<Undergraduate> Applying Cobb-Douglas Form of Production Function to Analyze China’s Transformation into an Investment-driven Economy over Past 30 Years

December 21, 2012

Akira Kondo

In the past three decades, China’s economy skyrocketed to the second largest economy in the world and to the largest economy in Asia. There were multiple factors, which must have been involved to this spectacular growth since the 1978 economic reform. The notable economic event in the recent China’s history was its accession into the World Trade Organization (WTO) in 2001. The anticipation of China’s entry into the WTO had pushed its economic growth in 1990s and further growth in 2000s after its entry. While the event of the WTO accession, China has been known as an export-led economy thanks to lower labor cost and it was the first developmental stage for China to earn foreign hard currencies. In the meantime, China has attracted record-high of Foreign Direct Investments in past decades.

However, China’s economy would not have grown so fast without a rise in saving rates. Saving is like fuel that becomes an energy source for China’s powerful economic engine. Thus, a rapid growth in its saving rates must have led to China’s fast economic growth over the past three decades. In addition, a rise in saving means investment to grow. The remarkably high national saving has supported China’s high-investment, export-led growth model.[1] Importantly, in China, the investment is largely domestically financed while in the other Asian countries it is financed through foreign capitals.[2] That said, the China’s investment is purely derived from its aggregate domestic saving.

[1] Yang, Dennis Tao, Jusen Zhang, and Shaojie Zhou (2010), pp. 28.

[2] Prasad (2011), pp. 32.

The increase in aggregate saving in China has clearly guided China to a high-investment-driven and export-led growth economy. Cobb-Douglas form of production function enables to define how the increase in saving has led China to the investment-driven economy and how it has brought three decades of China’s fast economic growth.

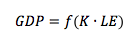

The aggregate production function is:

However, China’s economy would not have grown so fast without a rise in saving rates. Saving is like fuel that becomes an energy source for China’s powerful economic engine. Thus, a rapid growth in its saving rates must have led to China’s fast economic growth over the past three decades. In addition, a rise in saving means investment to grow. The remarkably high national saving has supported China’s high-investment, export-led growth model.[1] Importantly, in China, the investment is largely domestically financed while in the other Asian countries it is financed through foreign capitals.[2] That said, the China’s investment is purely derived from its aggregate domestic saving.

[1] Yang, Dennis Tao, Jusen Zhang, and Shaojie Zhou (2010), pp. 28.

[2] Prasad (2011), pp. 32.

The increase in aggregate saving in China has clearly guided China to a high-investment-driven and export-led growth economy. Cobb-Douglas form of production function enables to define how the increase in saving has led China to the investment-driven economy and how it has brought three decades of China’s fast economic growth.

The aggregate production function is:

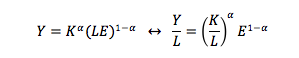

where K is capital, L is labor while E is “efficiency” or so called, “total factor productivity (TFP)”, and LE together is labor efficiency; therefore:

where measures extent of diminishing return to investment in K.

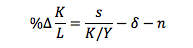

Then, assume that aggregate saving is equal to saving rate times output, S=sY, while a change in capital is subtracted investment by depreciation,

Then, assume that aggregate saving is equal to saving rate times output, S=sY, while a change in capital is subtracted investment by depreciation,

where s is saving rate, is depreciation, and n is population growth rate.

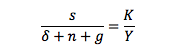

Hence, from the production function to set the equilibrium condition while a change in E defines growth rate, g:

Hence, from the production function to set the equilibrium condition while a change in E defines growth rate, g:

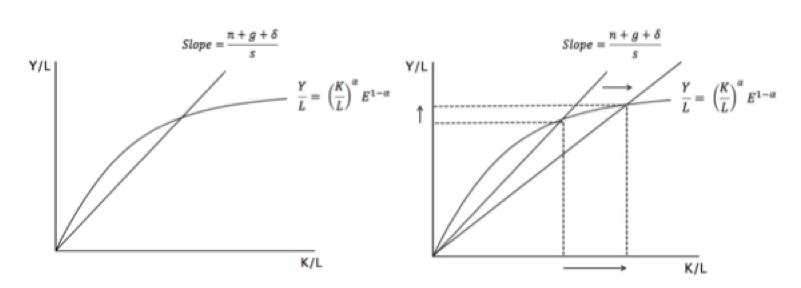

Therefore, China’s historically high saving rate has increased the standard of living, Y/L, while it has increased capital per labor, K/L, in much greater extent while other things equal (See the Figure). It is no wonder how China has transformed into more investment-driven economy over the past decades.

*This article is purely derived from my academic paper: China’s Fast Economic Growth over the Past 30 Years: The Engine of the National Saving

*Cobb-Douglas form of production function, which the E is used instead of an A, is based on the Economics lecture I have attended while I was an undergraduate student at Cal.

Sources:

Prasad, Eswar S. (2011), “Rebalancing Growth in Asia,” International Finance, Vol. 14, No. 1, pp. 27-66.

Yang, Dennis Tao, Jusen Zhang, and Shaojie Zhou (2010), “Why are Saving Rates so High in China?” NBER Working Paper, pp. 1-52.