley, are innovating sophisticated financial products and services for companies and institutions to promote greater innovation, education, and knowledge while they are better know as Research and Development. All of those then generate a greater (labor) efficiency to achieve higher economic growth. Without their capitals, today’s efficiency in Corporate America would not have been as efficient as in the past. However, a (financial) capital has also created a wrong innovation and knowledge that have led the worst financial crisis in the history.

|

More Articles on

|