The Power of Loyalty: Analyzing My Starbucks Rewards Programs in China and Thailand

Akira Kondo

March 15, 2014

|

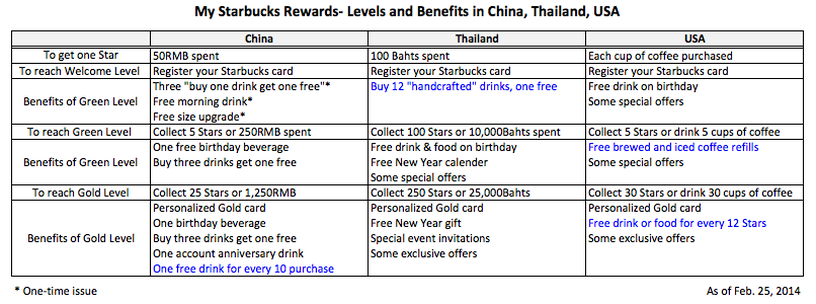

As I said earlier, collecting Stars is much easier in the states compared to China and Thailand. It seems like newly launched My Starbucks Rewards in Thailand requires more actual money spent with the card to reach the Gold level compared to China. Since each Star is collected based on the money spent, it requires about $774 spent to reach the Gold status in Thailand while about $203 spent to reach the Gold status in China.

The main difference is clearly the cost of Stars between China and Thailand. Collecting Stars to reach the Gold level in Thailand is much harder than doing so in the second largest economy in the world, China. Is it contradicting? Probably. However, Starbucks Thailand generously gives “a free drink for every 12 drink purchase” from an introductory Welcome level while Chins is not. Again, the main difference is that collecting Stars to reach the Gold level in Thailand is challenging for Thai local customers, who tend to be trapped in the middle-income level. Last year, there was an article that Starbucks’ products were more expensive than the U.S. It is nothing wrong. One cup of Tall Americano in China costs 22RMB, which is about $3.58. The same product costs only about $2.00 in the U.S. (depending on the cities). In Thailand, it costs 90Bahts or $2.79. The price of Tall Americano in China is relatively expensive. Without calculating operating costs in China, it is impossible to know how it leads to that $3.58 per cup of Tall Americano; however, one thing we know that the Chinese have to pay higher price to grab coffee in the country. |

|

|

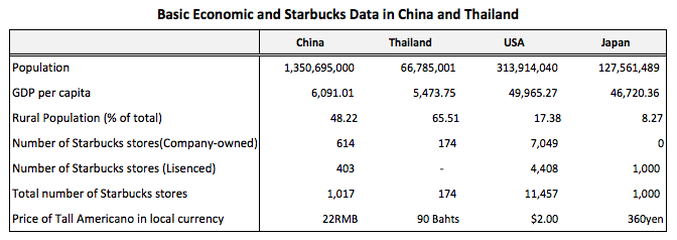

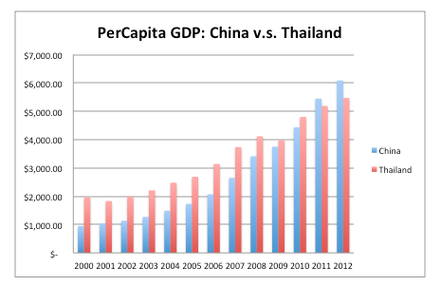

Who are the Starbucks customers and Starbucks loyalists in China and Thailand? Starbucks’ products are considered to be premium. Even in the wealthier countries in the U.S. and Japan, they think Starbucks coffee is not inexpensive. There are cheaper coffees outside of Starbucks. McDonald’s offers rich coffee at much reasonable price. They even offer Frappuccino, Café Mocha and Café Latte. However, Starbucks is opening up more stores in China as well as in Thailand while their income levels are much lower than the U.S. and Japan. Per capita GDP of China and Thailand are $6,091 and $5,473, respectively (in 2012), while the U.S. per capita GDP is almost $50,000. Since the cup of coffee is relatively more expensive in China and Thailand than the United States, how come Starbucks’ business so successful in these middle-income countries? It is contradicting that Starbucks offers more expensive prices of their products in those countries, where their per capita incomes are nearly 10 times smaller than that of the U.S. (Asian Starbucks stores tend to be occupied by their local customers for many hours, Starbucks may sell tables occupancy time and of course, cost of business)? In China, the current number of Starbucks stores opened is about 1,000 compared with more than 10,000 in the U.S. The population of China is 1.3 billion while that of the U.S. is about 300 million. Simple math tells that each Starbucks store in the U.S. can serve 27,000 customers, and each store in China can serve 1.3 million customers if all people have to drink Starbucks coffee. Again Starbucks is not inexpensive. If a single Chinese customer drank 10 cups of Tall Americano per month, she would have to contribute about 7 percent of her annual income and about 6 percent for Thai. However, American customers just need to spend about 0.5% of their annual income to get 120 cups of Tall Americano a year. By the way, if every Chinese drank 30 cups of Tall Americano a year, Starbucks’ revenue would become more than $120 billion! Plus, the Chinese prefer more sweeter and expensive Frappuccino, Café Mocha, and Latte, not the cheapest brewed coffee. Starbucks is, for sure, not focusing on 1.3 billion Chinese people but the company is focusing on some of the 1.3 billion. The average annual income in China is $6,091 but it is all about the average. These average people can still consume Starbucks coffee but one is not willing to spend $203 out of her annual income to attain the Gold level status. However, I somewhat often see the Starbucks Rewards Gold holders when I line up to grab my coffee in many of Shanghai Starbucks stores. Shanghai is the wealthiest city in China and according to China Daily, its annual disposable income is 40,188RMB or about $6,500. The disposable income is the income that a person can spend for anytime and it is a closer measurement to the GDP per capita. Higher income should allow more Starbucks consumption in China though it is not necessary. There is no reason why most Starbucks stores are located in urban modern cities, such as Shanghai, Beijing, and Guangzhou. In Shanghai, where I reside sometimes, there are four Starbucks stores near my home, which is located 5 miles away from the downtown (See the article). The average is just an average. Thus, there are many wealthier people above those average people. If 10% of total Chinese population were wealthier, that meant 130 million people, about the same size of the Japanese total population, would be a great target for Starbucks as well as multi-national global companies. Clearly Starbucks is trying to catch wealthier and middle-income customers. The middle-income customers can purchase several cups of coffee per month to enjoy modern culture of Starbucks. On the other hand, upper middle-income customers can purchase more Starbucks’ products, probably a few cups of coffee a week. They are surely today’s and future Gold-level customers. If all the Shanghai population attained the Gold-level status, Starbucks’ revenue would hit $10 billion annually while the U.S. sales in 2013 were $11 billion. That really makes sense why Starbucks wants to expand its business in China. The income level of China is growing rapidly and is moving toward upper middle-income level (See per capita GDP chart). Plus, the young Chinese enjoy the fashionable and modern culture that Starbucks offers. It is probably one of the best success stories among multi-national companies, which have entered into the Chinese market. |