What you all need to know about Chinese Stock Markets: Market Inefficiency (Page 3 of 3)

July 1, 2015

*This article or the contents of this article was originally written on December 20, 2015, at Fudan University, Shanghai China.

SSE Composite Index was down 7.4 percent on Friday, June 26, 2015. Market inefficiency might have been one of the great reasons to generate Friday's market nosedive. SSE Composite Index was down 7.4 percent on Friday, June 26, 2015. Market inefficiency might have been one of the great reasons to generate Friday's market nosedive.

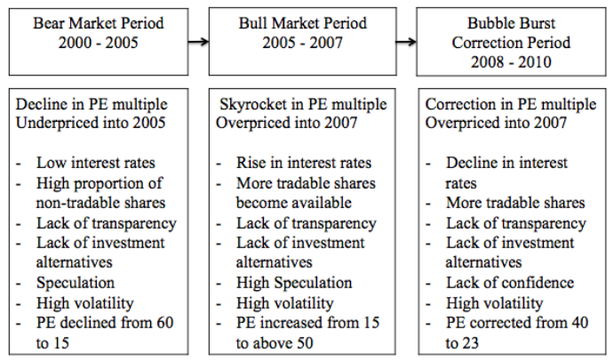

Since 2000, the Shanghai Composite Index experienced a roller coaster ride. When the market shows greater volatility, overpricing or underpricing appear in the stock market. In the meantime, many researchers believe stock price should follow random walk if markets were efficient. Thus, there are several factors should have created market inefficiencies in the Chinese stock market, especially in the first half of 2000s.

Tradable and non-tradable shares In the Chinese stock market, more than a half of the A-shares were non-tradable because the central government or local governments held state-owned shares. Also, two-thirds of total market capitalization was owned by the state. Thus, one-thirds of leftover shares were for investors. A research from Wang and Xu (2004) said that among those shares, private investment companies were believed to manage less than 30 percent of total outstanding shares. Those facts were intact till 2005. Prior to 2005, mainland Chinese companies had two share classes: tradable listed on the Shanghai and Shenzhen stock exchanges; and non-tradable, non-listed shares with the same ownership rights and claims as tradable shares. In 2005, the China Securities Regulatory Commission (CSRC) launched a program to convert non-tradable shares into tradable shares by 2006 according to Morgan Stanley Smith Barney (2011). Therefore, the existence of those non-tradable shares before 2006 had created market inefficiency because a half of the A-shares were non-tradable before 2006 while two-thirds of total market-cap was owned by the states. Thus, only one-thirds of shares were available to trade among individuals. Sluggish market performance in the first half of 2000s should be due to this market inefficiency designed by non-tradable shares. After 2006, more tradable shares appeared in the market along with even faster economic growth in China and a large number of investors jumped into the stock market to catch upward momentum. With combination of these two events, the Chinese stock market skyrocketed and became overpricing into 2007 or some said, “Chinese stock market bubble.” Speculation and turnover

Prior to 2006, there were the majority of shares owned by individuals in the Chinese stock market. If the majority of shares are owned by individuals, who may have good knowledge in investing or may not have any knowledge in investing and just want to throw money into the stock market to make lucky profits, what would happen to the stock market? More speculation in the stock market arises and it would create high turnover of stocks. Therefore, turnover ratios tend to be high in the Chinese stock market. The research from Wang and Xu (2004) observed the average annual turnover for the 1996-2002 period exceeded 500 percent while the U.S. average turnover is generally 200%. The higher the turnover rate, the more volatility the stock and the greater potential for wider swing in stock price. On the other hand, if turnover ratio is too low, investors may require a liquidity premium and this case typically happens in the B-share market. It was highly likely that high turnover led by speculation in the early 2000s should have been related to the limited tradable shares traded by individuals. In addition, trading stocks among individuals have become popular as more online investment companies appeared in the market in the past years. With more available information in the public, investors’ trading activities expand, especially in the second half of 2000s. Shiller (2003) mentioned more and more news was stations were reporting on the stock market and some cable channels focus solely on business news, which led to increased attention, and therefore, increased demand for stocks and other investment opportunities. As more information available through news station, investors are confused and try to catch upside momentum before being too late. This kind of activity happened right after 2005 and increased market volatility. The cause of the volatility is more country-specific than external factors though it is becoming more global-base as globalization of economy continues. Then, higher volatility created more uncertainty, which led more investors panic in the stock market. Eventually, those irrational investors have shaped an inefficient market and Yao and Luo (2009) said the extreme volatility of share prices in 2000s, in particular, must have made the rich richer and the poor poorer, fueling the already serious inequality problem in today’s China. Transparency

