Starbucks in Changsha, China: Growing Upper Middle-Income Consumers

March 20, 2015

|

Before the trip to Changsha, I was traveling from Shaoyang (邵阳), a prefecture-level city about 80 miles southwest to Changsha and home to Shaoyang University, and Shaodong (邵东), a county under Shaoyang city. While in Shaoyang, I was offered lunch at a Chinese restaurant by a first-time-met Chinese family. Soon later, a daughter of the family invited me to look into her home right above the Chinese restaurant. Her home (in China, home is a unit of an apartment or mansion) was just gorgeous and offered me fantastic views over the city and a river through the windows. I immediately realized her family belonged to an upper middle-income level, who could afford Starbucks drinks anytime as long as the store was located nearby their convenience.

Shaoyang, the most populous city in Hunan province with the population of well above 7 million, will be connected to Changsha, the second populous city in the province and the capital, by the fast-train rails in coming years. Upon the completion of the project, the fast trains will significantly increase the people’s mobility between the two biggest cities in Hunan, which I believe economic impact is somewhat positively enormous. Plus, I was really amazed to see that hundreds of new high-rise buildings along the main streets were under construction on the way into the downtown while I was truly convinced that inland China was still an investment-driven economy. However, there was no single Starbucks store available during my trip in Shaoyang. In the meantime, I believed that the city was possibly the next one to have a first Starbucks store out of the Changsha region (including Zhuzhou, Xiangtan, and Hengyang). |

Related ArticlesMore about China

|

(L) Visiting a richly-decorated house during Shaoyang trip. (C) Entering into the city of Shaoyang by car. Many high-rise buildings are under construction to welcome new residents and investors. (R) High-speed railroad construction expends to Shaoyang. Such huge investment nicely reflects China’s investment-driven economy.

|

Right after enjoying the Chinese lunch, I traveled to Shaodong to visit one of the leading high schools in Hunan province. While it was actually not my first time to visit Shaodong, my last trip to this neighbor was in earlier 2013 and I remembered that it was quite a boring city thanks to no foreigner-friendly stores, like KFC, which had expanded its businesses into inland at an earlier stage. KFC’s success probably has come from its early entry into the Chinese market, much faster than McDonald’s and Starbucks’s entry, and grabbed hundreds of millions of chicken-loved Chinese consumers over the past decades.

When I visited Shaodong in earlier 2013, there was no KFC available and the only fast-food restaurant coming into my eyes in that neighbor was a McKFC store, simply a combination of McDonald’s and KFC, and of course that was truly a typical Chinese counterfeit. Today, the real KFC stores have opened while no McDonald’s store has not arrived yet. Fresh modern-looking KFC stores nicely attract Chinese consumers and it is always nice to see how Yum! Brands, the parent of KFC, enjoys the business operation in inland China. Starbucks is not probably the next one to enter this neighbor while McDonald’s would be. As more distant away from the city in inland China, like from Shaoyang to Shaodong, the Chinese consumers’ wallets are tighter and they generally fall into the middle-income trap that their income levels cannot catch up with wealthier countries, like the United States. In addition, rural Chinese tend to like home-grown chicken, which seems to me the chicken meat is harder compared to chicken sold in a supermarket in the big cities. < To know more about the middle-income trap – please read “What is Middle-Income Trap?”>

(L) While experienced travelers to China may notice that this store is a typical counterfeit, it is a combination of McDonald’s and KFC. Three Chinese characters describes “Mac Kentucky Chicken.” Or MKJ stands for “Mai (Mac) Ken (Kentucky) Ji (Chicken).” (R) A new “real” KFC store opened in Shaodong within a past year. KFC’s presence in China is everywhere.

It is really likely that Starbucks’ entry into this neighbor is well after McDonald’s, which also operates McCafé, joins. On the other hand, the first Starbucks into Shaoyang may come sooner than later and I really hope it happens soon so that I can look forward to visiting the city again to sip my favorite Starbucks coffee. Starbucks’ presence in inland is not because of the population level but the income level of the area, where the store wants to meet up with upper middle-income Chinese consumers. Those consumers are growing fast in China, especially in the coastal cities. However, a larger population in inland cannot simply be ignored because some of those people are getting out of the middle-income trap anytime soon.

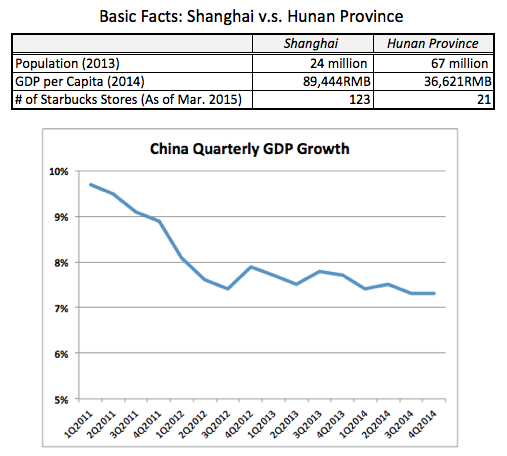

Over the next coming years, more Starbucks stores are expected to open across China but more store opening would probably be seen in inland. While hundreds of stores have opened in coastal cities, such as Shanghai, over the past years to welcome China’s wealthier consumers, now it is more interesting to see how Starbucks is going to attract inland consumers, who are getting out of middle-income trap over next years. Chinese economy is very ambiguous unless you travel there to uncover it but the great interest may lie within the inland. In the meantime, Starbucks is probably the one that can find the answer of what today’s Chinese inland economy really is. <Back to Previous Page>Sources: Deutsche Bank Research, “Shanghai” and “Hunan,” March 2015. The Economist, “Big Mac Index - January 2015,” http://www.economist.com/content/big-mac-index. National Bureau of Statistics of China, “China Quarterly GDP.” Starbucks, “Fiscal 2014 Annual Report,” Investor Relations. |

China-Related ArticlesChina's Consumption - Looking Purely at Starbucks Chinese ADRs: Is It Good to Buy Alibaba Shares? Food Stand Business in Shanghai, China Popularity of Smartphones in Shanghai Shanghai Metro Line 16: Dishui Lake Station Is China a Good Place to Invest? |