Background of Chinese Stock Markets in 2000s (Page 1 of 1)

July 1, 2015

Akira Kondo

*This article or the contents of this article was originally written on December 20, 2012, at Fudan University, Shanghai China.

Shanghai Stock Exchange in Lujiazui, Shanghai's financial district, on June 26, 2015, when the Shanghai Stock Exchange Composite Index was down 7.4%. Shanghai Stock Exchange in Lujiazui, Shanghai's financial district, on June 26, 2015, when the Shanghai Stock Exchange Composite Index was down 7.4%.

Chinese stock market is relatively young compared to the biggest stock exchange in the world, the New York Stock Exchange (NYSE), which opened in 1817, while the tech-dominant electronic market, NASDAQ, opened in 1971. There are two stock exchanges in China at this moment at Shanghai and Shenzhen. Shanghai Stock Exchange (SSE) opened on December 19, 1990 and Shenzhen Stock Exchange (SZSE) opened on July 4, 1991. As of 2012, there are 978 companies listed on SSE while 1,466 companies listed on SZSE. Both stock exchanges operate four hours a day from 9:30 to 15:00 with a 90 minute-break during lunch time Monday through Friday except special holidays. The listing requirement for both exchanges vary but SSE is similar to NYSE style, which consists of large-cap companies, while SZSE is more similar to NASDAQ, which focuses more on young growth potential technology companies.

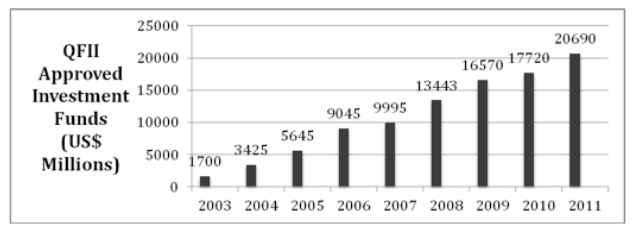

Both stock exchanges offer two different types of shares: A-shares and B-shares. In general, domestic investors are able to participate in both A- and B-share markets both in SSE and SZSE. On the other hand, foreign investors are only allowed to invest in B-share market; otherwise, they can participate in either Hong Kong’s H-share market or popular American Depositary Receipts, which are offered in NYSE and NASDAQ. Petro China (NYSE: PTR) and Baidu (NASDAQ: BIDU) are examples of ADRs. However, since the inception of the Qualified Foreign Institutional Investors (QFII) program in 2003, those groups of investors were allowed to trade both A- and B-shares and its number has grown and amount of investment funds from QFII, it significantly increased from US$1.7 trillion to more than US$20 trillion (See the Figure 1). On the flip side, domestic Chinese companies are able to list their shares through the Initial Public Offering (IPO) process at both A- and B- share markets as well as Hong Kong’s H-share market and ADR markets in NYSE or NASDAQ in the United States. Interestingly, the recent IPOs from Chinese companies, such as Renren (NASDAQ: RENN), Qihoo 360 Technology (NASDAQ: QIHU), and Youku (NASDAQ: YOKU) were all listed as ADRs rather than in A- or B-share markets. The reason could be due to a lack of regulatory system in Chinese stock market that led those young growth potential companies to be listed outside China to raise solid capital. In fact, A-share market both SSE and SZSE together is currently the fifth largest market capitalization in the world with $3.3 trillion in market cap or 55 percent of China’s 2010 GDP.

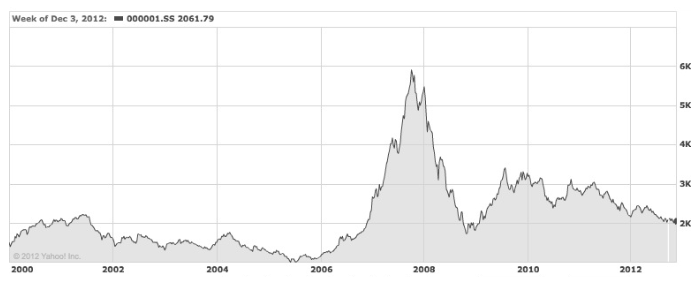

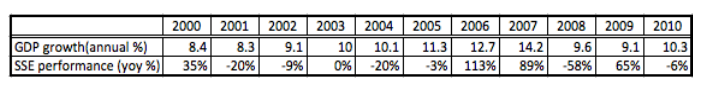

Looking at China’s GDP growth rate (See Table 1), China’s economy grew nearly 10 percent in the first half of 2000s, and then grew more than 10 percent until the global financial crisis kicked off in 2008. The global financial crisis quickly deteriorated stock markets around the world, including Hong Kong and Shanghai stock markets. In general when investing in a stock market, companies’ performance highly depends on economic condition in the domestic economy as well as its economic partner, in this case, the United States. Then, the performance depends on an industry-level, and next a company itself. It is often called a “top-down analysis.” That makes sense because investors are always paying “premium” for a company’s stock so the company’s earnings should be higher if the overall economy grows in the near future term. However, Chinese stock market did not response to its fast economic growth in 2000s, especially during the first half of 2000s. Although it was a dynamic ride throughout 2000s, but the stock market in the fist half of 2000s was somewhat very sluggish and was a downturn trend through the end of 2005. During the first half of 2000s, China’s economy grew fast at above 8 percent; therefore, companies’ production should increase average 8 percent, so should average income. If a stock market is a forward-looking indicator, Chinese stock market should not have underperformed unless market inefficiency exists. In 2001, the economy grew 8.3 percent but the Shanghai Composite was down 20 percent while the economy grew more than 10 percent in 2004 but the index was down even more to 20 percent. Therefore, there is no correlation found between China’s economic performance and its stock market performance in the fist half of 2000s. <Next Page - Price-to-Earnings Multiple> |

Next Pages

More Articles on China

Apple and Starbucks in Chengdu, China: Fast Growing Largest Inland Economy Apple and Starbucks in Chongqing, China: Price-Sensitive Inland Consumers Apple Store in Hangzhou, China: Popularity of Apple Products in China Starbucks in Changsha, China: Growing Upper Middle-Income Consumers Chinese ADRs: Is It Good to Buy Alibaba Shares? What is Middle-Income Trap? More Articles on Investment

How Do Stock Markets React when the Yield Curve Changes? The Great Gatsby and the Stock Market in the 1920s |