Where do the speculation and uncertainty come from? A-shares markets are generally domestic investors only. Companies and domestic investors may share insider information. There are no empirical or statistical data to proof but Chinese stock markets are not always efficient and investors cannot share the same information in China. If markets were efficient and all investors shared the same information, price volatility would still be small. However, in China, since markets are not always efficient and investors cannot share the same information, there exists some degree of speculation and uncertainty, stated Yao and Luo (2009). In China, all news organizations are fully state-owned, which means freedom of the press is likely to be limited, said Li (2008). Unreliable news always creates uncertainty in the stock market because the news is the only source available for the most investors. They highly depend on the news from media but any uncertain news can make investors into a panic mode and most result from this kind of situation leads to punish a stock market. Even regulation and law to enforce stock markets are relatively powerless compared to the developed countries. Although there is no systematic research on law enforcement quality or the efficiency of China’s legal system, China’s judges seem to be less professionally educated than those of developed countries. Without reliable regulation over stock markets, companies’ information is not fully shared among investors and those weak regulation and law might have created inefficient stock markets in China. However, it does not mean efficient market can create upside momentum for the stock market. Lack of investment alternatives

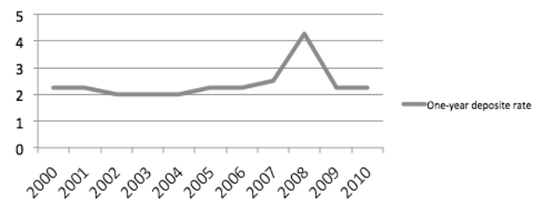

Lack of investment alternatives in China limited investors’ choice. Putting money into a bank account is generally the only choice for the Chinese. However, China’s bank deposit rates are low but they still want to put money into a bank account rather than investing. China’s bank deposit rates during the first half of 2000s were just 2 percent while the economy was heating up at the same time (See the Figure 6). When deposit rate is low, the central government short-term interest rate should be low; however, its rate should be higher than the deposit rates. Therefore, lower deposit rate does not motivate the Chinese investors to participate in the Chinese stock market. It is unusual circumstance in developed financial markets, such as NYSE, if this kind of inverse relation appears because stock prices in broader industry tend to appreciate given companies profit becoming profitable as interest rates decline. It is probably related to China’s high saving rates. Fernald and Rogers (2002) believe the Chinese may find it worthwhile to save, despite low interest rates, particularly given an aging population with limited pension coverage and substantial uncertainty associated with economic reforms. In the field of finance, investors are considered to be risk-averse but in fact, Chinese investors are “highly” risk averse although we see growing gambling popularity in Macau somewhat. In general, there are three things that the Chinese want to save for: social security guard, education, and housing. Thus, the importance in their savings has created some degree of distortion in the Chinese stock market.

|

<Previous Pages>More Articles on China

Apple and Starbucks in Chengdu, China: Fast Growing Largest Inland Economy Apple and Starbucks in Chongqing, China: Price-Sensitive Inland Consumers Apple Store in Hangzhou, China: Popularity of Apple Products in China Starbucks in Changsha, China: Growing Upper Middle-Income Consumers Chinese ADRs: Is It Good to Buy Alibaba Shares? What is Middle-Income Trap? More Articles on Investment

How Do Stock Markets React when the Yield Curve Changes? The Great Gatsby and the Stock Market in the 1920s All the sources in this article are listed at the bottom of this page.

|