The Largest Government Pension Fund is Investing Overseas: Is it an Ironic Move for the Japanese?

January 17, 2015

Akira Kondo

|

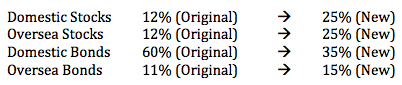

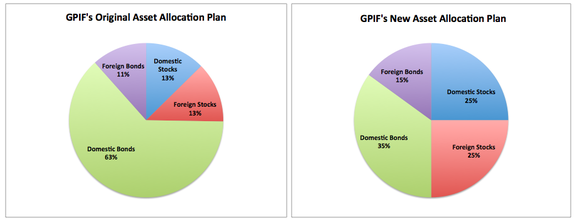

In November 2014, Japan’s Government Pension Investment Fund (GPIF), the largest pension fund in the universe, rolled out its plan to expand asset purchases overseas. With $1.1 trillion assets under GPIF’s management, its planned exposure into oversea markets may become favorable over the U.S. equity markets. The GPIF’s asset allocation before the announcement and its future new asset allocation are as follows:

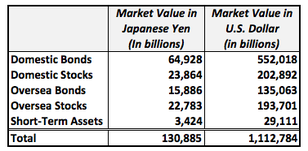

According to the GPIF’s new asset allocation plan, its significance mainly comes from a huge cut back of the domestic bonds, which today accounts for 50 percent or about $550 billion value (as of the end of September 2014). The GPIF plans to decrease its share of domestic bonds into the 35 percent target from the original 60 percent or from today’s 50 percent. It would generate additional $163 billion worth of cash from the future sale of the domestic bonds to fund the other asset classes, such as domestic stocks, oversea stocks, and oversea bonds. Specifically, $75 billion goes to domestic stocks, $84 billion goes to oversea stocks, and $32 billion goes to oversea bonds out of the $163 billion cash generated after the sale of domestic bonds (assuming no short-term assets).

|

|

|

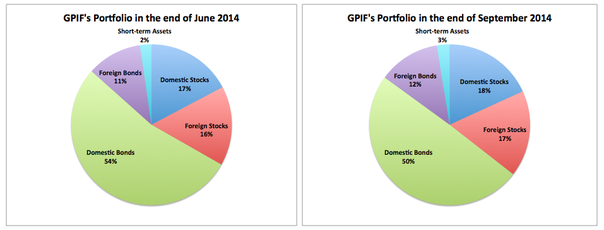

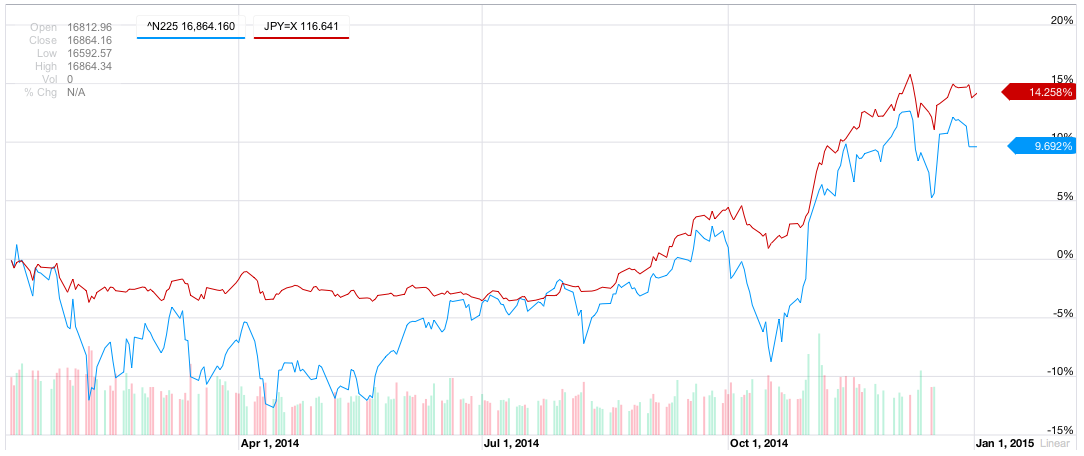

Over the past months, the GPIF’s asset allocation has been in progress but by the stock markets’ strength. Its domestic bonds holding declined to 50 percent in the end of September 2014 from 54 percent in the end of June. In the meantime, a share of domestic stocks rose to 18.2 percent from 17 percent, a share of oversea stocks climbed to 17.4 percent from 16 percent, and a share of oversea bonds increased to 12.1 percent from 11 percent.

|

|

This bull market condition will not continue unless the Japanese economy is firing all cylinders to generate higher output. Without higher production, the wages remain the same while the consumer prices across the market increase and eventually the Japanese stock market itself starts to struggle after generating 34 percent gain since the Bank of Japan Governor, Kuroda, took the office in earlier 2013 or generating 65 percent gain since the Prime Minister, Abe, was re-elected in the end of 2012. Whether it is late for the GPIF to jump onto the market momentum now or not, it is still considered to be a wise move, especially its new allocation to oversea stocks and bonds, which later consist of 40 percent of the GPIF’s asset. The generation-to-generation pension fund probably has the highest patience among any investors and that patience the GPIF has may yield the reward in the long run.

Sources: Government Pension Investment Fund of Japan, http://www.gpif.go.jp/en/. Norges Bank, http://www.nbim.no/en/investments/. |